Investors and traders analyse a securitys volatility to assess previous price changes and forecast future moves. Stock market volatility refers to the range of price movement of a stock over time.

What Is Volatility Definition And Meaning Capital Com

The results are known as India VIX.

Volatility in stock market meaning. If you know anything about the stock market India youve probably heard the term stock market volatility at some point especially when the market is volatileDespite having heard the term several times most of us have no idea what it means. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. A more volatile trade has the potential for significant gains but also substantial losses.

Volatility often refers to the amount of uncertainty or risk related to the size of changes in a securitys value. Stock market volatility is a measure of how much the stock markets overall value fluctuates up and down. However when it comes to buying and selling securities science will only get you so far.

If it is. Markets hate uncertainty and theres plenty of it related to the election from the expected surge of absentee voting this year to a possibly delayed and contested result. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days.

Beyond the market as a whole individual stocks. In the stock market volatility stands for the risk of change in the price of a security. Volatility stands for the risk of change in the price of a security.

Volatility in the stock market refers to the changes in the price of an individual asset or the overall market. Most traders associate higher volatility with downward action but it simply means wider ranges between high and low prices. Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way.

Volatility refers to amount of risk related to the amount person has invested on the stock. It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is how fast the price of an investment fluctuates over time.

Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of time. In simple terms when the VIX rises the SP 500 will fall which means it should be a good time to buy stocks. A higher volatility means that a securitys value can.

Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks. Volatility is a broad term used loosely by many in the financial world. The stock market can be a tumultuous place with wide-ranging annual quarterly and even daily swings across all industries.

When a security experiences an abnormally wide range of highs and lows in its price investors call it highly volatile. Stock volatility is the range of price changes a security experiences over a given period of time or known as The rate at which price movements occur serves as a good working definition of the word volatility as it applies to the stock market. A stock that maintains a relatively stable price has low volatility.

And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. A stocks volatility is equal to the amount that particular stock will separate from the original price at which it was traded. In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns.

Implied volatility looks forward in time being derived from the market price of a market-traded derivative in particular an option. Say higher the volatility higher the risk the price of the stock may go either high or low. In India market volatility is determined using the NIFTY 50 index.

What is volatility. What is volatility. Volatility in the stock market is critical to an investors trading journey.

A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis considered highly volatile. Generally it is measured by calculating the standard deviation between the returns of a market index or security. When volatility is high the dispersion will be.

What stock market volatility means for investors. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time.

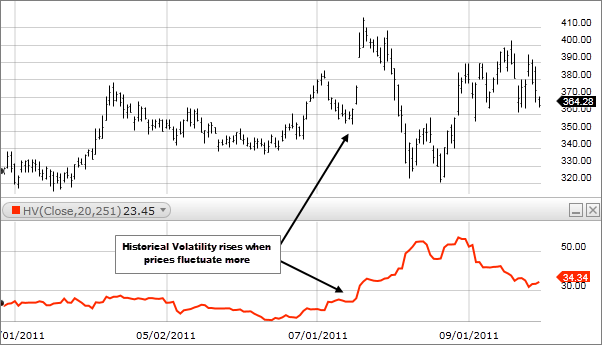

Stock volatility is when stock dramatically increases or decreases within a period of time. What is Volatility in the Stock Market. Historic volatility measures a time series of past market prices.

Sometimes it relates to price movements while at other times it is synonymous with risk. It expresses the degree of risk associated with a securitys price fluctuations. High volatility is associated with higher risk.

There is a science to investing in the stock marketCollecting and analyzing financial and economic data can lead to smart trading decisions. If volatility is high for a stock that means it could be a risky bet because of wild price swings. Calculated by prices in options a higher VIX reading signals higher stock market volatility while low readings mark periods of lower volatility.

What elevated volatility means.

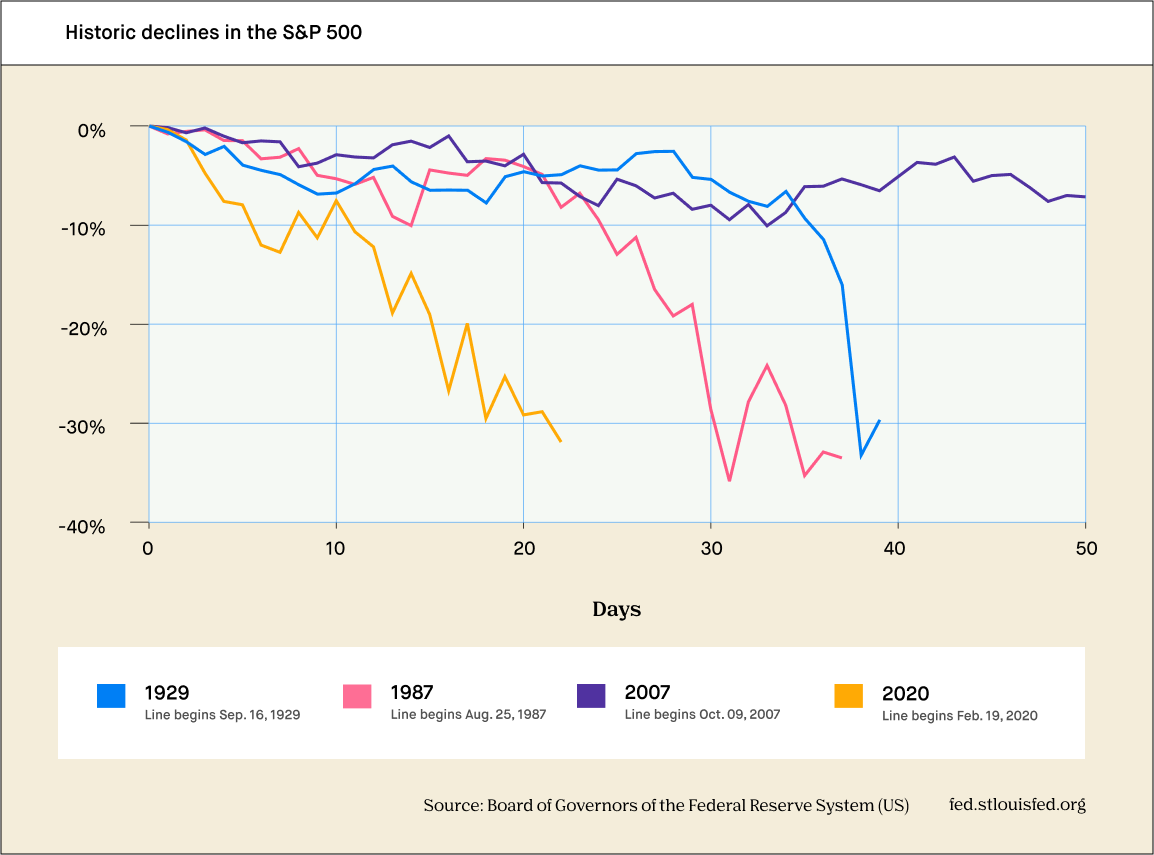

Three Charts To Help Put Stock Market Volatility Into Context Robinhood

What Is Volatility Definition Causes Significance In The Market

Why Volatility Can Be Bad For Long Term Returns

Stock Market Volatility Defined The Motley Fool

Understanding Stock Market Volatility Rule 1 Investing

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg)

Trading Volatile Stocks With Technical Indicators

Standard Deviation Indicator Fidelity

Most Volatile Stocks 2021 High Volatility Stocks To Watch Today

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Trading Volatile Stocks With Technical Indicators

Implied Volatility What It Is Why Traders Should Care

Understanding Stock Market Volatility Rule 1 Investing

What Is Historical Volatility Fidelity

What Is Volatility Definition And Meaning Market Business News

How To Measure Volatility With Average True Range Atr

How To Research Volatile Stocks

What Is Volatility Definition And Meaning Market Business News

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility