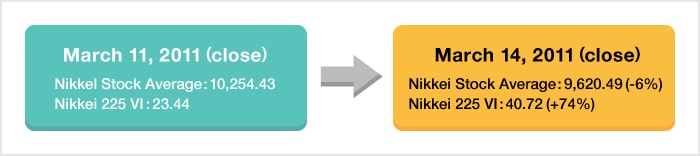

Nikkei 225 Technical Analysis. For the details regarding the calculation formula for the VI please refer to the Index Guidebook for the Nikkei Stock Average Volatility Index.

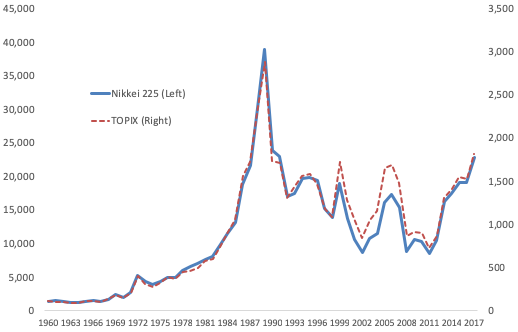

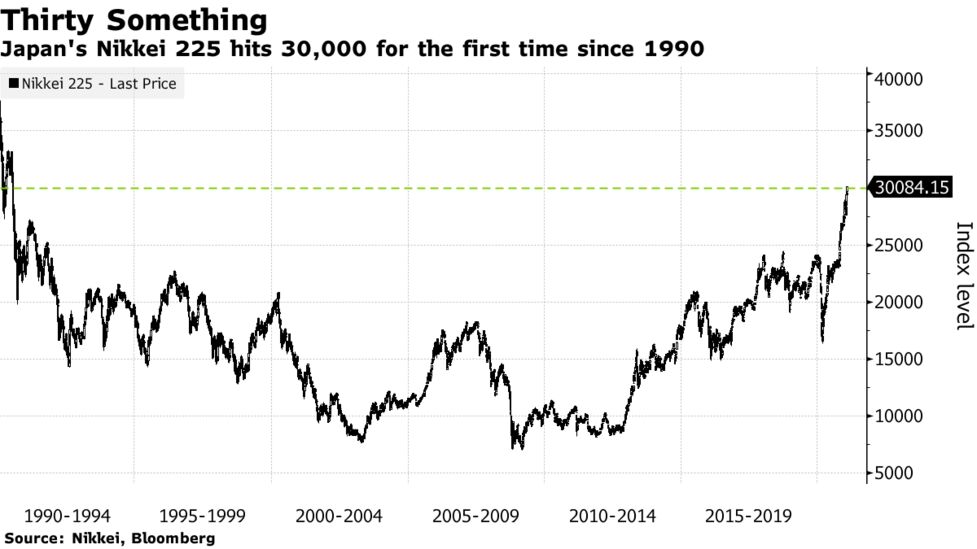

Japan S Amazing 25 Year Post Bubble Drama Investing Com

Japan Exchange Group JPX offers a one-stop shop for a range of products and services with TSE OSE and TOCOM markets at its core ensuring safe and highly convenient trading venues for all market users.

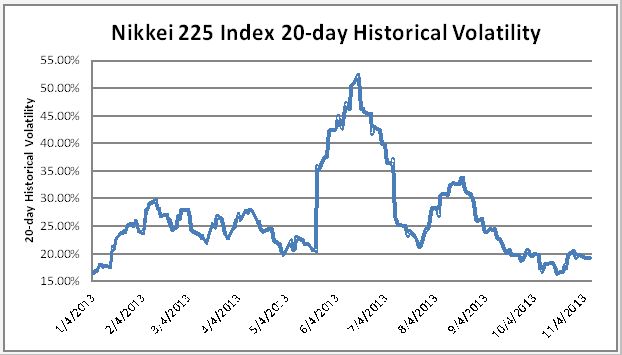

Nikkei volatility index. Nikkei 225 Index - 67 Year Historical Chart. VIX Volatility Index - Historical Chart. The 21-day SMA based Bolling Bands are at an extreme width indicating the volatility that the market has.

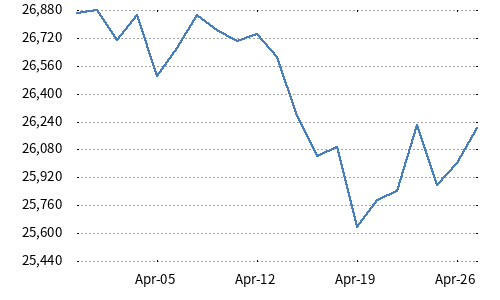

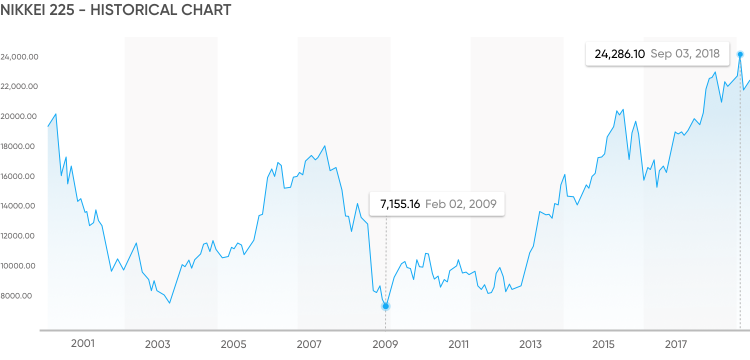

The Nikkei 225 index stalled at the 55-day simple moving average SMA and 200-day SMA. View stock market news stock market data and trading information. Interactive daily chart of Japans Nikkei 225 stock market index back to 1949.

Nikkei owns copyrights and any other intellectual property rights to the Nikkei 225 VI and the methods used to calculate the Nikkei 225 VI. Index performance for Nikkei 225 NKY including value chart profile other market data. Nikkei 225 up 134.

Get historical data for the Nikkei 225 N225 on Yahoo Finance. The index is derived from trading prices of options which indicate investor. NIKKEI 225 Index volatility depicts how high the prices fluctuate around the mean or its average price.

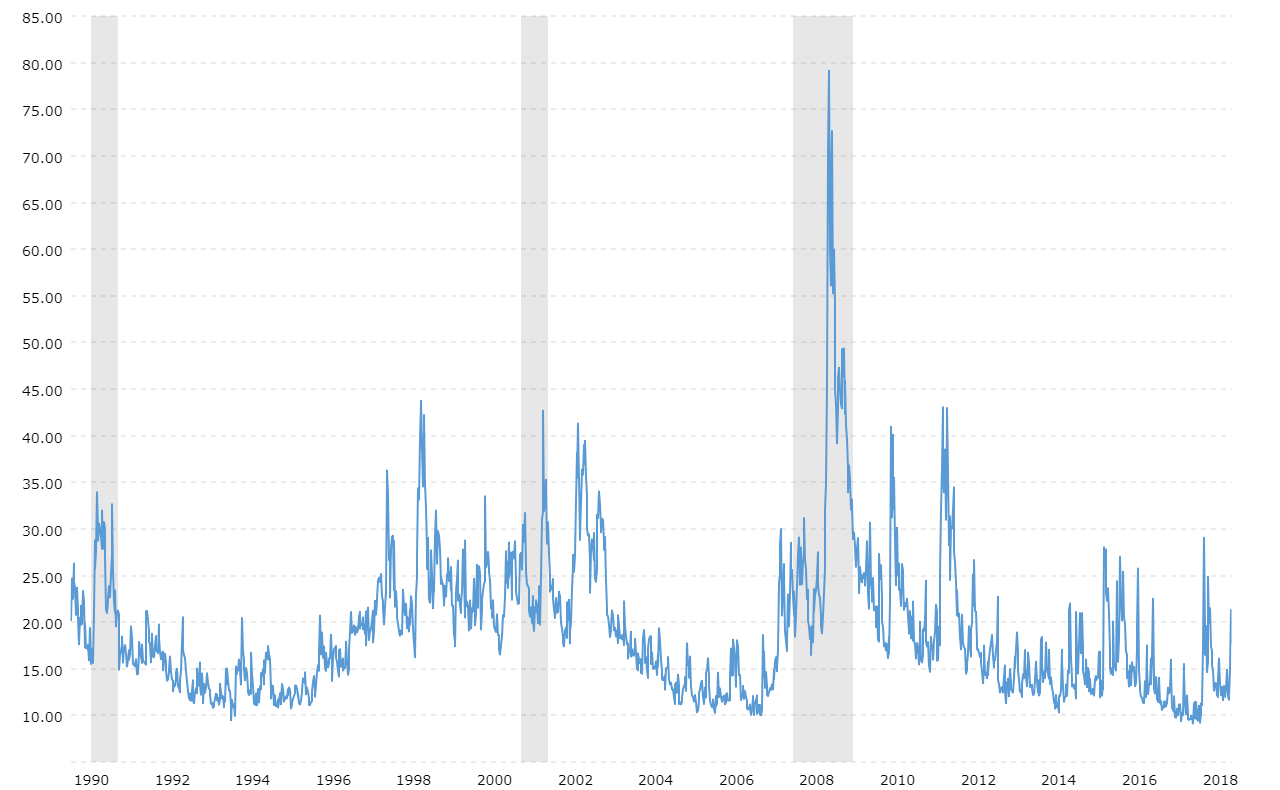

The median estimate in the Aug. The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options. Live Chart of Nikkei Index.

The Nikkei 225 Volatility Index is another separate index that represents the degree of fluctuation expected from the original Nikkei index in the future. Japan shares higher at close of trade. The Nikkei Stock Average Volatility Index which tracks the cost of options on the Nikkei 225 NKY Stock Average tumbled 33 percent this year to 153 yesterday the steepest decline among similar gauges tracked by Bloomberg worldwide.

The 21-day SMA-based boring band is extremely wide demonstrating the volatility the market saw last month. JPVIX index price live market quote shares value historical data intraday chart earnings per share in the index dividend yield market capitalization and news.

Global Last Chg Chg. Live updated rates of Nikkei Futures other Stock Market Futures. Nikkei Stock Average Volatility Index is calculated by using the traded price on Nikkei 225 option market and the indicator represents the volatility in the one month period expected by the investors.

The Nikkei 225 Index stalled with a 55-day simple moving average SMA and a 200-day SMA. This advanced professional chart gives you an in depth look at leading world. The Nikkei225 index and its futures are used in our empirical analysis.

The Nikkei Volatility Index temporarily dropped 27 on Friday to 1797 its lowest level since roughly 14 months ago. The Nikkei Stock Average Volatility Index Nikkei 225 VI is a copyrighted work calculated by methods independently developed by Nikkei Inc. Each data point represents the closing value for that trading day and is denominated in japanese yen JPY.

Get Current prices of Nikkei Futures. The measure touched 151 on July 8. The current VIX index.

View and download daily weekly or monthly data to help your investment decisions. Interactive historical chart showing the daily level of the CBOE VIX Volatility Index back to 1990. The Tokyo Stock Exchange Economic Calendar Whatever your trading profile scalping day trading or swing trading its important to follow the economic calendar in addition to technical.

The Nikkei Stock Average Volatility Index is calculated in accordance with the following procedure. Nikkei Volatility Interactive Chart Get instant access to a free live advanced chart for the Nikkei Volatility index. We also apply our model to futures hedging and find that both the optimal hedge ratio and the hedging effectiveness critically.

The current price of the Nikkei 225. 11-24 poll of 22 analysts and fund managers forecast the benchmark Nikkei index would gain 62 from Tuesdays close of 277321 to reach 29450 by the end of. Contrary to the Samuelson effect we find that the volatility of the futures price decreases when the contract is closer to its maturity.

In other words it is a statistical measure of the distribution of NIKKEI daily returns and it is calculated using variance and standard deviation. The current price is updated on an hourly basis with todays latest value. NIK A complete NIKKEI 225 Index index overview by MarketWatch.

Nikkei 225 Vi Futures Japan Exchange Group

The Time Series Of Nikkei 225 A Index And B Log Return From January Download Scientific Diagram

Implied Volatility Surface For Nikkei 225 Index Options July 2002 Download Scientific Diagram

Skew Levels Of The Nikkei 225 Index Download Scientific Diagram

The Effectiveness Of The Bank Of Japan S Large Scale Stock Buying Programme Vox Cepr Policy Portal

Index Information Nikkei Indexes

S P 500 Nikkei 225 Outlook Stocks Hit Record High As Vix Falls

Nikkei 225 Index Leaps As Ldp Election Win Opens Stimulus Plans Where Will Nikkei 225 Land

Japan S Nikkei 225 Tops 30 000 For First Time Since 1990 Bloomberg

Vix Volatility Index Historical Chart Macrotrends

Cme Options On Nikkei 225 Futures Enhancing The Stock Index Risk Management Repertoire

Volatility Index Japan Vxj Mmds

Trade Nikkei 225 Japan 225 Your Guide To Trade Nikkei 225 Japan 225 Capital Com Trade Now

S P 500 Advance May Lift Nikkei 225 Traders Eyeing Jackson Hole

S P 500 And Nikkei 225 Download Scientific Diagram

Volatility Index Japan Vxj Mmds