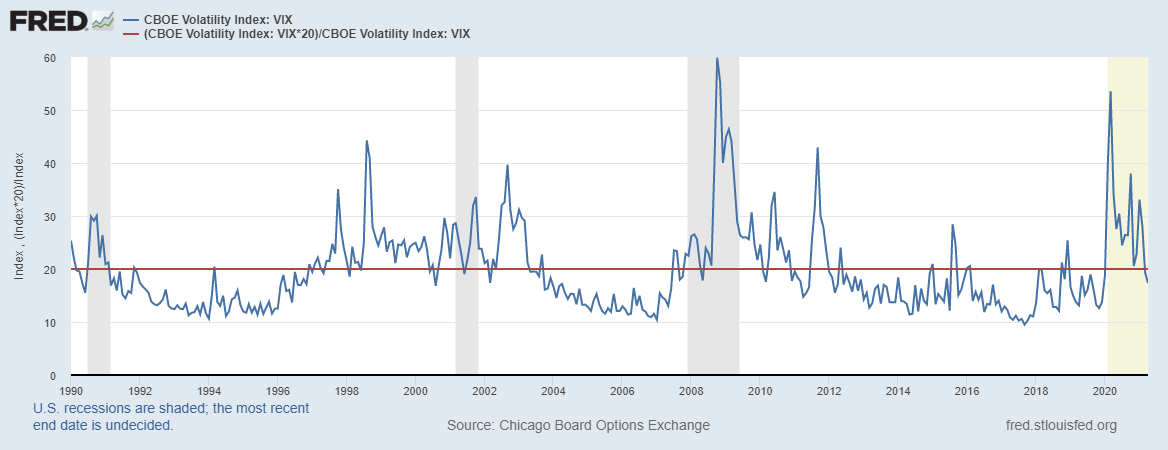

The Chicago Board Options Exchange Volatility Index commonly known as the VIX reached an intraday low of 1868 on a scale of 1-100 where 20 represents the historical average. Whenever the VIX dips below 20 the stock market marks a medium-term top.

How To Profit Using The Vix Indicator

You see individual equity option volume has exploded.

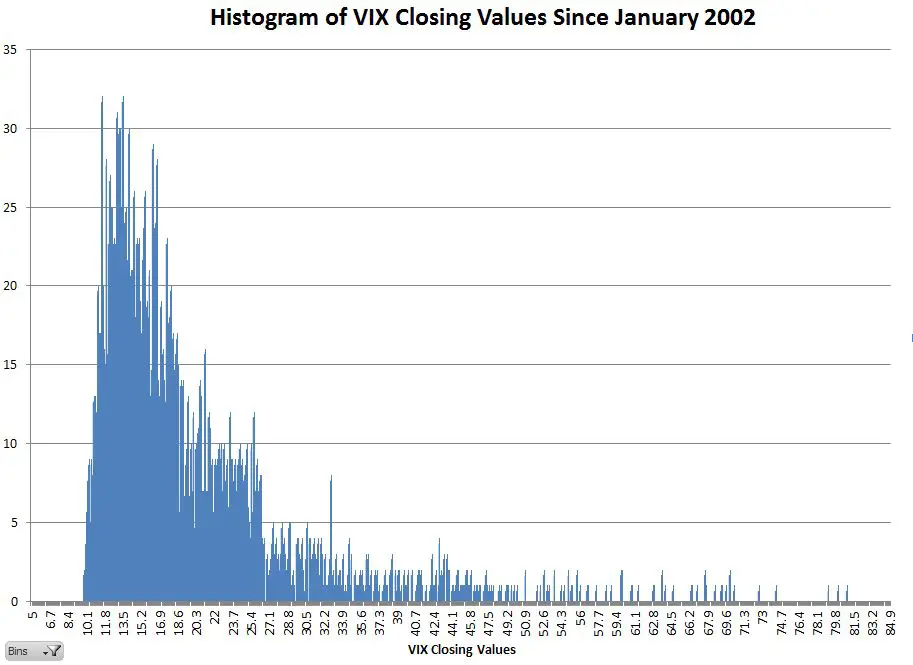

Vix below 20. The VIX is a measure of that expected volatility When the VIX is high and falling Wall Street is climbing that wall of worry. The VIX median back to 1993 is 1826 so if nothing else Id use that as the cheap point. How to Trade the VIX VIX index has paved the way for using volatility as a tradable asset although through.

The question will resolve on the first date that the closing price of VIX is below 200 as per the CBOEs daily updated csv file or if unavailable any other report from CBOE. In between 20 and 30 is a good time to sit tight watch and wait for the right buying or. A low VIX under 20 is good for buying - everyone is aligned in expectations and the market is stable.

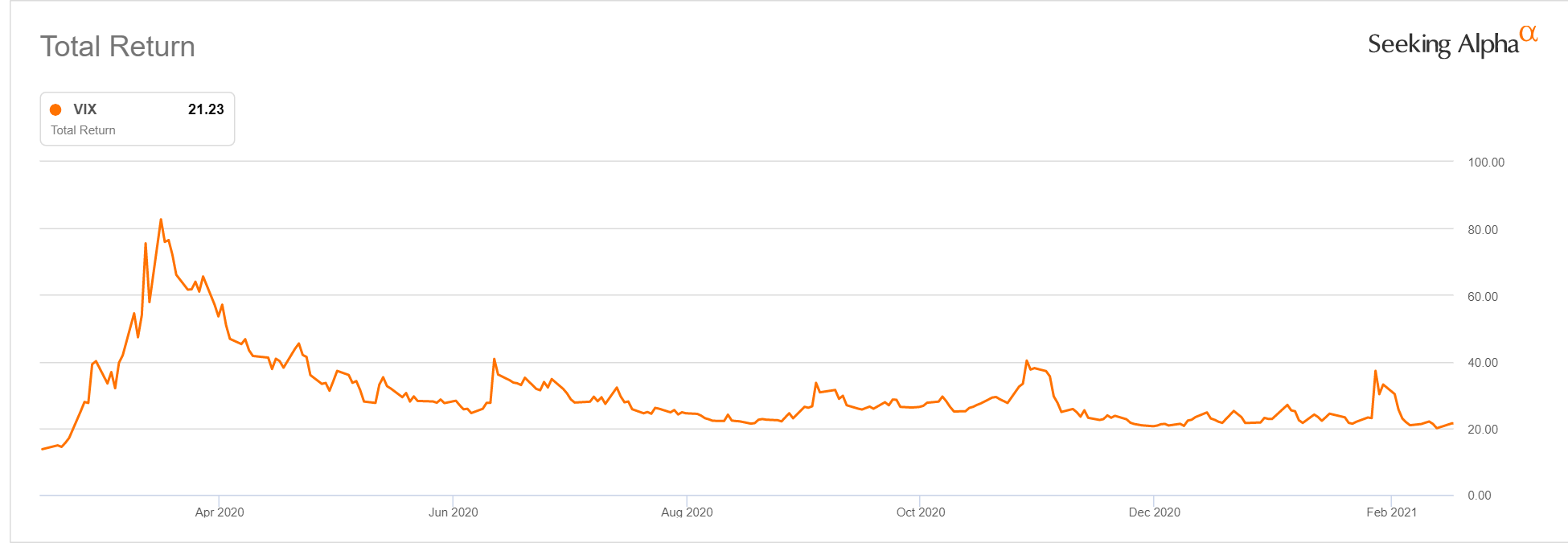

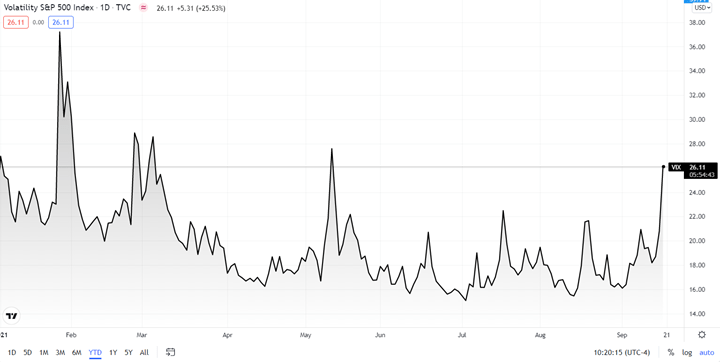

On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. The VIX fell 128 points to end at 1997. The CBOE VIX VXX pulled back slightly on Friday as the US.

With the vix lowering below 20 presents a great oppurtunities for investors to enjoy the r. During the last two bear markets the 16-17 level on the VIX has been the floor. Stock Market Super Bull run of 2021 starts off with vix under 20.

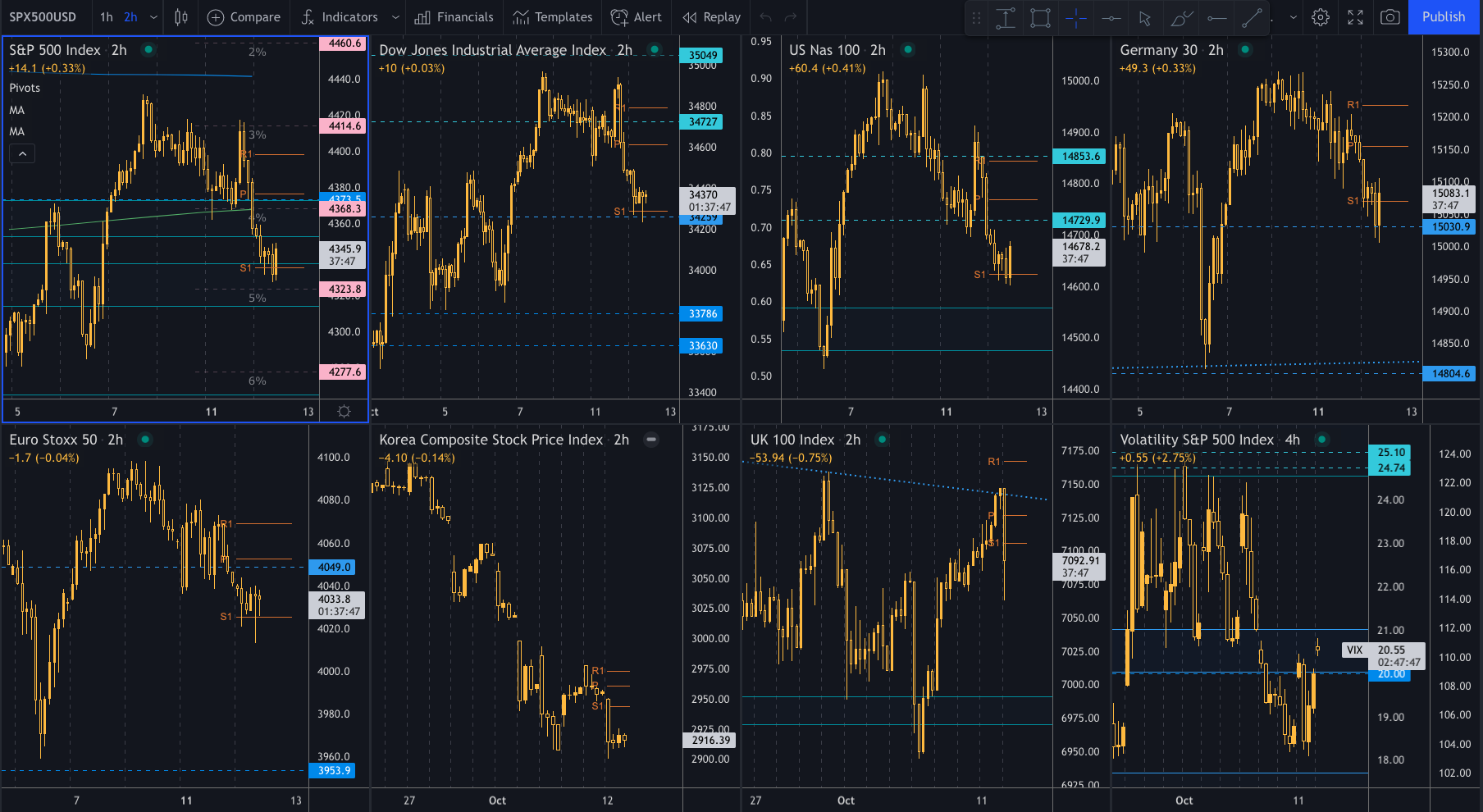

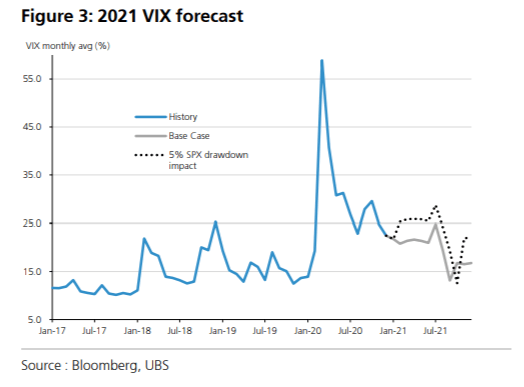

VIX The VIX has been hovering around the 20-21 region so far today. As the VIX began to fall VIX 24 23 and 22 puts became bigger delta options as they became more in the money. A high VIX over 30 is bad from a risk averse perspective - expectations are all over the place and the market is unstable.

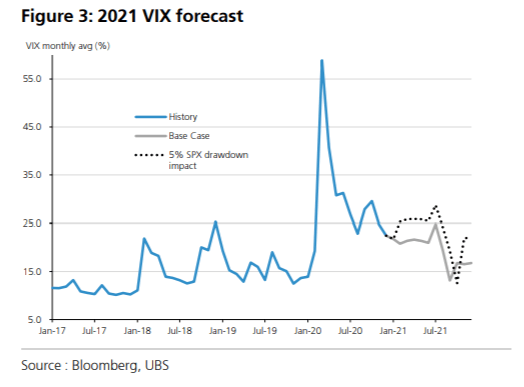

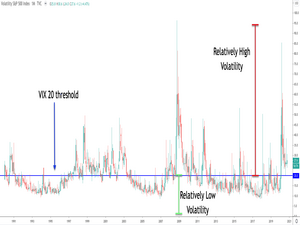

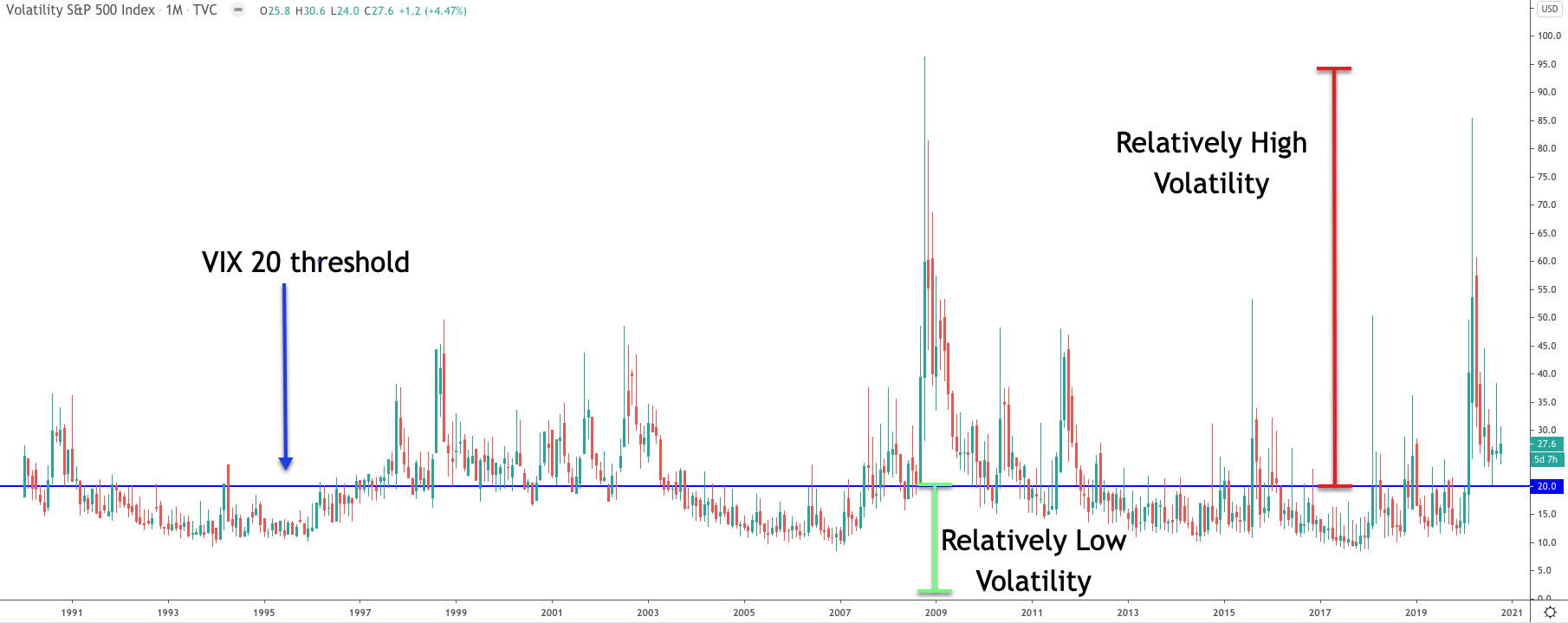

As the chart below shows the VIX trades above the level of 20 during the periods of US recessions and the. Whenever the VIX begins to register readings above 20 then it is a sign of a higher risk market environment. The VIX has been a great shibboleth for testing whether stocks will rise or fall and a quick barometer on the risk tone.

A VIX level of 20 would consider a borderline in case the VIX went below that line it usually meant market traders increased their appetite for riskier assets so as a general observation we would like to increase risk in case the VIX drops below 20 which in 2020 happened very little as a fact it happened the minimum number of times in the. The Chicago Board Options Exchange Volatility Index commonly known as the VIX reached an intraday low of 1885 on a scale of 1-100 where 20 represents the historical average. Below is a monthly analysis of the VIX this century with the SP 500 performance shown beeneath it.

From the chart above its pretty clear that when the VIX moves above 20 you must remain cautious as many times this signals bear market action for an extended period. Last week was slow by recent standards and option volume on Friday was 43 MILLION contracts. It had not closedbelow 20.

On Friday the VIX fell to 1997 on the close the first time weve seen the VIX close below 20 since the pandemic began and fear exploded. The VIX generally tells you what the market is doing not leading the market. Now for two weeks in a row not only did we see a close of the VIX below 20 it has closed at the lowest level in over 12 months.

As Global Head of Trading Structuring and Quant RD I was responsible for 2050 billion dollars of daily trading across 1617 trading desks - comprising head count of 50 traders reporting into me Across listedOTC products including Spot FwdsFutures Options Ex. The VIX CBOE Index is currently trading below 20 which is a very important level. The SP 500 rose 313 points or 015 percent to.

Throw in an end-of-day SP 500 Index SPX ramp-up and it was the perfect recipe for a VIX dump. Most find VIX cheap under 20 even though thats not really the case. As the VIX is breaking below 20 in Figure 1 it indicates that the investment crowd is extremely complacent about the.

The CBOE VIX Volatility Index held below 20 on Friday. Answer 1 of 3. Its the price of SPX options out about 30 days in expiry both puts and calls.

This is rather significant as it implies that the fear and. Now the VIX is below 20 again on a Monday night. Intraday price movements will not count towards resolution.

The Cboe Volatility Index known as Wall Streets fear gauge ended below 20 forthe first time in nearly a year on Friday. The VIX is a measure of that expected volatility When the VIX is high and falling Wall Street is climbing that wall of worry. Stock market ended a volatile week on a positive note.

And cheap isnt really that. And market makers were forced to sell VIX futures to hedge. When there is heightened anxiety in the market the VIX price reading can spike quickly higher as market participants are more inclined to buy insurance.

When the market moves fast usually down it rises fast and. The CBOE VIX VXX edged lower on Wednesday as surging tech shares powered the SP 500 to gains. SP 500 Volatility Index VIX Weve used a weekly VIX chart here to illustrate the significance in the recent reduction in volatility.

VIX values below 20 generally correspond to stable stress-free periods in the markets. The CBOE VIX Volatility Index holds below 20. For over a year the VIX has not ended a week below the 20 mark.

Equity indexes finished mixed yesterday after climbing off midday lows while the CBOE Volatility Index fell back below the 20 level. Answer 1 of 3. Despite the VIX being under 20 the way options trade now versus a year ago has fundamentally changed.

A VIX below 20 is seen as a signal that the stock market is transitioning from a high-volatility regime to a low-volatility regime according to Fairlead Strategies Katie Stockton. The VIX is not the nose of the dog its the tail. Below you will find the long term chart of the VIX based on monthly timeframe.

By comparison a year ago Option Clearing Corporation OCC volume was 26 million on a. A full series of VIX prices since its 2002 inception is available here.

Vix Breaks Its Streak Above 20 Seeking Alpha

Why The Vix Index Is A Bullish Sign For Stocks

How Does The Cboe S Vix Index Work Six Figure Investing

Keep An Eye On The Vix Around The 20 Region

Vix What Is It And How To Use It Correctly Forex Training Group

Vix Sub 20 The Short Volatility Trade Is Back Nysearca Svxy Seeking Alpha

The Turn Of The Skew Marquette Associates

:max_bytes(150000):strip_icc()/dotdash_INV-final-Using-Moving-Averages-to-Trade-the-VIX-Apr-2021-02-4ab65b117ded4245808342a4a45a8e4f.jpg)

Using Moving Averages To Trade The Vix

Vix Etfs Rally As Volatility Levels Spike Seeking Alpha

Vix Daily Update Fear Index Drifts Further Below 20 Tradinggods Net

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

Vix Breaks Its Streak Above 20 Seeking Alpha

Vix Closed Below Its Bollinger Bands For Cboe Vix By Edogawa89 Tradingview

Volatility Index Vix Mq4 Indicator

The Vix Hits Its Lowest Level Since The Pandemic Began Are We Finally In The Clear The Motley Fool

Vix What Is It And How To Use It Correctly Forex Training Group

:max_bytes(150000):strip_icc()/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)