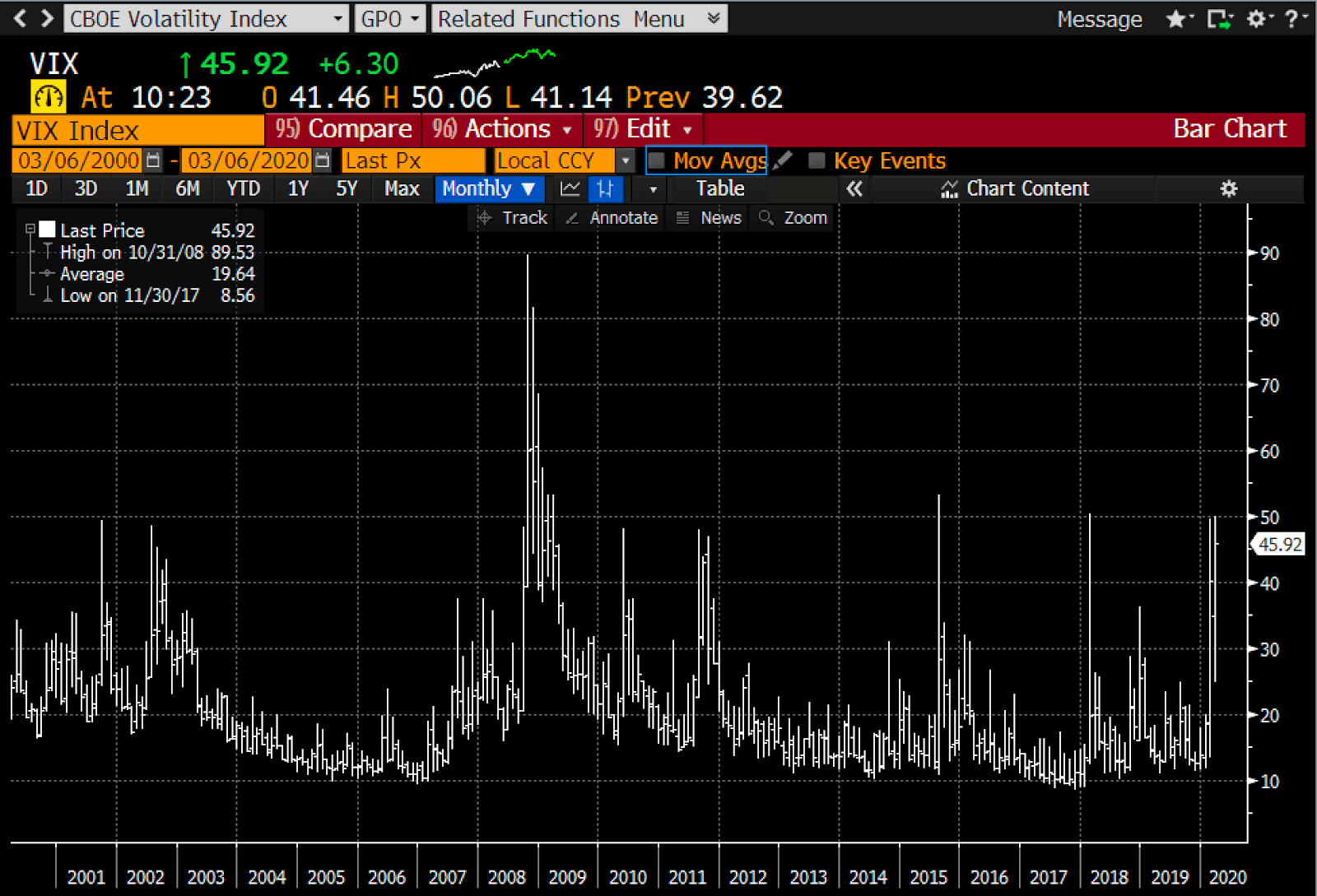

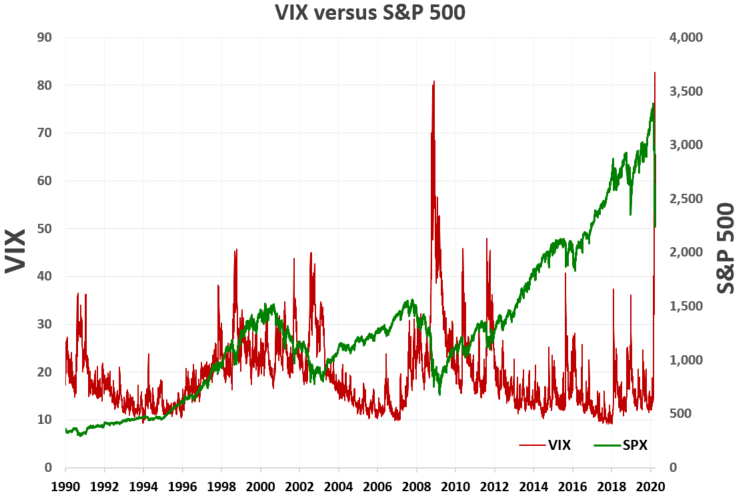

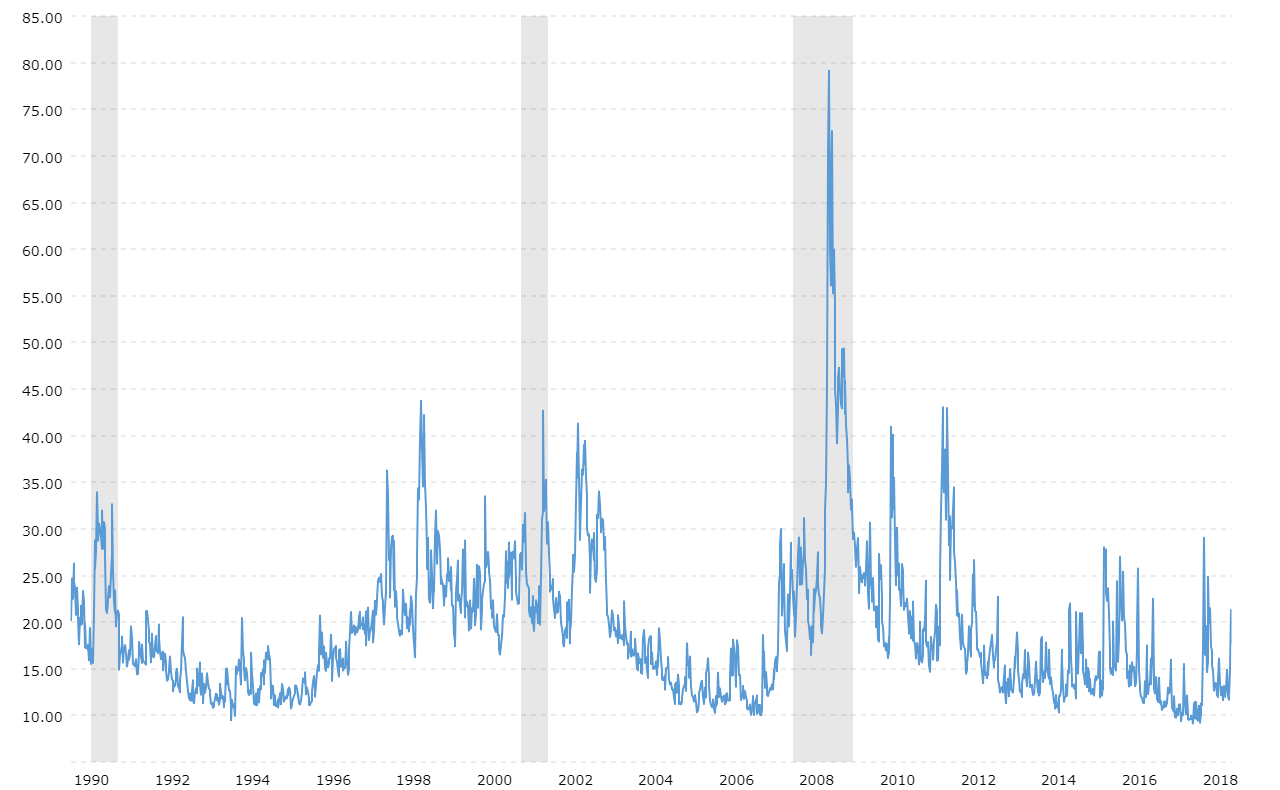

ViX can remain in 11-16 for a longer period of time. Interactive historical chart showing the daily level of the CBOE VIX Volatility Index back to 1990.

Keep Your Eyes On The Vix The Motley Fool

VIX volatility can be in broader range of 11-25 for long period of time.

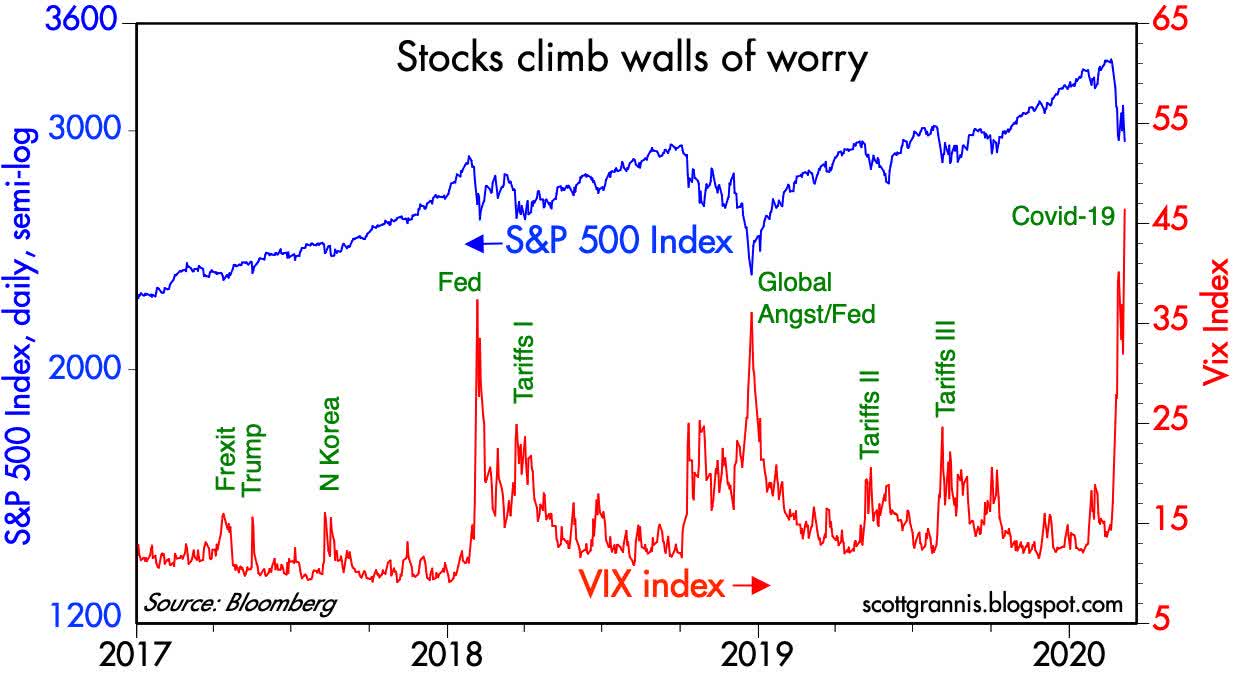

Vix index now. CBOE Volatility Index VIX Chicago Options - Chicago Options Delayed Price. Register now for our 1117 webinar at 2PM ET. 2017-2020 saw such range bound movement.

Now that you know a bit about the VIX and how to use it let dive in to some ways to trade it. The VIX index options actually showed some life in terms of volume. Investors use the VIX to measure the level of risk.

Johnson Johnson rallied more than 3 in pre-market trading after it announced it would split into two companies. 103342 -283 Pre-Market Brief. In spite of a degree of optimism over.

Try Now Try Now The CBOE Volatility VIX Index works as a popular means to find out the expected markets volatility based on the options of the SP 500 index. The ratio of puts to calls was 13 to 1. View real-time VIX index data and compare to other exchanges and stocks.

This is a neutral reading and indicates that market risks appear low. The index is a financial benchmark meant to measure the markets expectations for future volatility. Financial media frequently refers to the CBOE Volatility Index VIX as the markets fear gauge.

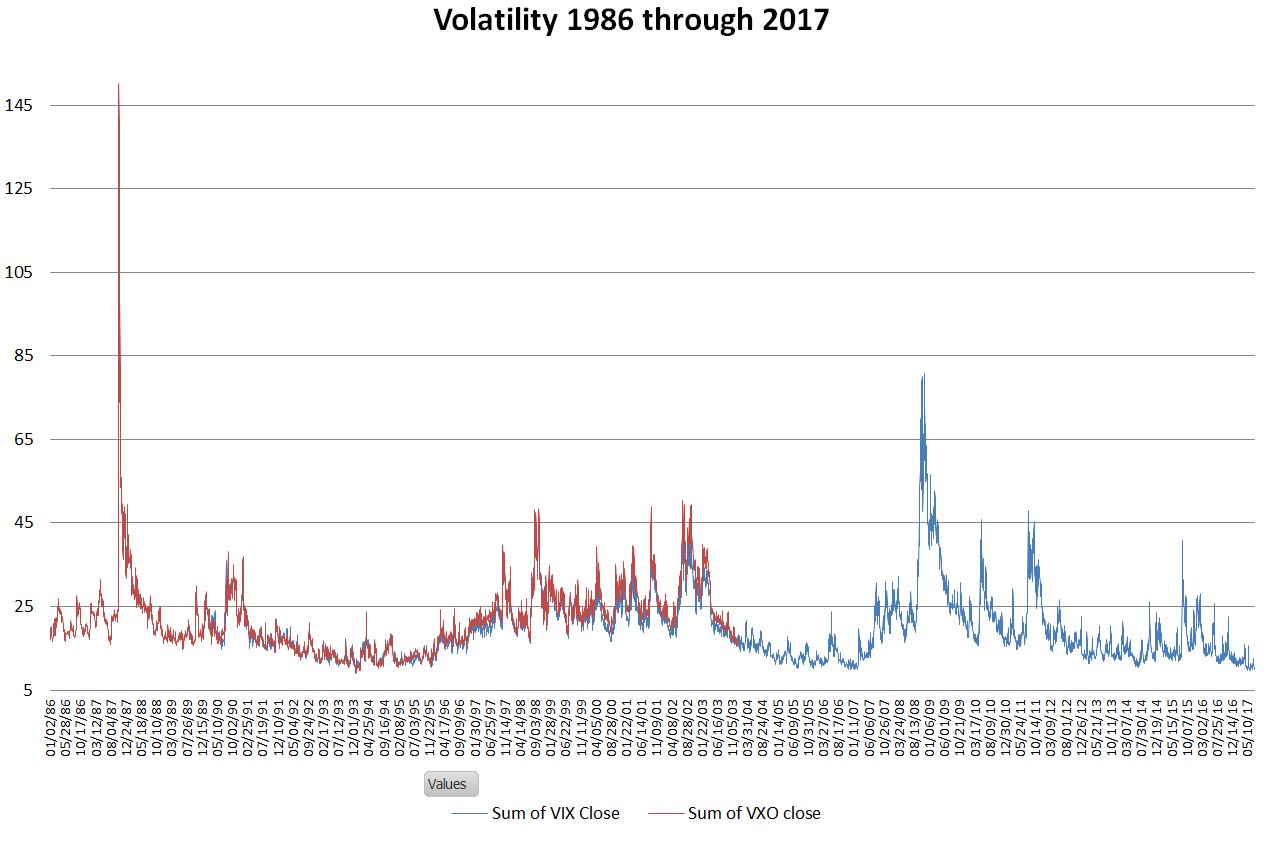

Calls traded above their average volume puts traded almost TWICE their normal volume. You should note that the values of the old method index are different from the what we have now as VIX Index so they should be treated as different indexes. The VIX also known as the stock markets fear index has since subsided from Marchs multi-year highs in line with the bounce back in US stocks.

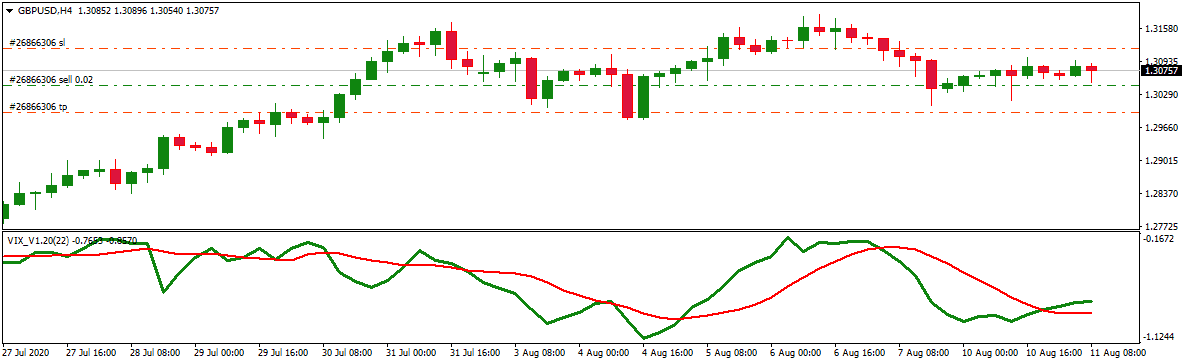

VIX if falls to this level then caution should be taken in option selling and short term trading positions. One of the best-known measures of implied volatility is the Cboe volatility index or the VIX Index which were now offering to clients. At 110th the size of the standard VIX futures contract Mini VIX futures are designed to provide additional flexibility in volatility risk management and greater precision when allocating among.

The Cboe Volatility Index or VIX is a real-time market index representing the markets expectations for volatility over the coming 30 days. VIX is commonly known as the VIX which is also its ticker symbolIt is a popular measure of the stock markets expectation of volatility based on options activity in the SP 500 index SPX. It is calculated in real-time based on the live prices of the SP 500 index.

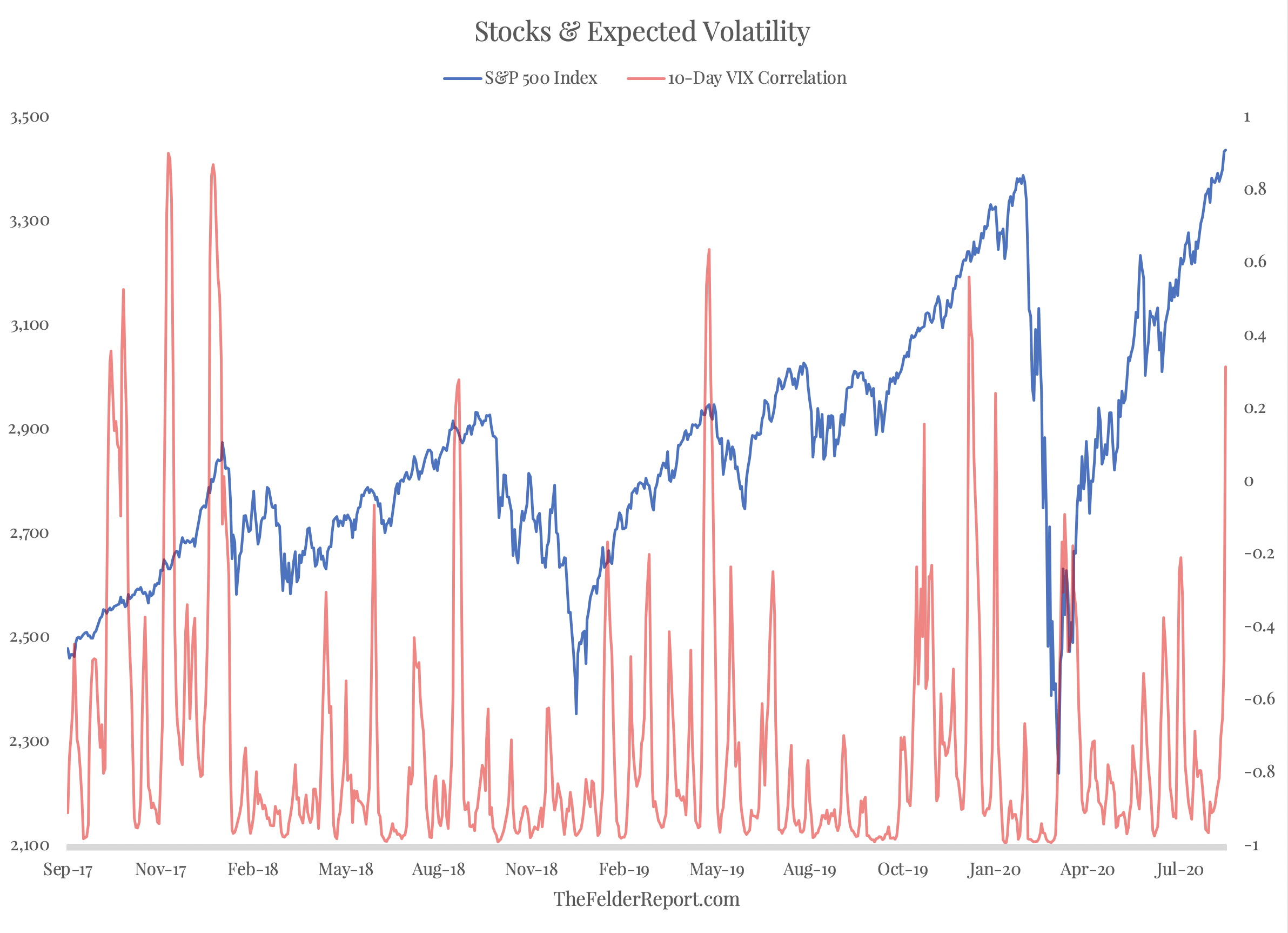

2020 was one of event for ViX. The significant risk here is a spike in the VIX above 24 which would be a de-risking event for the equity market. The VIX is a financial benchmark operating in real-time.

However while the daily historical data for the VIX is available from 1990 the VXO historical data covers as far as 1986 capturing the Black Monday event of 1987. CBOE Volatility Index advanced index charts by MarketWatch. The VIX stock market index is published and calculated by the Chicago Board Options Exchange CBOE.

The Chicago Board Options Exchanges CBOE Volatility Index INDEXCBOE. Weve all heard it. VIX Volatility Index - Historical Chart.

Volatility dictates broad market conditions it is the heart of the market environment in which we as traders operate and is as important whether utilising a discretionary or algorithmic strategy. Invest In MC 30. So what does this mean.

The CBOE Volatility Index VIX is at 1629. VIX A complete CBOE Volatility Index index overview by MarketWatch. After the bearish Sept close I studied the VIX the weekend of Oct 2nd to figure out if the stock market was going to crash in October since we ended the month with a.

On a day the VIX got smoked. India VIX uses the computation methodology of CBOE with suitable. Buying a 30-40-50 butterfly for the July expiration gives a profit zone between 32 and 48.

Last changed Oct 4 from an Extreme Fear rating. Get all information on the VIX Index including historical chart news and constituents. The VIX was first introduced by the Chicago Board Options Exchange CBOE now known as Cboe Global Markets Cboe in 1993.

It looks like the SP 500 filled yesterdays gap lower and hit resistance at 4365. Click on image to enlarge SP 500. The first strategy is a butterfly trade which can be used as a portfolio protection measure for the July expiration.

Introduced in 1993 the VIX Index is now an established and globally recognized gauge of US. The VIX index measures the expectation of stock market volatility over the next 30 days implied by SP 500 index options. Watching the VIX is extremely important right now and might give us clues as to where the stock market is heading next.

Morning Markets Dec SP 500 futures this morning are up 019. VIX Trading Strategies. While that is a convenient shorthand certainly more digestible than its official definition as a measure of 30 day anticipated volatility see below VIX.

Mini VIX futures are based on the VIX Index and reflect the markets estimate of the value of the VIX Index on various expiration dates in the future. Now it seems like we have a gap to fill tomorrow at 4305. Traders are positioning for the VIX to potentially fall further.

SP 500 Set to Open Higher as Asian Markets Rally Barchart - Fri Nov 12 747AM CST. VIX is Not Now Nor Has It Ever Been the Fear Index. View stock market news stock market data and trading information.

However 11-12 is the bottom of slope. MC30 is a curated basket of 30 investment-worthy mutual Fund MF schemes.

A Brief History Of Fear Vix Over The Last 30 Years Six Figure Investing

Vix What Is It And How To Use It Correctly Forex Training Group

Rising From The Ashes The Vix In 2020 Seeking Alpha

Vix Cboe Volatility Index Education Tradingview

Vix Volatility Index Historical Chart Macrotrends

Cboe Volatility Index Vix Explained The Options Futures Guide

Quarterly U S Equity Realized Volatility And The Vix Index The Vix Download Scientific Diagram

The Vix Is Raising A Red Flag For The Rally Seeking Alpha

Trading Volatility Vix Contracts For Difference Com

Vix Index Characteristics Why Volatility Products May Provide Unique Hedging And Income Strategies In 2021 Global Indices Volatility Index Investing Strategy

The Cboe Volatility Index Has Reached Its Highest Level In History Bmo Gam

What Is Volatility 75 Index Download Vix Mq4 Indicator Forex Education

The Vix Hits Its Lowest Level Since The Pandemic Began Are We Finally In The Clear The Motley Fool

:max_bytes(150000):strip_icc()/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)