Of course anyone is free to decide whether VIX is likely to increase or decrease from here thats trading. A major directional move can be expected in the market and a quick broadening of range can be expected.

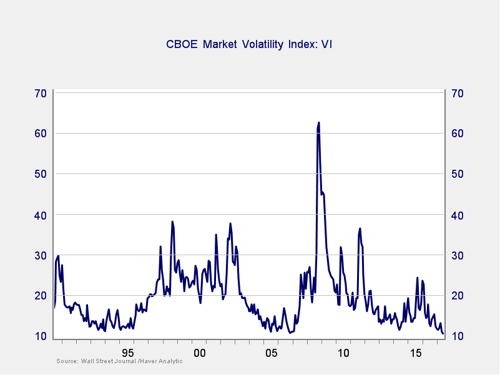

The Year In Vix And Volatility The Big Picture Big Picture Investing Chart

For example during the sub-prime crisis India VIX was trading at 55-60 high of 90 levels and the market was in a state.

If vix is high. Investors use the VIX to measure the level of risk. Get all information on the VIX Index including historical chart news and constituents. All-time highest VIX close was 8269 on 16 March 2020.

The VIX can go roughly as high as historical volatility will allow it to go and based on history a VIX above 120 is not impossible. As a brief reminder the VIX SP 500 Volatility Index is a measure of implied volatility levels on SP 500 options. Answer 1 of 2.

The most affected options are At The Money ATM and Out Of the Money OTM. Rest of then factors do not affect much. After all VIX is expectation of future 1 month historical volatility.

Please note that ATM and OTM options are made of Theta time value and VIX factor only. The VIX too is the highest it has been after these occurrences. Generally speaking if the VIX index is at 12 or lower the market is considered to be in a period of low volatility.

When we account for boosts to VIX from both types of out of the money options a 215 reading is not unreasonable. The index traded as high as 4369 but fell roughly 50 bps in the final 45 minutes. Before March 2020 all-time highest VIX close was 8086 on 20 November 2008.

The Cboe Volatility Index or VIX is a real-time market index representing the markets expectations for volatility over the coming 30 days. The most comparable time to this is the signal in October 2008 where the 21-day HV was 76 and the VIX was right around 55. View stock market news stock market data and trading information.

When investors anticipate large upswings or downswings in stock prices they often hedge their positions with options. Those who own call or put options are only willing to sell them if they receive a. On the other hand abnormally high volatility is often seen as anything that.

In fact the VIX reached its highest level since 2011. If that doesnt mean much it might help to think of the VIX as a fear index. A high VIX indicates high expected volatility and a low VIX number indicates low expected volatility.

To start for those of you wondering exactly what the VIX is formally it is an index of expected volatility in the returns of the SP 500 Index. A higher VIX level usually signals high volatility and lower trader confidence about the current range of the market. VIX is a trademarked ticker symbol for the CBOE Volatility Index a popular measure of the implied volatility of S.

A skilled topographer could determine an average for the whole state but this statistic would be skewed by Mount McKinley and the other huge mountains in the Last Frontier. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. The figures include VIX data up to and including 8 November 2021.

In the past 30 years the VIX has. Figuring out the normal VIX level is akin to figuring out how high Alaska my home state is above sea level. VIX A complete CBOE Volatility Index index overview by MarketWatch.

Based on Exhibit 2 we might suppose that VIX has. You can read more on Option Greeks here. The Cboe Volatility Index or VIX is a real-time market index representing the markets expectations for volatility over the coming 30 days.

The VIX often referred to as the fear index is calculated in. It seems pretty clear that as long as the as the SP 500 continues moving on a daily basis between 1 and 15 the VIX is going to find it hard to break meaningfully lower. When a lowhigh VIX is generated the most effected option strikes are At-The-Money ATM options.

This coincided with the VIX pushing higher after finding support around 21 once again. The VIX is calculated by the Chicago Board Options Exchange CBOE. All-Time Highest VIX Closes.

The VIX Wall Streets fear gauge spikes to 62 amid a market rout. But starting an assumption that VIX is simply too high is not borne out by the evidence. Overall market volatility is most commonly tracked by watching the VIX.

The VIX Index is used as a barometer for market uncertainty providing market participants and observers with a measure of constant 30-day expected volatility of the broad US. Does a Low VIX Mean High Risk. Below 12 to be low a level above 20 to be high and a level in between to be normal Exhibit 2 illustrates the historical distribution of SP 500 price changes over 30-day periods after a low VIX after a high VIX and after a normal VIX.

Often referred to as the fear index or the fear gauge the VIX represents one measure of the markets expectation of stock market volatility. The VIX Index is not directly tradable but the VIX methodology provides a script for replicating volatility exposure with a portfolio of SPX options a. W all Streets fear gauge the VIX spikes to its highest level as stocks tumble and oil prices plunge.

Its calculated based on the prices of eight different put and call options. Here is a similar page for VIX all-time lows. Find the latest information on CBOE Volatility Index VIX including data charts related news and more from Yahoo Finance.

How Option Prices Reflect Volatility. Investors use the VIX to measure the level of risk. As many of you know the VIX is often considered the markets fear gauge.

Moxie High Vix Lumenex Tee Cycling Tops Tees Clothes Design

Stock Market Digital Graph Chart On Led Display Concept A Large Stock Market Investing Financial Investments

The Vix Says It All Implied Volatility Volatility Index Vix

Setup Options Diagonal Trade Even When The Vix Is High In 2021 Options Trading Strategies Option Strategies Options

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

High Maintenance Quotable Quotes Words Of Wisdom Words

The Vvix Which Measures Volatility In The Vix Reached A Multi Year High Impliedvolatility Implied Volatility Volatility Index Stock Options

Options Trading Why Is Vxx Option Different From Other Plain Vanilla Options

Stats And Technical Analysis Of Vix For Snp 500 Market Volatility Quantlabs Net Implied Volatility Stock Market Stock Options Trading

Dolce Vita Vix Thigh High Boot Women Nordstrom Boots Thigh High Boots Thigh Highs

Pin By רפי וחיה On בורסה In 2021 Vix Map Screenshot

Vix Index For S P 500 Index Investing Stock Market

Vix Swimwear Beijo One Piece Swimsuit Vix Swimwear One Piece Swimwear

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

Vix Paula Hermanny Hot Pant High Waist Bikini Bottoms Vix Swimwear High Waisted Bikini High Waisted Pants

Pin By Angel On Tiktok Video Useful Life Hacks What To Do When Bored Advice

Pin On The Best Skinny Jeans To Buy Ahead Of The New Season