Each VIX futures contract represents 1000 units. Youll find the closing price open high low and change for the selected range of dates.

Trading Volatility Vix Futures Historical Data

Get free historical data for the SP 500 VIX Future.

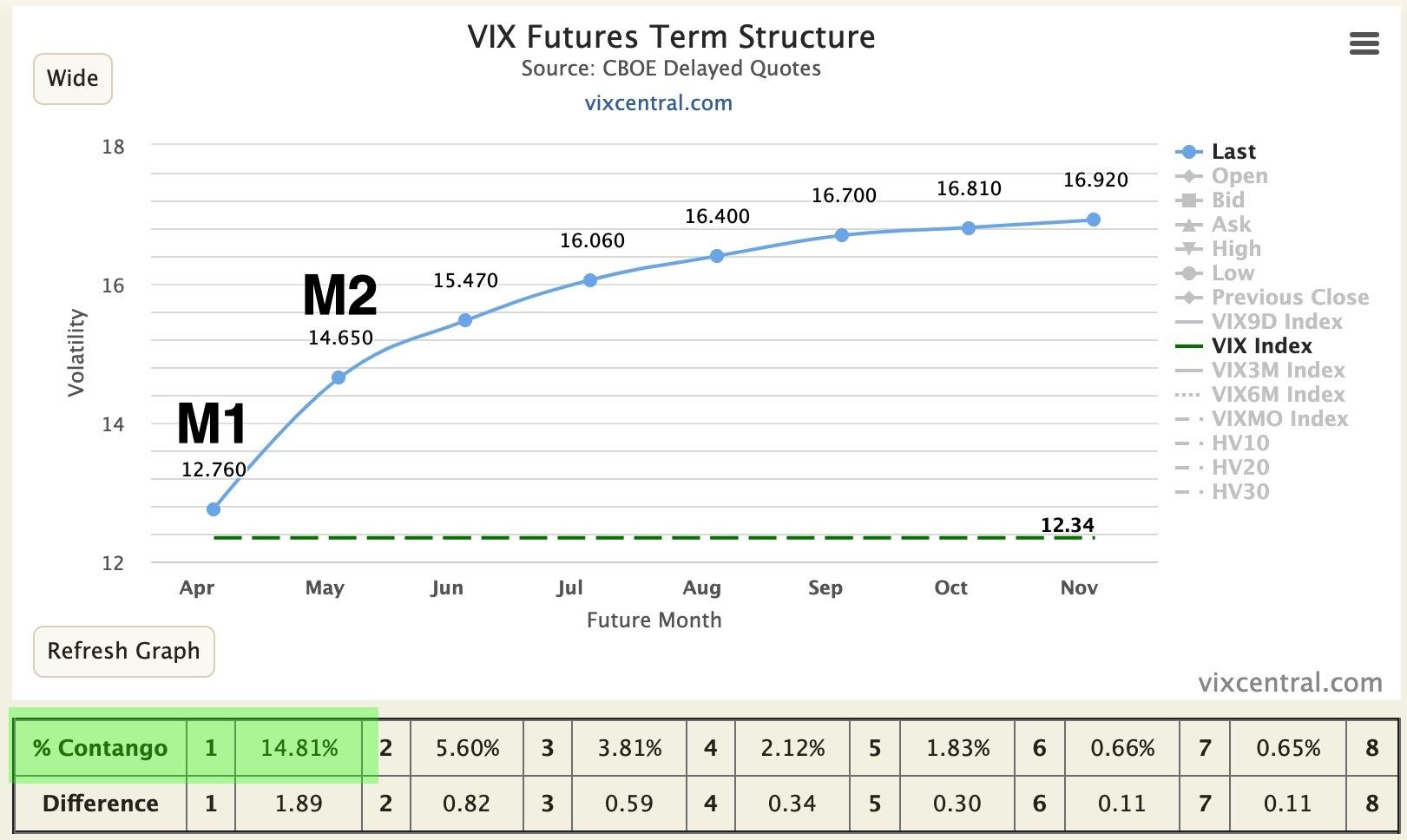

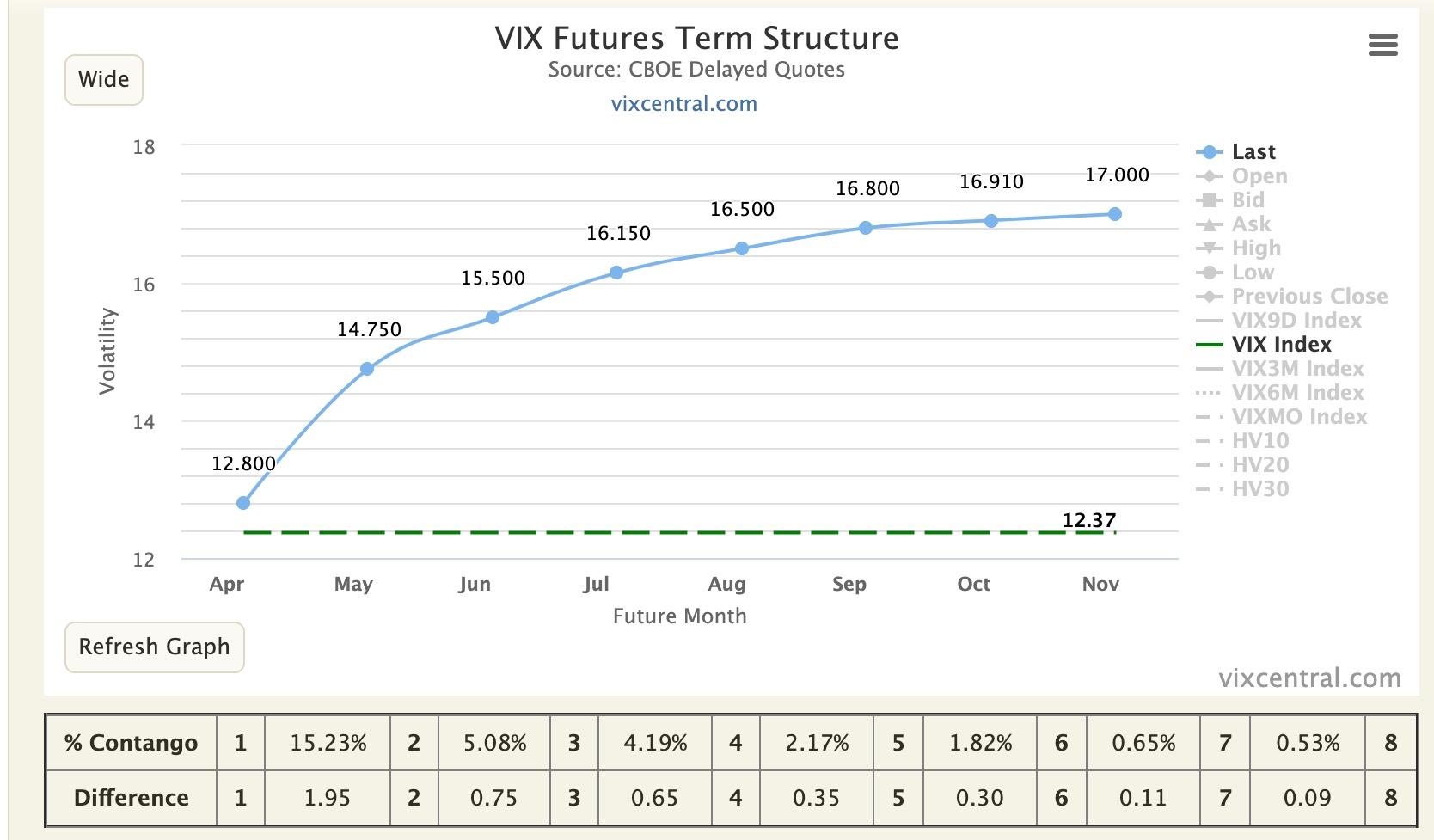

Vix futures prices. Once the markets have closed the Last Price will show an s after the price indicating the price has settled for the day. As you can see from the diagrams the current price of the VIX is 1524 while the price of the VX futures is 1860. Overnight Globex prices are shown on the page through to 7pm CT after which time it will list only trading activity for the next day.

Chicago Options Delayed Price. 16 1-161801 Ln 101 31623023 16 01116 23979 3162321 1693. Volatility as a tradable asset.

The commodity of equity markets. Two years later in February 2006 Cboe launched VIX options the. VIX is generally in contango like index option volatility.

The prices for the nearest expiration of Mini VIX futures tend to move in relationship with movements in the VIX Index. Get the latest VIX VIX value historical performance charts and other financial information to help you make more informed trading and investment decisions. In other words the value of one futures contract is 1000 times the respective VIX Index value.

The SP 500 Index SPX SPY on Friday closed slightly lower by -011 the Dow Jones Industrials Index DOWI DIA closed 021 and the Nasdaq 100 Index IUXX QQQ closed -087. Find the latest information on VIX Jul Futures Index VIXJUL including data charts related news and more from Yahoo Finance. Intraday futures prices are delayed 10 minutes per exchange rules and are listed in CST.

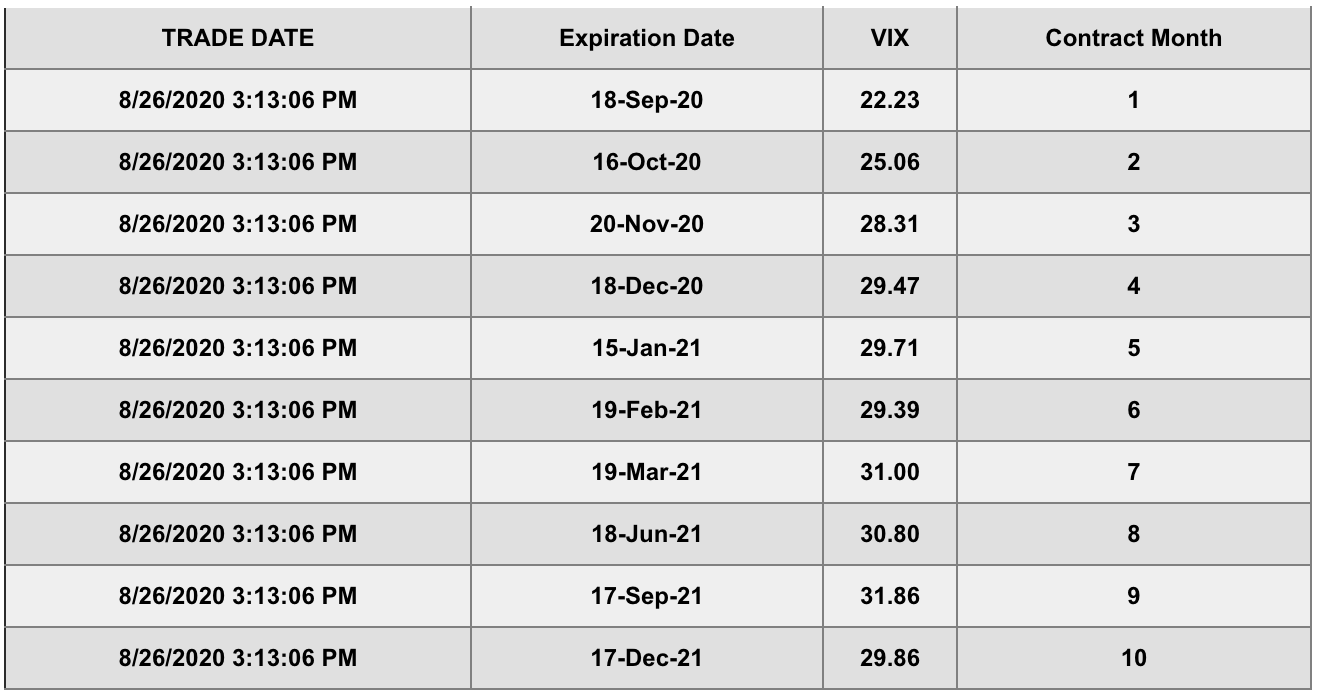

The historical price data for VIX futures are obtained from Quandl. In some cases spreads block trades it is 001 points 10. SP 500 VIX futures price quote with latest real-time prices charts financials latest news technical analysis and opinions.

Now VIX futures trade on several electronic platforms in different parts of the world including the XTB. VIX Futures Futures contracts with monthly expirations settling on spot VIX. Live VIX Index quote charts historical data analysis and news.

We have validated the Quandl data against that directly from the CBOE. VIX futures are listed as the first VX CBOE SP 500 Volatility Index VIX Futures. SP 500 VIX Futures Market News and Commentary.

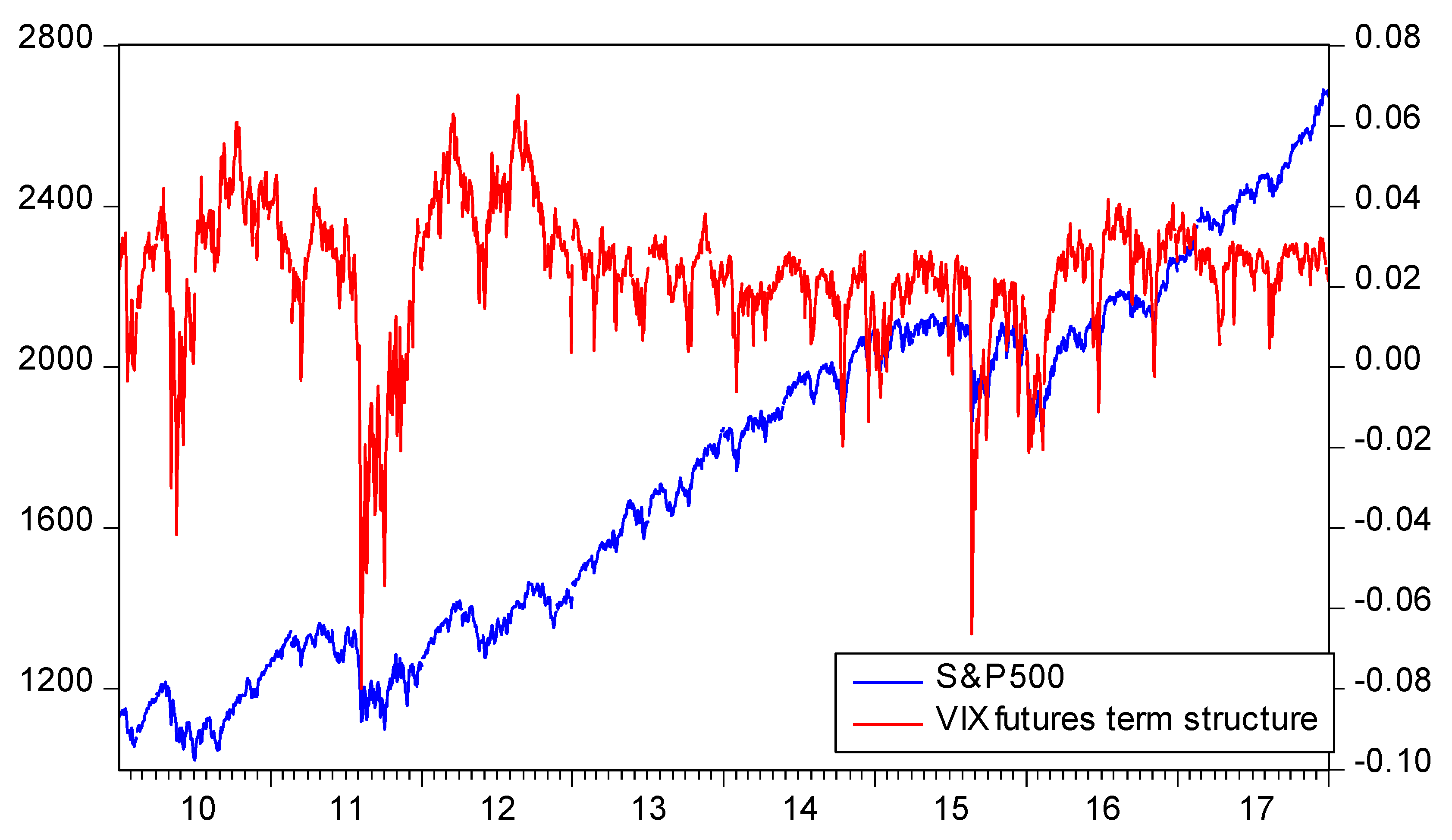

After compiling our dataset consists of the entire closing price history from March 26 2004 the 1st day VIX futures began trading through January 27 2017. For the spot VIX data as well as the related ETNs we use Yahoo. On the CFE platform the VIX futures are generally quoted with the symbol VX but some figures may be added to denote the expiration period.

The SP 500 VIX Front Month Futures Index is designed to measure the return from a long position in the first VIX futures contract that rolls to the second month contract three days prior to the expiration day. Tick size is 005 VIX points 50. 2 As a VIX future gets closer to its settlement date the contracts price will converge to the VIX Index price as well as become more sensitive to changes in the VIX Index.

Where VIX is the current VIX index value VIX Median is the historic VIX Median value 1801 for March 2004 through September 2015 and X days until VIX Future expiration. What you need to know. If the VIX is at 16 and a VIX future has 10 days before expiration this model predicts a price of 1693.

Add to watchlist. 10 monthly expirations are actively traded with considerable liquidity in the 3 front months. VIX Futures Options On March 24 2004 Cboe introduced the first exchange-traded VIX futures contract on its new all-electronic Cboe Futures ExchangeSM CFE.

You can easily recognize it not only because it is at the end but also because all prices Open High Low Close except the Settle price are zero as well as Volume. To measure investors changing risk expectations the authors have chosen therefore to look at the response of CBOE Volatility Index VIX futures prices to news stories about employment. VIX futures provide market participants with a variety of opportunities to implement their view using volatility trading strategies including risk management.

However this relationship may be undercut depending on for example the amount of time to expiration for the Mini VIX futures contract and on supply and demand in the market for those futures. 1 Longer-term contracts typically have more risk in terms of carrying costs. In other words when you are long one VIX futures contract and its price increases by 1 point you make 1000 it works both ways of course.

For more information on this equation see A Very Simple Model for Pricing VIX Futures. CBOE SP 500 VIX Contracts Delayed Futures - 2102 - Tuesday July 12th. Get live VIX futures prices and pre-market data including CBOE Volatilty Index futures charts news analysis and more SP 500 VIX Futures coverage.

Price quotes for SP 500 VIX are delayed by at least 10 minutes as per exchange requirements. They used OpenHighLowClosing data for the serial front-month first to expire VIX future provided by CQG Inc. For the calendar year 2012.

View VIX CBOE volatility index price based on real time data from SP 500 options. Before trading a VIX futures contract these are the most important things you need to be aware of. VIX futures reflect the markets estimate of the value of the VIX Index on various expiration dates in the future.

VIX futures trade almost round the clock during the work week. A near real-time chart of the VIX Futures values.

Trading Vix Futures Volatility Product Guide Projectoption

The Vix Futures Curve Is In Backwardation S P Global

A Very Simple Model For Pricing Vix Futures Six Figure Investing

Cfe Five Things A Trader Should Know About Vix Futures Phillipcapital

Vix Term Structure The Ultimate Guide Projectoption

Contrasting The Price Dynamics Of The Vix And Vix Futures By Tim Leung Ph D Towards Data Science

Contrasting The Price Dynamics Of The Vix And Vix Futures By Tim Leung Ph D Towards Data Science

Contrasting The Price Dynamics Of The Vix And Vix Futures By Tim Leung Ph D Towards Data Science

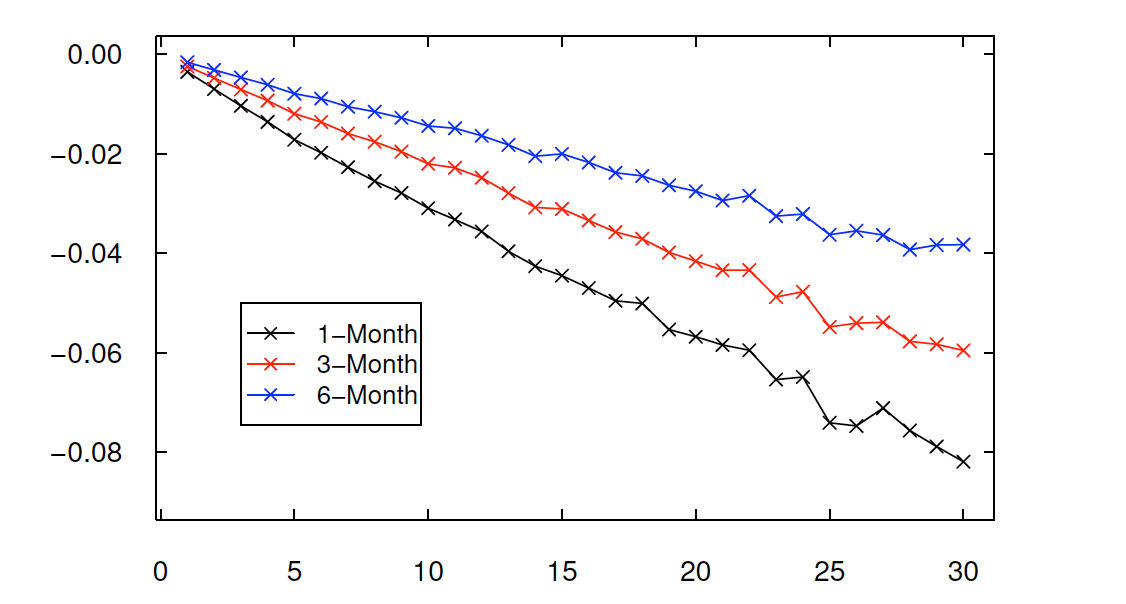

Slopes Of The Vix And Vstoxx Futures Term Structures The Graph Shows Download Scientific Diagram

Trading Vix Futures Volatility Product Guide Projectoption

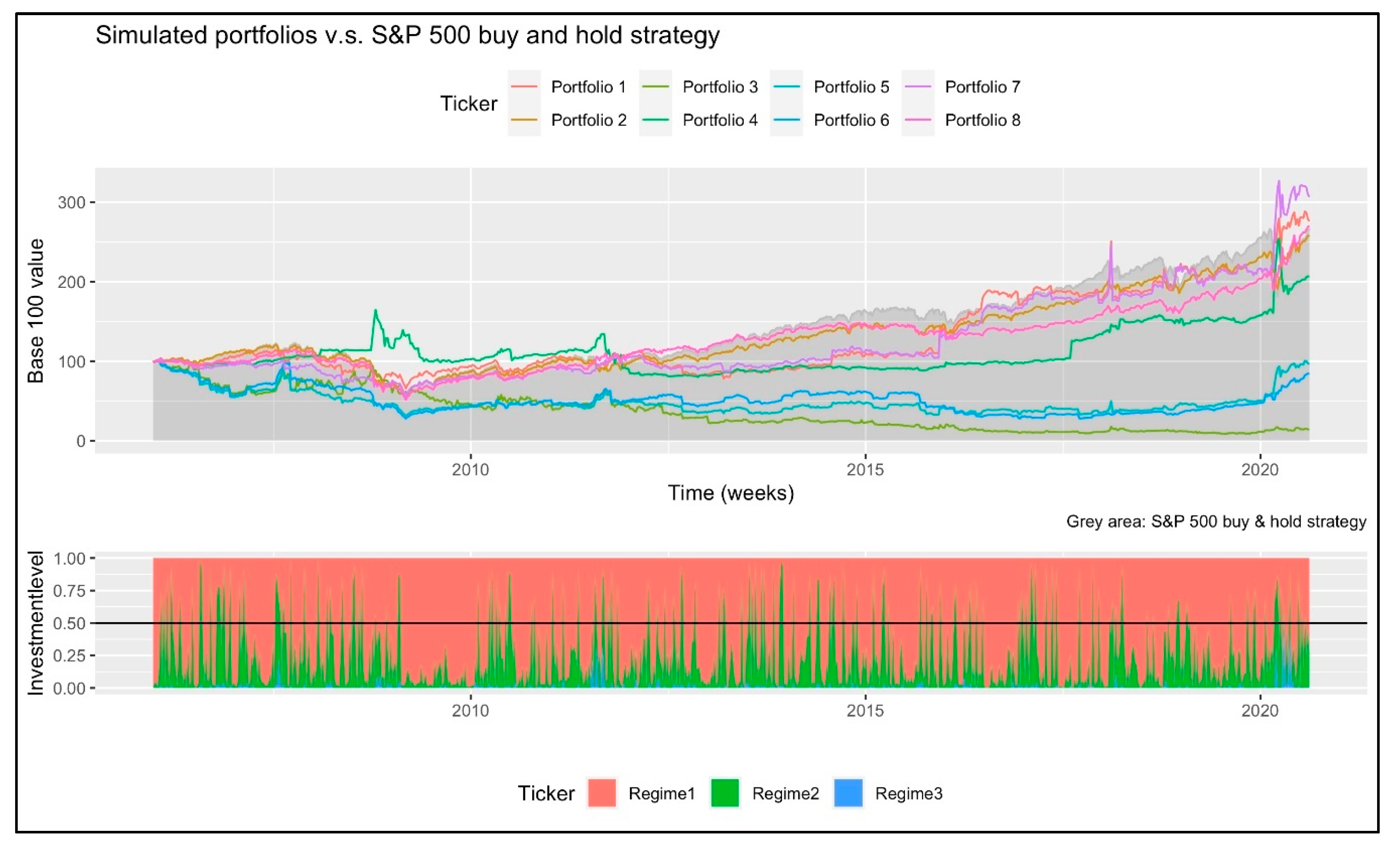

Mathematics Free Full Text Enhancing Portfolio Performance And Vix Futures Trading Timing With Markov Switching Garch Models Html

Adjusting M1 M2 Vix Futures Contango For Days To Expiration Bats Vxx Seeking Alpha

M1 M2 Vix Futures Explained Contango Backwardation Vxx Bats Vxx Seeking Alpha

Jrfm Free Full Text Vix Futures As A Market Timing Indicator Html

Constant Maturity Vix And Vstoxx Futures Indices Evolution Of The Download Scientific Diagram

The Vix Futures Curve Is In Backwardation S P Global

How To Read Vix And Vix Term Structure Burney Investment Management

Trading Volatility Vix Futures Historical Data

Vix Futures Spread Trading Quantitative Analysis And Trading