Nexo is another crypto lending and borrowing platform thats quite popular especially in Europe. Many using Crypto Lending had been affected by those lasts days dump there is a post about it.

10 Best Crypto Lending Platforms In 2021 Coincodecap

Interest rates can even go up to 30.

Lending crypto reddit. The borrower going on a platform requests a crypto loan backing it up with his crypto Step 2. Because its a global feeless currency I can send everyone some and it will be in your wallet instantly. Lend from 30-90 days to individuals or 90.

Once the platform accepted the loan request the borrower stakes his crypto collateral. You can also participate in lending economies as a borrower. Currently the borrowing rate on Nexo is 59 while the saving rate is an awesome 10.

There are a host of ways crypto owners can get paid interest or its equivalent. Earn money by lending crypto. Not crypto lending but you may be interested to check out COSS and its community project CELT.

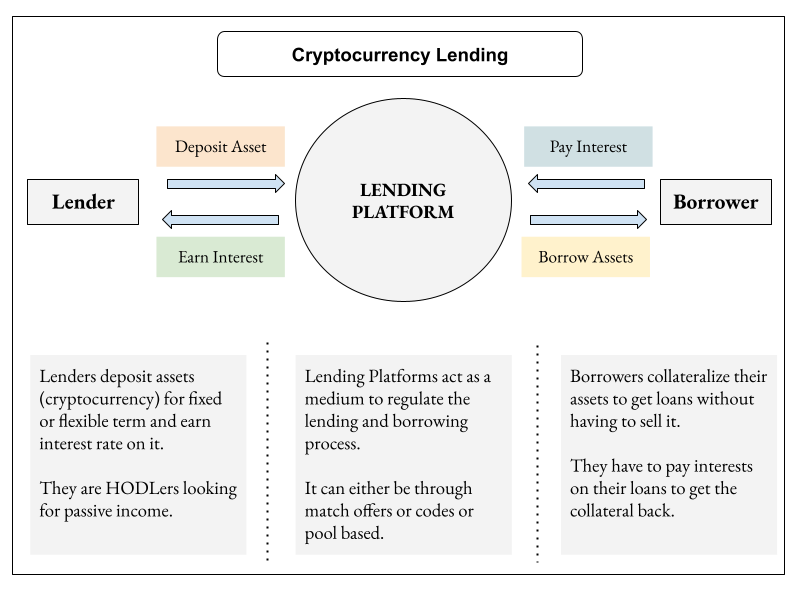

Speaking to The Block after the hearing Gensler indicated that crypto lending and even staking platforms were likely to fall under the scope of US. While cryptocurrency is new crypto lending is quite similar to traditional lending. The borrower wont be able to get back the staked amount until he funds back all his loan.

Yield farming involves lending or staking cryptocurrency in. Crypto lending is a pretty new segment of the lending investment industry that is rapidly growing in the past years. DeFi is a young and evolving market and the demand for it is constantly increasing.

Lend crypto to passively make money from assets that youre not currently using. Savers can earn a very attractive interest rate on their deposits with Nexo. Crypto lending is a pretty new segment.

I sincerily believe it should work in a different way. Investors lenders fund the loan. TRAVA performs blockchain data analysis to optimize pool parameters calculate credit score and.

If they ask USDC 50 interests is like you would be already covering the loan you are asking for. Ive been a long time fan of BlockFi and Celsius Network. Crypto lending is not a risk-free investment and it doesnt have to be.

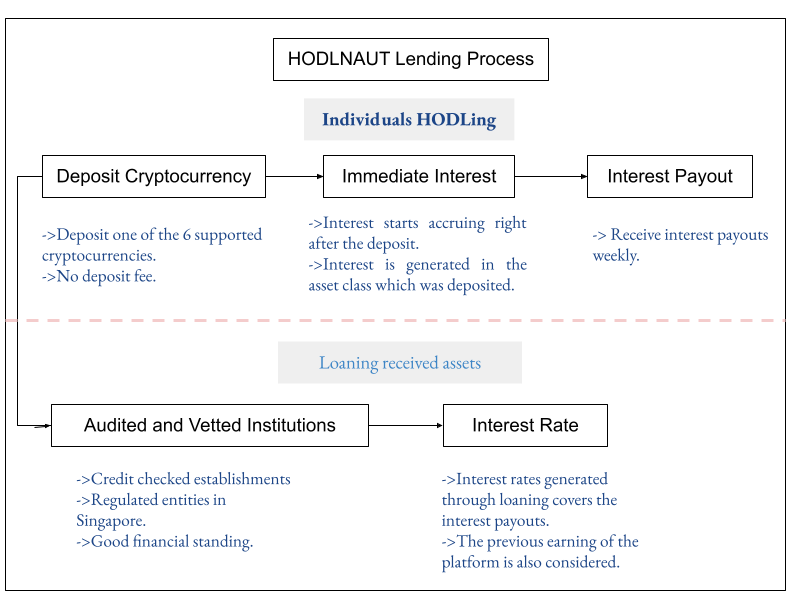

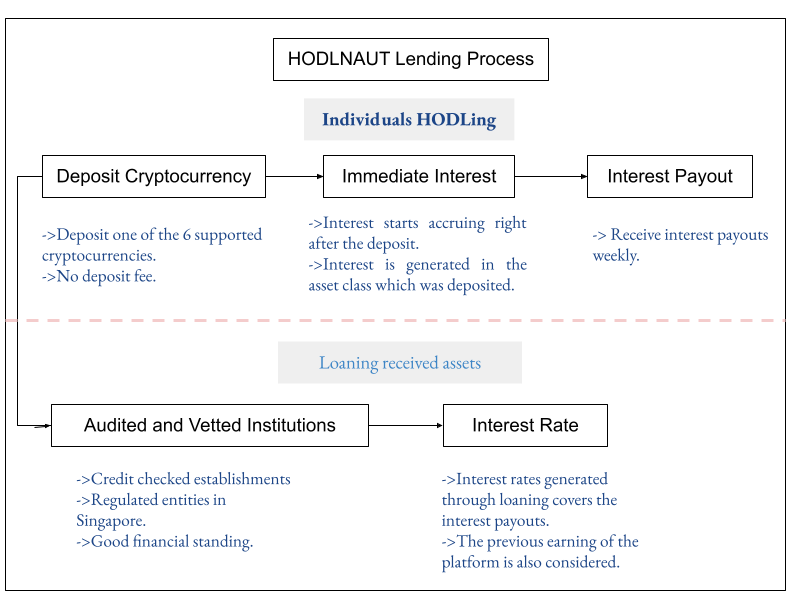

The process explained above is known as CRYPTO LENDING. Reshab Agarwal October 19 2021. Anyways I put together a list of crypto lending platforms in an attempt to find the best platforms to use.

Letitia has asked a number of questions regarding the activities of these 3 companies and seeks immediate answers. Apart from these she also has her eyes on 3 other platforms. How Cryptocurrency Lending Works source.

Advertisement Securities and Exchange Commission chairman Gary Gensler indicated Tuesday that crypto lending and staking platforms that hold custody of user funds could fall under. Nano is a digital currencycryptocurrency that offers secure feeless instant and eco-friendly transactions on a secure and decentralized network. Here is an article on the basics of Nano.

As a lender you can gain money through interest on your crypto perfect for earning passive income on assets youre hodling. The field is growing fast despite increasing regulatory pressure. COSS pays 50 of its profit to COSS token holder and CELT is a COSS Exchange Liquidity Token that is funded by COSS community members to run trading bots.

CryptoStudio conducts detailed crypto lending platform reviews including interest accounts lending rates borrowing rates and blockchain investment opportunities. Cryptocurrency lending is still a topic of debate but more and more people are turning to crypto loans as an alternative source of income. This is a form of decentralized finance DeFi scheme that allows people to lend out their digital currencies to borrowers.

An easy to use platform that allows you to safely lend or borrow BTC ETH USDC and a few others to earn a daily back. When there is a big pump or dump an increasing number of users will be willing to amplify their profits by Margin trading which may boost the demand for crypto borrowing. TRAVA is a decentralized lending marketplace.

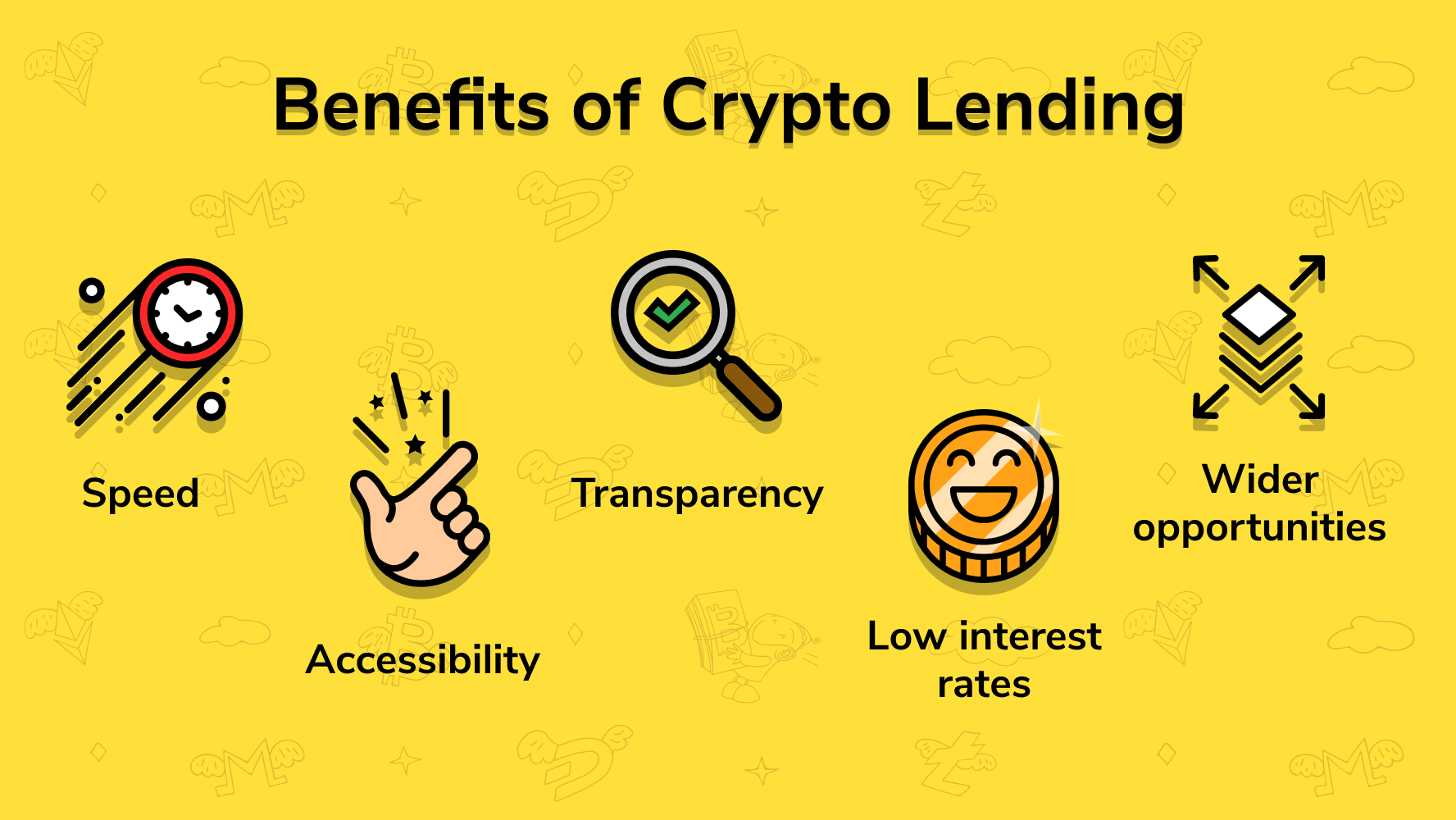

CDC has also made it into the top 3. This crypto lending platform comparison lists the best crypto lending platforms and blockchain interest accounts in 2021. Pros of Crypto Lending.

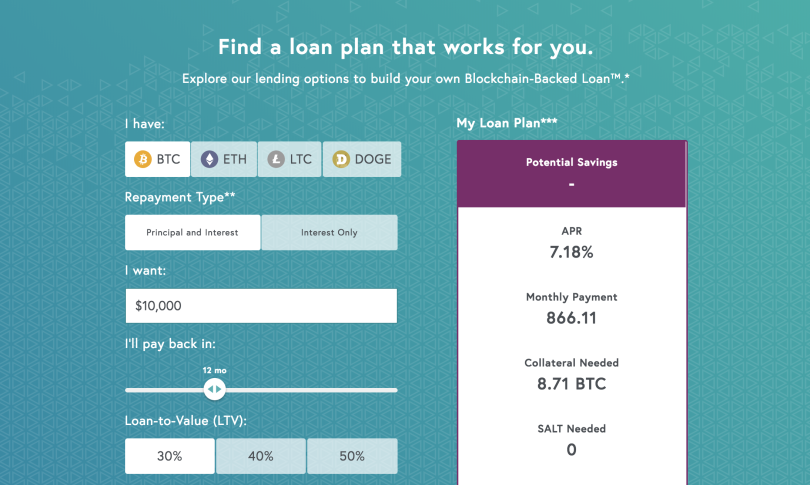

CELT pays 95 of generated profit in ETH to CELT holders weekly and currently it is 5. You want to earn interest and that doesnt come without risk. With a cryptocurrency loan a borrower typically offers up their cryptocurrency as collateral to the lender who gives them cash or a stablecoin cryptocurrency thats tied to a traditional currency and charges the borrower interest on the loan.

We list legit lending programs only and provide a. The goal of this type of investment is to allow individuals with cryptocurrency assets to generate some dividends ranging from 4 to 17 yearly ROI by lending their cryptocurrencies. It allows traders to obtain cash by utilising their crypto holdings as security without having to sell their coins.

But platforms I hadnt really looked at in-depth were Nexo Cred and Bitrue. Yield farming involves staking or locking up your cryptocurrency in exchange for interest or more crypto. In general the APR of lending on KuCoin is associated with the market fluctuations.

With crypto lending lenders earn interest or crypto dividends and many online platforms provide a DeFi. As long as you understand what risks you are taking and the expected return justifies these risks there is no reason to shy away from crypto lending. In fact crypto loans have gained momentum across social media domains such as Reddit and YouTube.

Two cryptocurrency lending platforms were asked to cease activities in New York by the states attorney general on Monday and three other platforms were directed to provide information about. These products which often tout high yields are securities the agencies have said. Weve exampled how does crypto lending work now lets look at the pros and potential rewards in store.

Having seen what crypto lending is and how crypto lending works lets talk a bit about the advantages and disadvantages that come with crypto lending. The New York Attorney General Letitia James has recently ordered 2 crypto lending platforms to shut down. The risk also depends on your investment strategy.

Crypto lending has come under scrutiny from the Securities and Exchange Commission and state regulators.

![]()

What S Your Favourite Bitcoin Lending Platform R Bitcoin

In Case You Weren T Aware Of This Already Lending Usdt On Kucoin Yields At Least A 55 Apr R Kucoin

Is It Safe To Lend Eth Is It Really Profitable R Ledgerwallet

What Is Crypto Lending The Easy Simple Explanation

Bitcoin To Paypal Reddit Bitcoin Bitcoin Value Union Bank

What Is Crypto Lending Explained 2021 Tradesanta

10 Best Crypto Lending Platforms In 2021 Coincodecap

10 Best Crypto Lending Platforms In 2021 Coincodecap

11 Blockchain Lending Cos Changing Mortgages Credit More Built In

Why You Need To Stake Lend Your Crypto If You Re Hodling R Cryptocurrency

10 Best Crypto Lending Platforms In 2021 Coincodecap

10 Best Crypto Lending Platforms In 2021 Coincodecap

Sec Has Told Coinbase Why Crypto Lending Is A Security Ledger Insights Enterprise Blockchain

Bitcoin Loan Reddit Bitcoin Loan Bitcoin Cryptocurrency

![]()

Best Crypto Lending Interest Paying Companies R Cryptocurrency

Defi Lending Making Your Crypto Work Harder R Defi

How To Borrow And Lend Cryptocurrency With C2c Loans On Okex Beginners Tutorial Okex Academy Okex

10 Best Crypto Lending Platforms In 2021 Coincodecap

What Is Crypto Lending Explained 2021 Tradesanta