Results are available at a quick glance. The VIX is based on the prices of options on the SP 500 Index and is calculated by aggregating weighted prices of the indexs call and put options Options.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

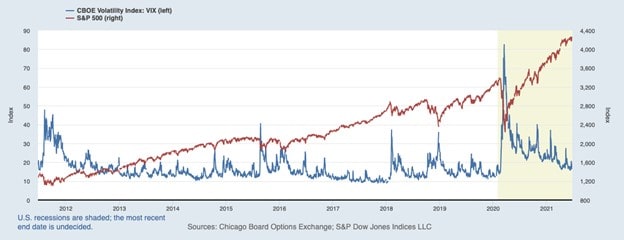

The VIX Index or Volatility Index measures how volatile the SP 500 Index is.

S&p 500 vix meaning. Get the latest SP 500 VIX Short-Term Index MCAP SPVIXST value historical performance charts and other financial information to help you make more informed trading and investment decisions. The VIX is the 30-day implied volatility of the SP 500 and it usually moves in the opposite direction as stocks. Based on VIX levels on each date and the distribution of subsequent 30-day price changes in the SP 500 using closing price levels.

If the VIX is at 20 it means the SP 500 is expected to stay within a - range of 20 of the current price of the SP 500 over the next 12 months 68 of the time which is one standard deviation. The summary for VOLATILITY SP 500 is based on the most popular technical indicators Moving Averages Oscillators and Pivots. Where have you heard about the SP 500 VIX Index.

Monitor this investment daily. Historical data charts technical analysis and. In New York after rising in 16 of the previous 18 sessions its best run since 1990.

Because the stock market tends to rise in a. Past performance is no guarantee of future results. Stocks on Friday settled moderately higher.

The VIX climbed 44 to. Calls and Puts An option is a derivative contract that gives the holder the right but not the obligation to buy or sell an asset by a certain date at a specified price. The VIX and the SP 500 have an inverse relationship.

Technical analysis gauges display real-time ratings for the selected timeframes. SP 500 Vix Short Term Futures ER Overview. Chart is provided for illustrative purposes.

The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. This results in a constant one-month rolling long position in first and second month VIX futures contracts. Trajectory Of Most Shorted Stocks Now Resembling Bitcoin By Michael Kramer - Feb 07 2021 1.

As stated earlier the VIX is the implied volatility of the SP 500 Index options. What is the SP 500 VIX Index. The SP500 VIX can be used to identify market turns more specifically bottoms.

It judges the expectations of the stock market over the following 30-day period. If you understand VIXs significance and can measure the SP 500 indexs expected volatility you can decide whether or not the volatility level is too big. Remember that volatility doesnt measure the direction of price movement rather it measures the rate of change or how rapidly price moves up.

If you purchase the VIX index you foresee higher volatility in the SP 500 that is traders pay higher prices for the index options. The SP 500 Index SPX SPY on Friday closed up 072 the Dow Jones Industrials Index DOWI DIA closed up 050 and the Nasdaq 100 Index IUXX QQQ closed up 104. On this article we check out how the VIX is constructed its inverse relationship to the SP 500 in addition to how merchants can make the most of the VIX of their inventory market buying and selling methods.

VIXStocks rose on February 5 with the SP 500 gaining 39 bps to close at 3886 with the VIX Futures. SP 500 VIX Short-Term Index MC SPVIXST Charts Data News - Yahoo Finance. More information is available in the different sections of the SP 500 Vix Short Term Futures ER page such as.

Using VIX to predict SP 500 Volatility. For each year since 1990 the first year we have VIX data the chart below shows. This means it must be monitored daily as it bases its return on a single day benchmark.

Comprehensive information about the SP 500 Vix Short Term Futures ER index. Over a wide range of strike prices. Cboe Global Markets revolutionized investing with the creation of the Cboe Volatility Index VIX Index the first benchmark index to measure the markets expectation of future volatility.

That means when the VIX is increasing the SP 500 is likely falling and when the VIX is declining stocks are likely rising. The VIX and the SP 500 are considered to be strongly negatively correlated. These options use such high strike prices and the premiums are.

3 ProShares Short VIX Short-Term Futures ETF SVXY This is an inverse ETF that aims for daily investment results that are equal to one-half the inverse of the daily performance of the SP 500 VIX Short-Term Futures Index. You might have heard it. That VIX should contain some predictive content is to be expected.

The VIX Index is based on options of the SP 500 Index considered the leading indicator of the broad US. The SP 500 was flat at 1215 pm. VIX is calculated from the prices of a particular basket of SP 500 options whose value to their holders.

The SP 500 VIX correlation is a main instance of why the connection between the inventory market and the VIX is known as a concern barometer. The SP 500 VIX Short-Term Futures Index utilizes prices of the next two near-term VIX futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. Explore The Guide.

Strength in technology stocks on Friday was supportive of the overall market.

Cboe Volatility Index Vix Explained The Options Futures Guide

Djia Dow Jones Industrial Average Dow Jones Dow Jones Industrial Average Dow

How Stocks Behave After S P 500 Vix Returns Are Positive

What Is The Vix A Guide To The S P 500 Volatility Index

Microsoft Return To Top Market Value Means Less For Gates Value Meaning Bill Gates Wealth Market Value

What Is The Vix A Guide To The S P 500 Volatility Index

Time Series Plots Of S P 500 And Its Vix Download Scientific Diagram

Aug 26 History S Weight Chart History Weight

Home Renko Chart Trading Trading Charts Chart Position Position Trading

The Standard Poor S S P 500 Volatility Index Vix Also Known As Download Scientific Diagram

S P 500 Vs Vix Stock Market Indicators In 2021 Stock Market Vix Marketing

Cboe Volatility Index Vix Volatility Index Brent Crude Oil Index

What Is The Vix A Guide To The S P 500 Volatility Index

Renko Chart Bar Types Standard And Custom Mean Renko Bars In 2021 Trading Charts Day Trading Price Strategy

What Is The Vix A Guide To The S P 500 Volatility Index

What Is Vix Index Trading Thevolatility Index Libertex Com

/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)