What is Volatility in the Stock Market. If the price almost never changes it has low volatility.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Trading Volatile Stocks With Technical Indicators

Stock with High Volatility are also knows as High Beta stocks.

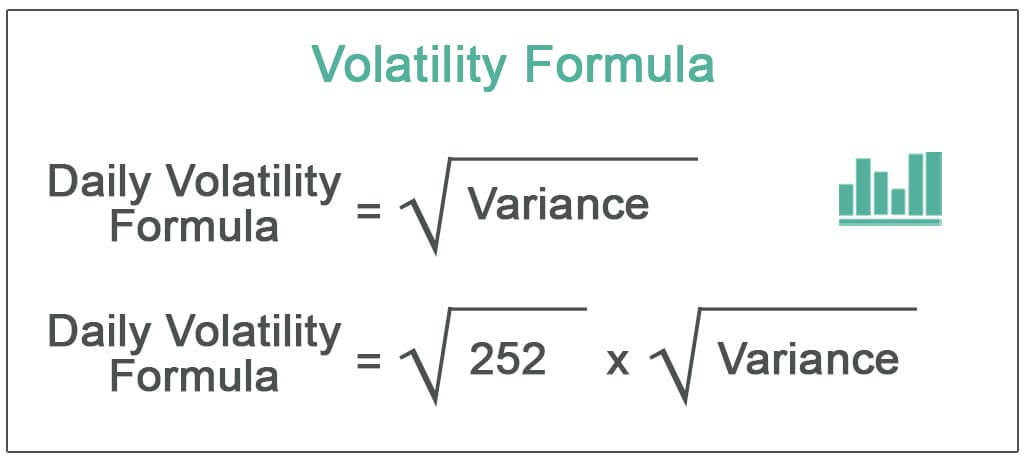

Volatility in stocks meaning. It measures how fast those movements are how often they occur and how big they are. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. In the stock market volatility stands for the risk of change in the price of a security.

It indicates how much an assets values fluctuate above or below the mean price. Say higher the volatility higher the risk the price of the stock may go. In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns.

If volatility is high for a stock that means it could be a risky bet because of wild price swings. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. Implied volatility looks forward in time being derived from the market price of a market-traded derivative in particular an option.

What is volatility. There are volatility indexes. If the price of a stock moves up and down rapidly over short time periods it has high volatility.

Stock market volatility refers to the range of price movement of a stock over time. Volatility refers to amount of risk related to the amount person has invested on the stock. A measure of risk based on the standard deviation of the asset return.

Volatility is an arithmetic measure of the spread of the returns from investment in an asset. A stock that maintains a relatively stable price has low volatility. Such as a scale of 1-9.

Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of timeInvestors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock. Volatility trading is trading the expected future volatility of an underlying instrument. A characteristic feature of such stocks is its high risk high return ratio.

Volatility is the measure of how much a stocks price moves. The higher the number the more volatile the. Volatility is a variable that appears in option pricing formulas where it denotes the volatility of the underlying asset return from now to the expiration of the option.

So what does stock volatility mean. At its most basic stock volatility is the extent to which share prices increase and decrease. Volatility in investing refers to up or down shifts in the price of a stock bond mutual fund or other security over time.

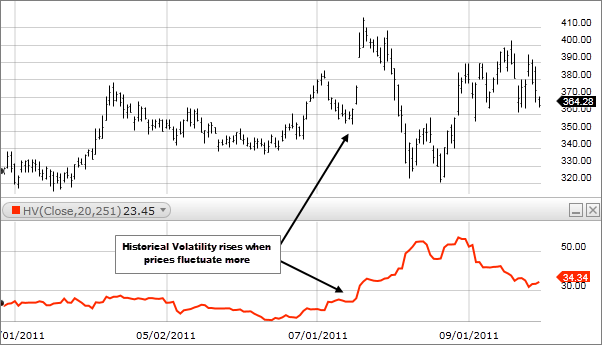

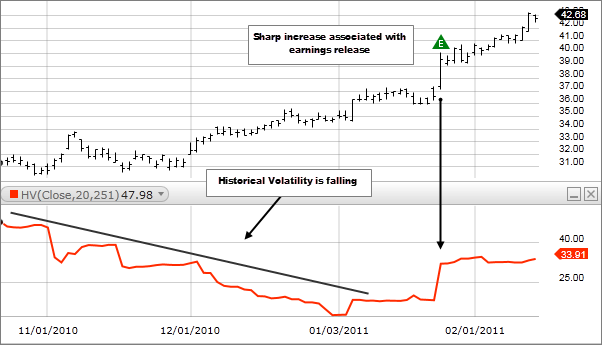

Historic volatility measures a time series of past market prices. Beta coefficients option pricing models and standard deviations of returns are examples of techniques to quantify volatility. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns.

High volatility is associated with higher risk. A stocks volatility is equal to the amount that particular stock will separate from the original price at which it was traded. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis considered highly volatile.

Instead of trading directly on the stock price or futures and trying to predict the market direction the volatility trading strategies seek to gauge how much the stock price will move regardless of the current trends and price action. It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility stands for the risk of change in the price of a security.

What does Volatility Means. Volatility is often expressed as a percentage. Volatility is a measure of the securitys stability and is usually calculated as the standard deviation derived from a continuously compounded return over a certain period of time.

When volatility is high the dispersion will be wider as well as the price range. If a stock is ranked 10 that means it has the potential to either gain or lose 10 of its total value. It can be measured against the ups and downs of the market Or it can be plotted statistically against the average price.

Investment analysts most often measure the volatility of. Equity shares of small and mid-cap companies are usually classified as volatile stocks and are subject to both systematic and unsystematic risks of the stock market. Generally it is measured by calculating the standard deviation between the returns of a market index or security.

Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. High volatile stocks in NSE are popular among institutional investors and individuals willing to assume a high market risk in order to earn high profits through market trends. It can also be defined as a statistical measure of dispersion for particular securities and is.

Volatility is found by calculating the annualized standard deviation of daily change in price. What is Stock Volatility. Malcolm Tatum Stock volatility is when stock dramatically increases or decreases within a period of time.

Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. A higher rating means higher risk. A more volatile trade has the potential for significant gains but also substantial losses.

Volatility is a key component of the options pricing model.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg)

Trading Volatile Stocks With Technical Indicators

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-02-2b2f422acb804825bac05f317099fdaf.jpg)

Trading Volatile Stocks With Technical Indicators

Stock Market Volatility Defined The Motley Fool

What Is Historical Volatility Fidelity

Standard Deviation Indicator Fidelity

Understanding Stock Market Volatility Rule 1 Investing

Risk Vs Volatility How To Profit From The Difference

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

Price Volatility Definition Calculation Video Lesson Transcript Study Com

What Is Volatility Definition And Meaning Capital Com

Implied Volatility What It Is Why Traders Should Care

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

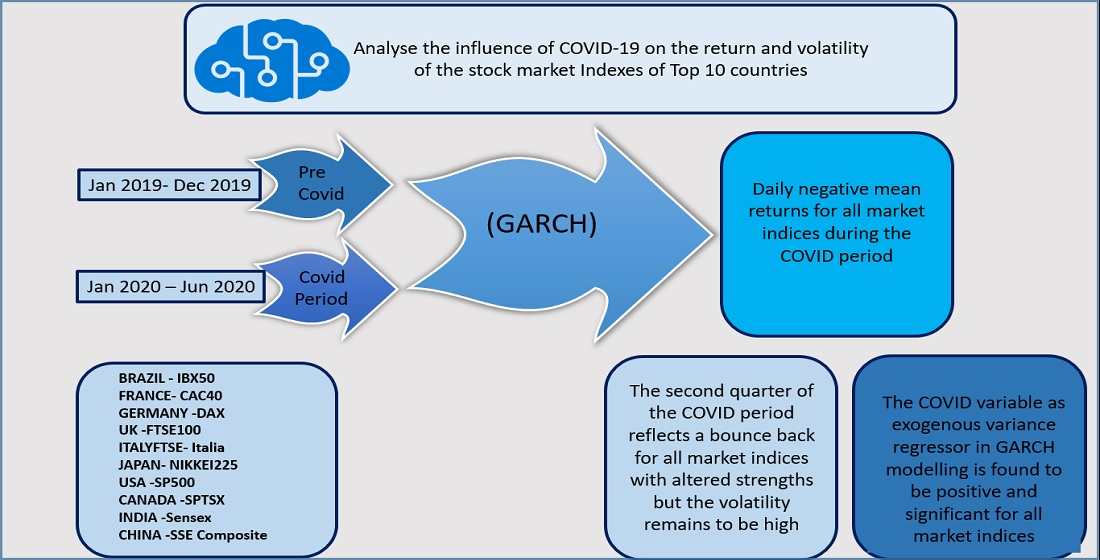

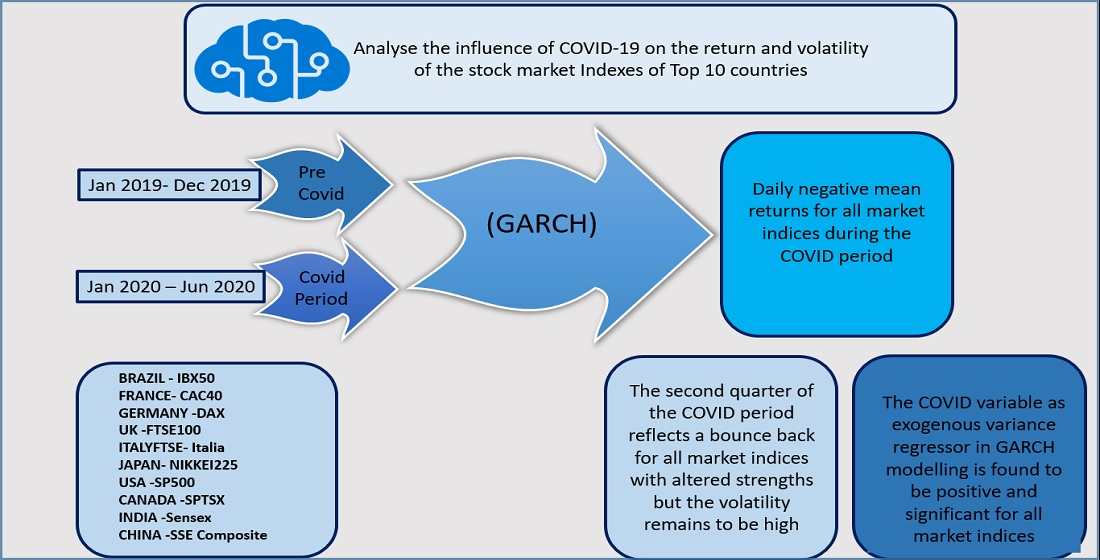

Jrfm Free Full Text Volatility In International Stock Markets An Empirical Study During Covid 19 Html

What Is Historical Volatility Fidelity

Risk Vs Volatility How To Profit From The Difference

What Is Volatility Definition Causes Significance In The Market