The iShares MSCI Emerging Markets Minimum Volatility Index ETF seeks to provide long-term capital growth by replicating to the extent possible the performance of the MSCI Emerging Markets Minimum Volatility Index USD net of expenses. IShares MSCI Emerging Markets Min Vol Factor ETF has an MSCI ESG Fund Rating of BBB based on a score of 507 out of 10.

Minimize Volatility While Investing In Emerging Markets With Eelv

XMM A complete iShares MSCI Minimum Volatility Emerging Markets Index ETF Units exchange traded fund overview by MarketWatch.

Msci emerging markets minimum volatility index. Emerging markets exposure with lower volatility characteristics INVESTMENT OBJECTIVE The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. It uses an optimizer to select and weight stocks from the MSCI Emerging Markets Index in a. MSCI EMERGING MARKETS MINIMUM VOLATILITY EUR INDEX The MSCI Emerging Markets Minimum Volatility EUR Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid-cap equities across 23 Emerging Markets EM countries.

The table below includes fund flow data for all US. Fund Flows in millions of US. The optimization uses the Parent Index as the universe of eligible securities and the specified optimization objective and constraints to determine the.

Listed Highland Capital Management ETFs. IShares Edge MSCI EM Minimum Volatility UCITS ETF. ETFs Tracking The MSCI Emerging Markets Minimum Volatility Index ETF Fund Flow.

Total Expense Ratio 040. Fees as stated in the prospectus Expense Ratio. Benchmark Index MSCI Emerging Markets Minimum Volatility Index.

Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. It uses an optimizer to select and weight stocks from the MSCI Emerging Markets Index in a. IShares Edge MSCI EM Minimum Volatility UCITS ETF.

USD Accumulating NAV as of Oct 28 2021 USD 3424. The value of your investment and the income. 1 Day NAV Change as of Nov 02 2021 -023 -036 NAV Total Return as of Nov 01 2021 YTD.

Fees as stated in the prospectus Expense Ratio. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index in EUR for the lowest. The MSCI Minimum Volatility Index is constructed using the Barra Optimizer3 in combination with the relevant Barra Equity Model.

MSCI minimum volatility indexes. The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. IShares Edge MSCI EM Minimum Volatility UCITS ETF.

1 Day NAV Change as of 20Aug2021 -020 -060 NAV Total Return as of 19Aug2021 YTD. The index is calculated by optimizing the MSCI Emerging Markets Index its parent index for the lowest. The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets.

Data prior to the launch date is back-tested data ie. USD Accumulating NAV as of 20Aug2021 USD 3301. The MSCI Emerging Markets Minimum Volatility USD 100 Hedged to USD Index was launched on Aug 25 2015.

The MSCI ESG Fund Rating measures the resiliency of portfolios to long-term. IShares Edge MSCI EM Minimum Volatility UCITS ETF. Shares Outstanding as of 03Nov2021 13800000.

The fund tracks the MSCI Emerging Markets Minimum Volatility Index. Use of Income Accumulating. The MSCI Minimum Volatility Indexes are designed to serve as transparent benchmarks for minimum.

The iShares MSCI Emerging Markets Min Vol Factor ETF seeks to track the investment results of an index composed of emerging market equities that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. Calculations of how the index might have performed over that time period had the index existed. View the latest ETF prices and news for better ETF investing.

NAV as of Nov 02 2021 6328. 1 Day NAV Change as of Oct 28 2021 -011 -031 NAV Total Return as of Oct 28 2021 YTD. The MSCI Minimum Volatility Indexes are part of the MSCI Factor Indexes which represent the return of factors common stock characteristics that have historically earned a persistent premium over long periods of time.

The Fund seeks to track the performance of an index composed of selected companies from emerging markets countries that in the aggregate have lower volatility characteristics relative to the broader emerging equity markets. IShares MSCI Emerging Markets Min Vol Factor ETF. The fund tracks the MSCI Emerging Markets Minimum Volatility Index.

Benchmark MSCI Emerging Markets Minimum Volatility Index ISIN IE00B8KGV557 Total Expense Ratio 040 Distribution Type None Domicile Ireland Methodology Optimised Product Structure Physical Rebalance Frequency Semi-Annual UCITS Yes ISA Eligibility Yes SIPP Available Yes UK DistributorReporting Status NoYes Use of Income Accumulating.

The Case For Emerging Markets Small Cap Man Institute Man Group

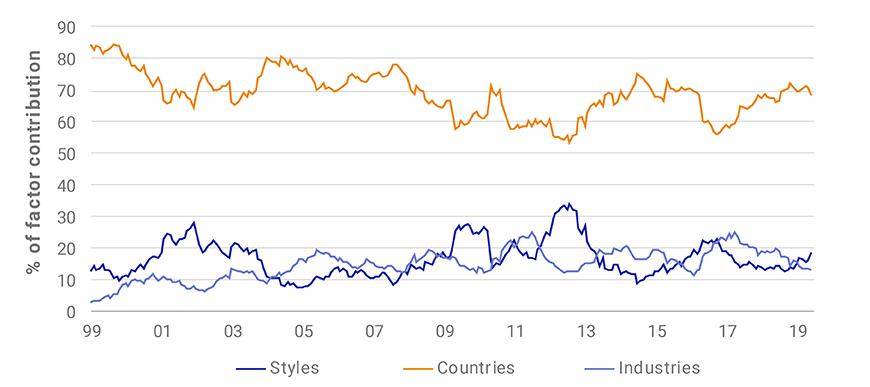

Emerging Market Country Allocation Matters Msci

Msci Emerging Market Index An Overview Recent Trends And The Future Performance Forecast Ig En

Msci Completes Factor Indexes Research Study For World S Largest Pension Fund Business Wire

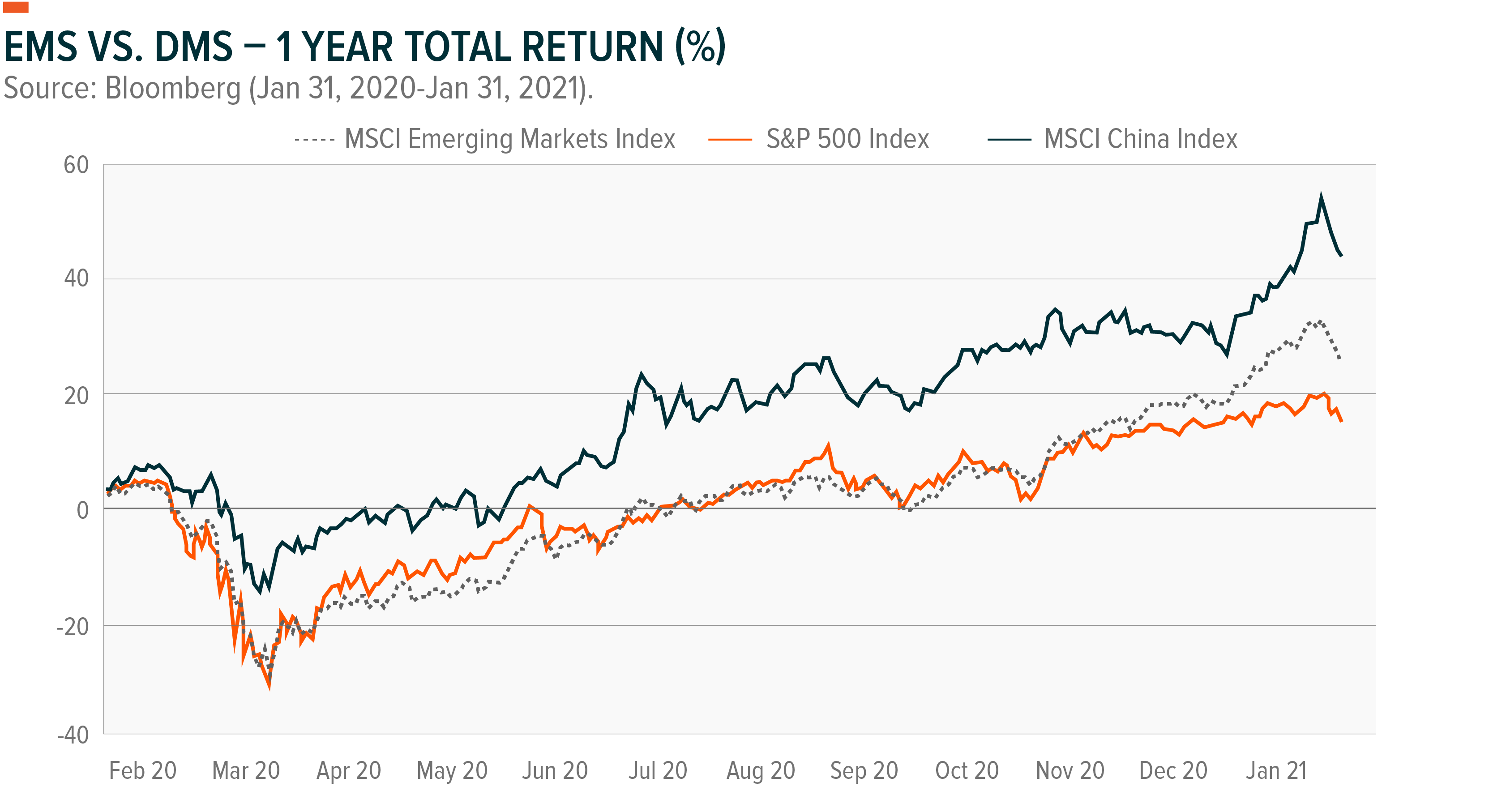

Emerging Markets Set Up For Growth In 2021 Global X Etfs

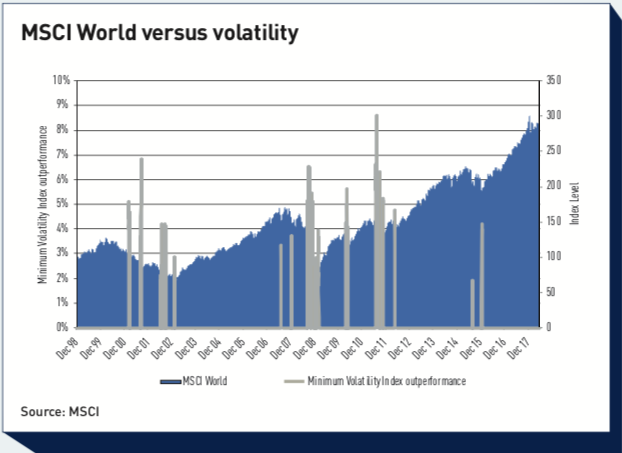

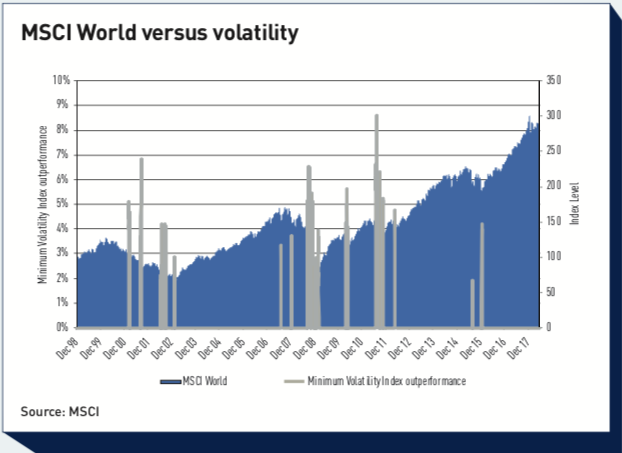

Factor Investing The Paradox Of Low Volatility Special Report Ipe

Msci Emerging Market Index An Overview Recent Trends And The Future Performance Forecast Ig En

A Bright Future For Emerging Market Equities Investors Corner

Msci Emerging Market Index An Overview Recent Trends And The Future Performance Forecast Ig En

Style Factor Exposures And Contribution For Msci Emerging Markets Index 86 Download Table

Historical Growth Of Emerging Markets 3 Download Scientific Diagram

Emerging Markets A Great Source Of Growth That Depends On Your Definition Kraneshares

Msci Emerging Market Index An Overview Recent Trends And The Future Performance Forecast Ig En

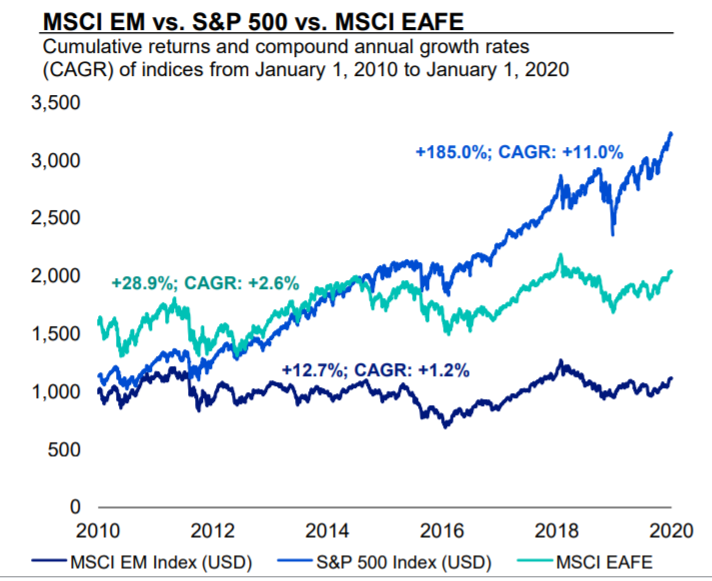

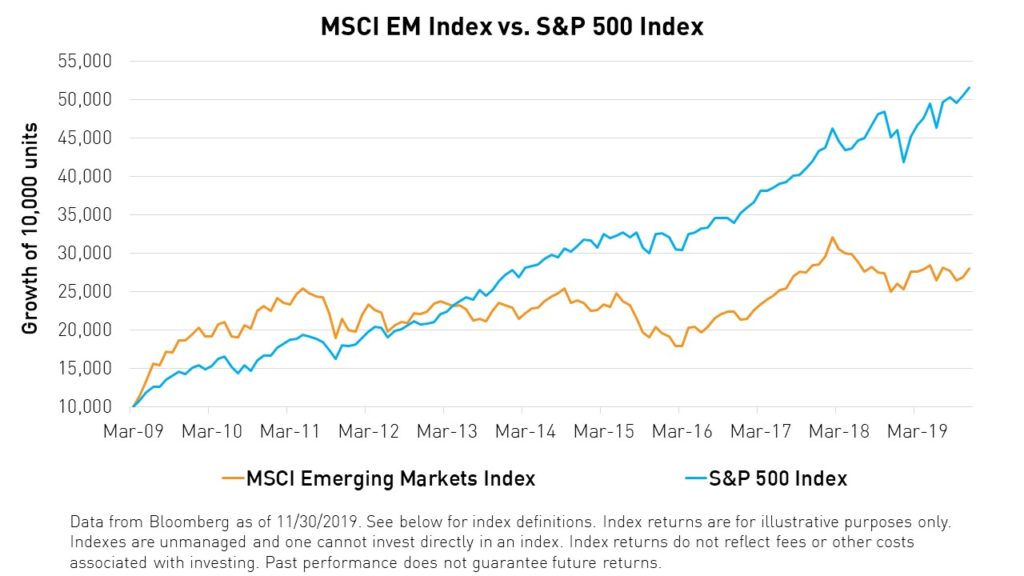

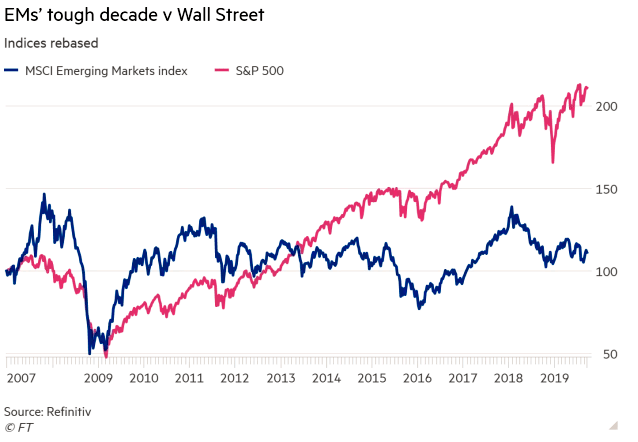

S P 500 Vs Msci Emerging Markets Index Isabelnet

A Rebound For Emerging Markets In The 2020s By Invesco Harvest

Msci Emerging Markets Index Marketing Emergency Insight

Eemv Ishares Msci Emerging Markets Min Vol Factor Etf Etf Quote Cnnmoney Com

Msci Emerging Markets Ex China Index Msci

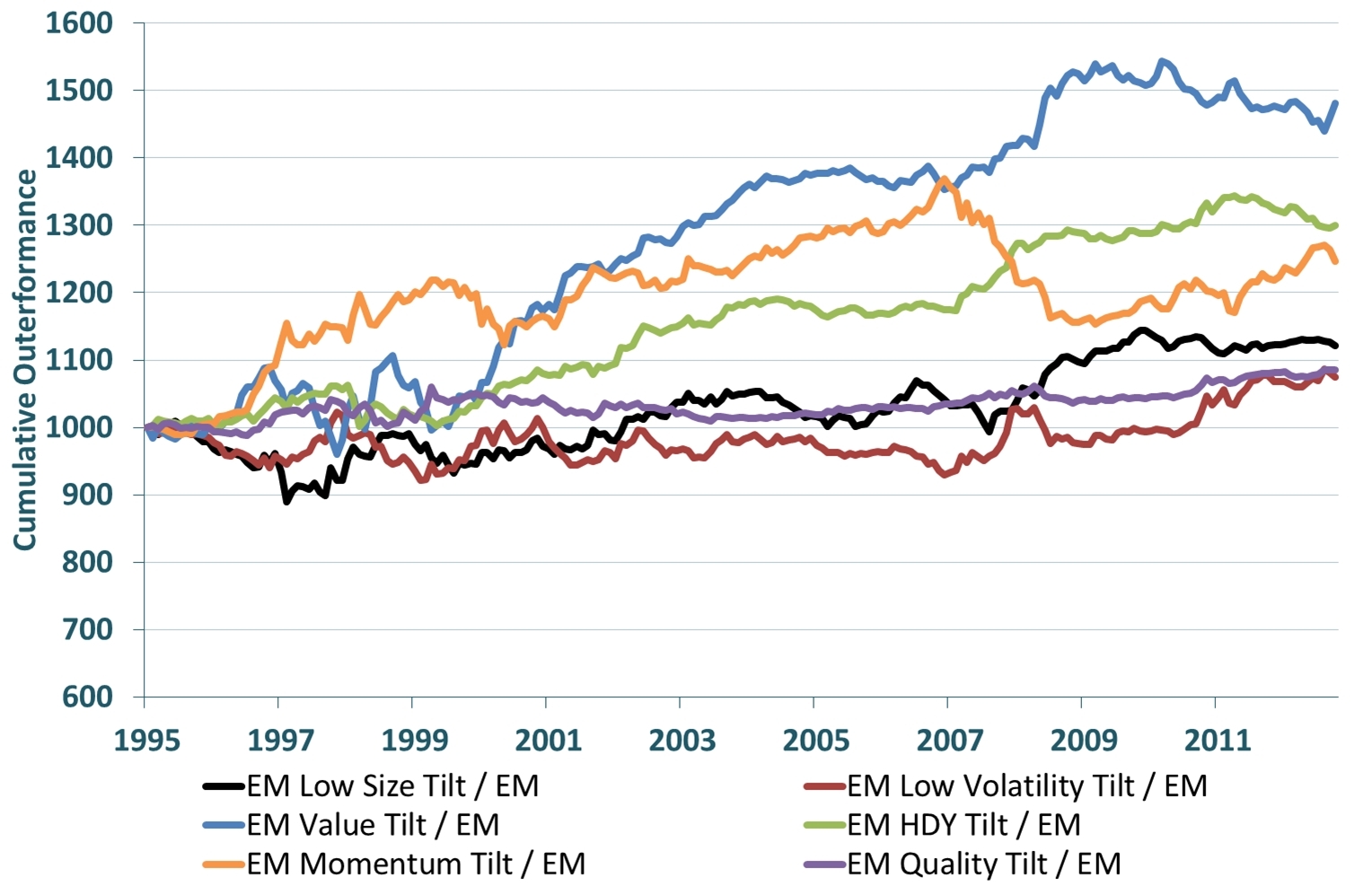

The Case For Value In Emerging Markets The Emerging Markets Investor