Trades by very large institutional investors. Foreign and institutional vs.

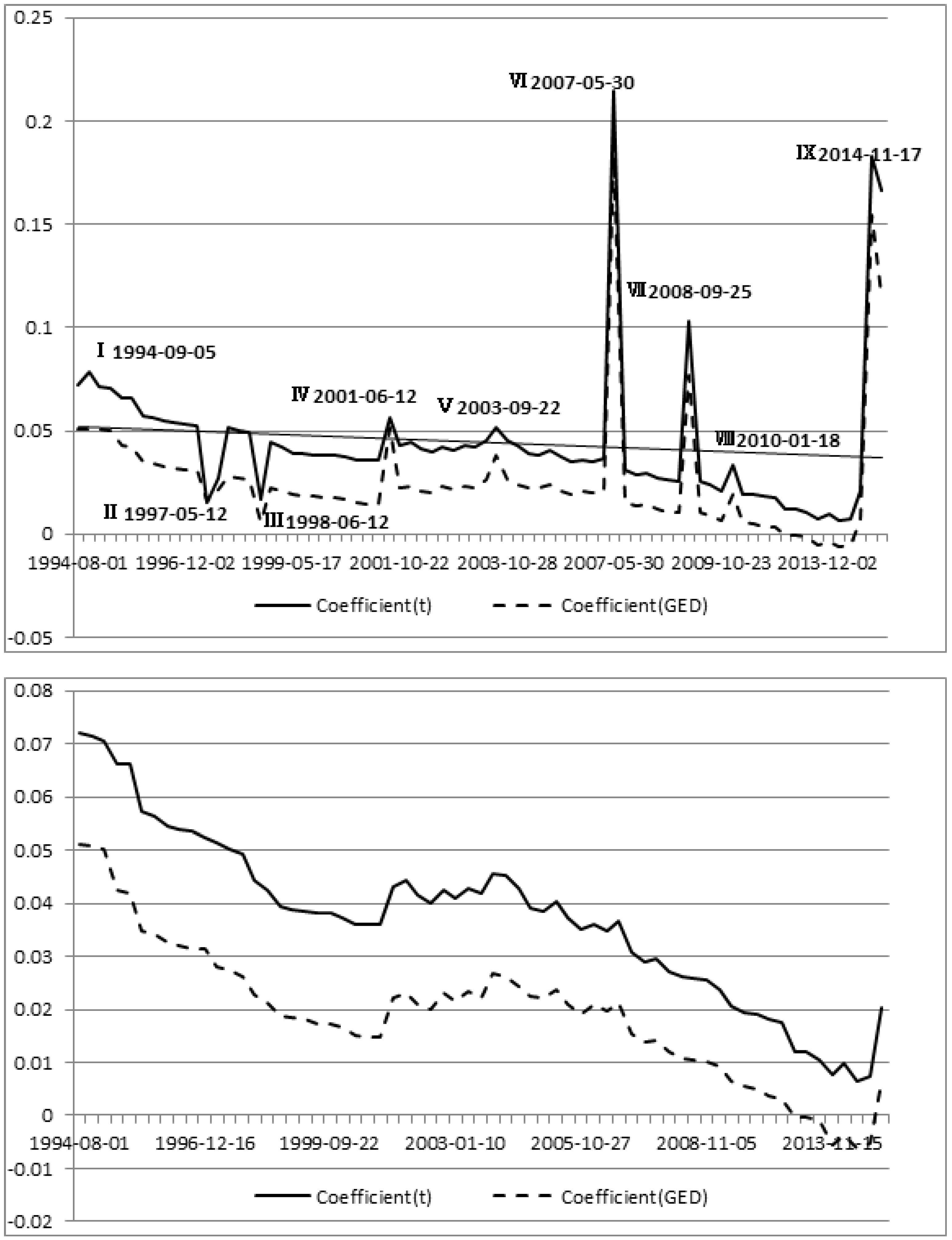

Ijfs Free Full Text Policy Impact On The Chinese Stock Market From The 1994 Bailout Policies To The 2015 Shanghai Hong Kong Stock Connect Html

A Non-destabilization hypothesis that says FTIs have no impact on stock market volatility.

Institutional investors and stock market volatility. Such trades generate significant spikes in returns and volume. Asia-Pac J Manag Res Innov 93329335. We present a theory of excess stock market volatility in which market movements are due to trades by very large institutional investors in relatively illiquid markets.

We present a theory of excess stock market volatility in which market movements are due to trades by very large institutional investors in relatively illiquid markets. However the level of the stock market and the volatility of the stock market are two distinct statistics and such conclusions are unwarranted. We can conclude that the entrance of institutional investors on the Polish stock market reduced at least temporarily the volatility of stock returns.

Such trades generate significant spikes in returns and volume even in the absence of important news about fundamentals. You hear about them in the business press often but how do their actions move markets. BlackRock Vanguard State Street Fidelity and Capital Group are driving up equity market volatility and fuelling mispricing in company stocks according to an analysis that raises fresh.

Foreign institutional investors FIIs and mutual funds net equity investment. Rubin and Smith 2009. 7-Mamta etal 2012 examined the impact of foreign institutional investment on stock market using statistical tool of Karl Pearsons coefficient of correlation.

A cause and effect relationship. The results can also help policymakers efforts to stabilize stock market volatility and uncertainty in order to protect investors wealth and attract more investors. Of institutional investment with stock return volatility is negative.

The investment by Foreign Institutional Investors FIIs has become a dynamic force in the development of Indian stock market and is increasingly seen as an important cause of stock market volatility. We derive the optimal trading behavior of these investors which allows us to provide a unified explana-. Stock market volatility across two crisis events the Asian crisis of 1997 and the 2008 global financial crash.

The institutional volatility metrics described below also have little to no correlation with the financial volatility or market return indicators. A Positive Feed Back Trading hypothesis that says foreign institutional investors enter in the market when there are some positive signals of higher stock return. The study attempted to examine the pattern of FII s and its effect on volatility of BSE Sensex.

While the high-volatility regime in 2000 can be explained by the bear market the evidence around 19 May 1999 convincingly demonstrates the stabilizing effect of institutional investors on Polish stock price dynamics. We present a theory of excess stock market volatility in which market movements are due to trades by very large institutional investors in relatively illiquid markets. Evidence from India - Pramod Kumar Naik Puja Padhi 2015.

But there are signs that volatility in crypto markets is turning a corner. A theory of excess stock market volatility in which market movements are. Interaction of Institutional Investment Activity and Stock Market Volatility.

IntroductionThe issue of stock market volatility has become increasingly important in recent times due to increasing links of national stock market with the world stock markets consequent to financial sector reforms. It was observed that there is. Between FII inflows and stock market levels is widely cited supposedly as sufficient proof to conclude that FII trading causes volatility in stock markets.

By taking the investor sentiment into account as a significant determinant of stock market volatility in asset price models investors can enhance their portfolio performance. INSTITUTIONAL INVESTORS AND STOCK MARKET VOLATILITY Xavier Gabaix Parameswaran Gopikrishnan Vasiliki Plerou H. Eugene Stanley October 2 2005 Abstract We present a theory of excess stock market volatility in which market movements are due to trades by very large institutional investors in relatively illiquid markets.

What Are Institutional Investors and How Do They Affect Stock Volatility. Institutional investors and trading firms are beginning to enter the asset class with more conviction and a derivatives market for cryptocurrencies is also beginning to take shape as part of the development and expansion of the broader crypto market ecosystem. Whereas Vo 2016 finds institutional ownership helps in stability of stock price volatility.

Such trades generate significant spikes in returns and volume even in the absence of important news about fundamentals. INSTITUTIONAL INVESTORS AND STOCK MARKET VOLATILITY Xavier Gabaix Parameswaran Gopikrishnan Vasiliki Plerou H. Mehla S Goyal SK 2013 Impact of foreign institutional investment on Indian stock market.

Thisindicates the level of influence by the foreign institutional investmenton those companies particularly and on the stock market in generalAny withdrawal of foreign institutional investment may result inhuge volatility in the market as well as share price movementsSimilarly any increase in the shareholding pattern by the foreigninstitutional investors may result huge rally in the. The two major capital market reforms of i entry of Foreign Institutional Investors FIIs in Indian stock market ii permission to. Our results suggest that the buy and sell trades have an asymmetric effect on volatility.

However Azzam 2010 finds that the impact of private institutions is significantly positive on the stock return volatility. If we look at the impact of the Flls on stock market return there also we have two views. We investigate the trading behaviour of domestic vs.

Six-month volatility of contract-intensive money correlates only at 028 with realized market volatility and 004 with market returns while the measure of investor protection volatility correlates at between -001 and -002 for market volatility and market. Such trades generate significant spikes in returns and volume even in the absence of important news about fundamentals. Eugene Stanley We present a theory of excess stock market volatility in which market movements are due to trades by very large institutional investors in relatively illiquid markets.

Naik PK Padhi P 2015 Interaction of institutional investment activity and stock market volatility.

Return And Volatility Spillover Across Equity Markets Between China And Southeast Asian Countries

World Investment Report Chapter 5 Capital Markets And Sustainable Finance

Who Moves The Stock Market In An Emerging Country Institutional Or Retail Investors Sciencedirect

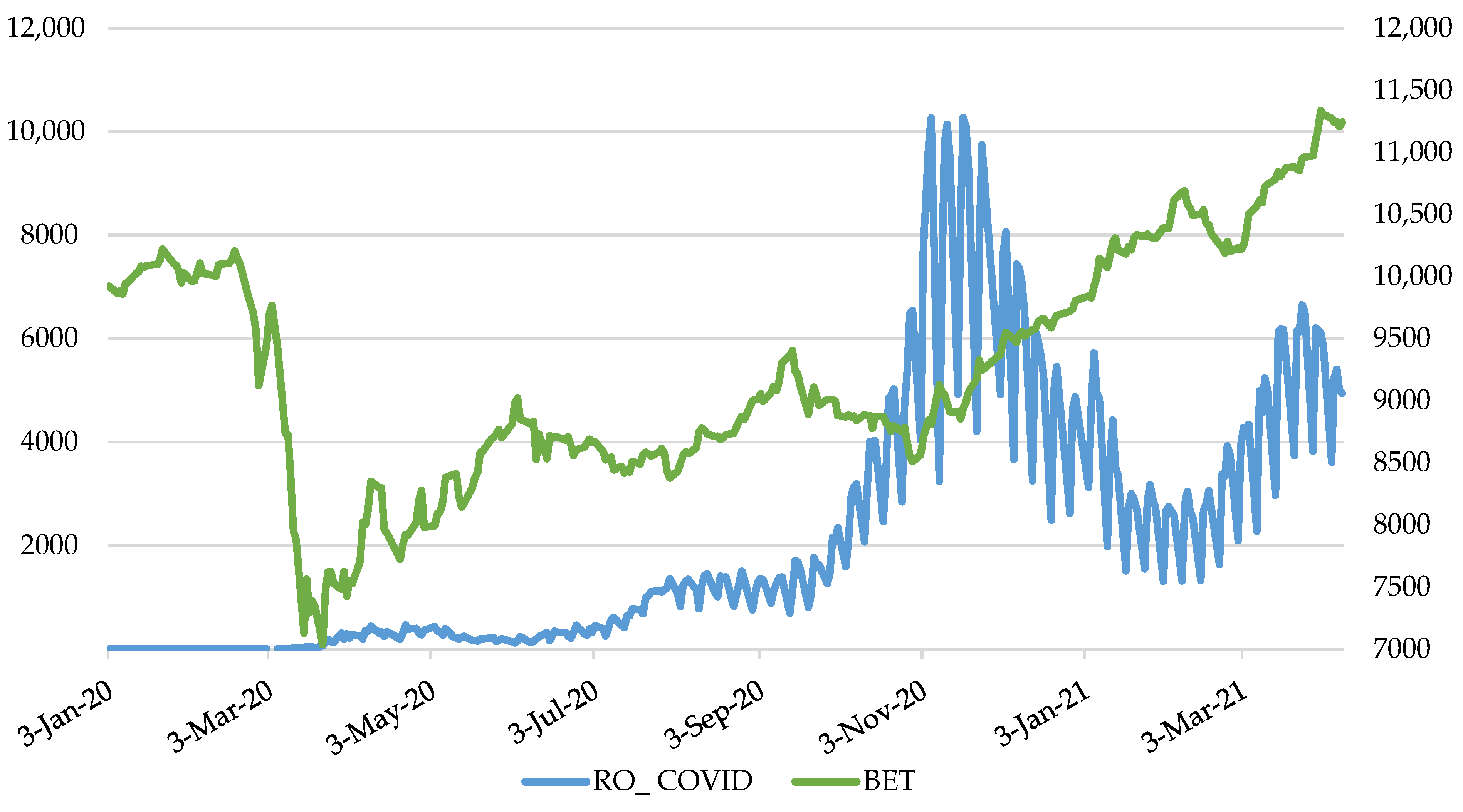

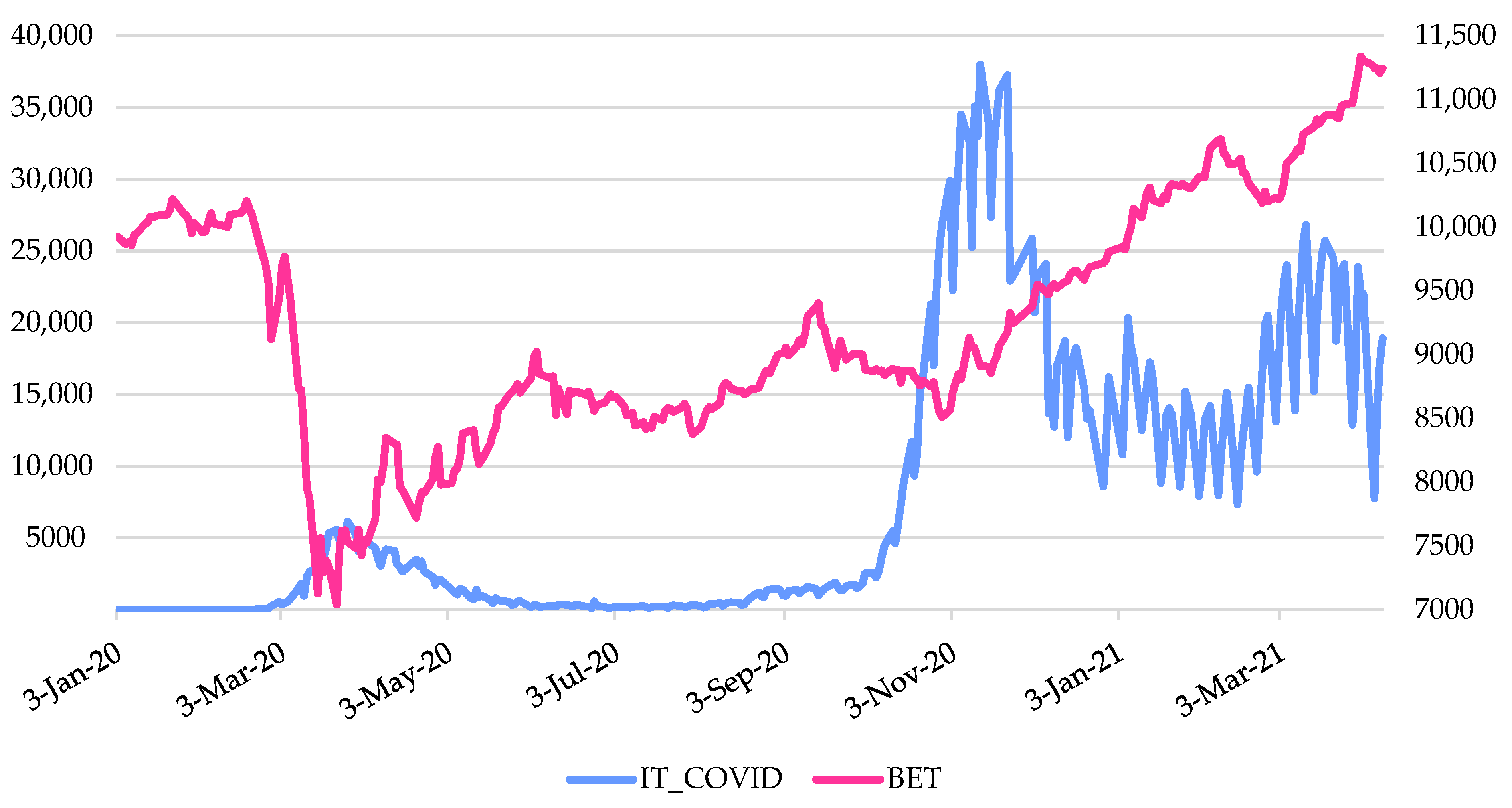

Jrfm Free Full Text Covid 19 Pandemic And Romanian Stock Market Volatility A Garch Approach Html

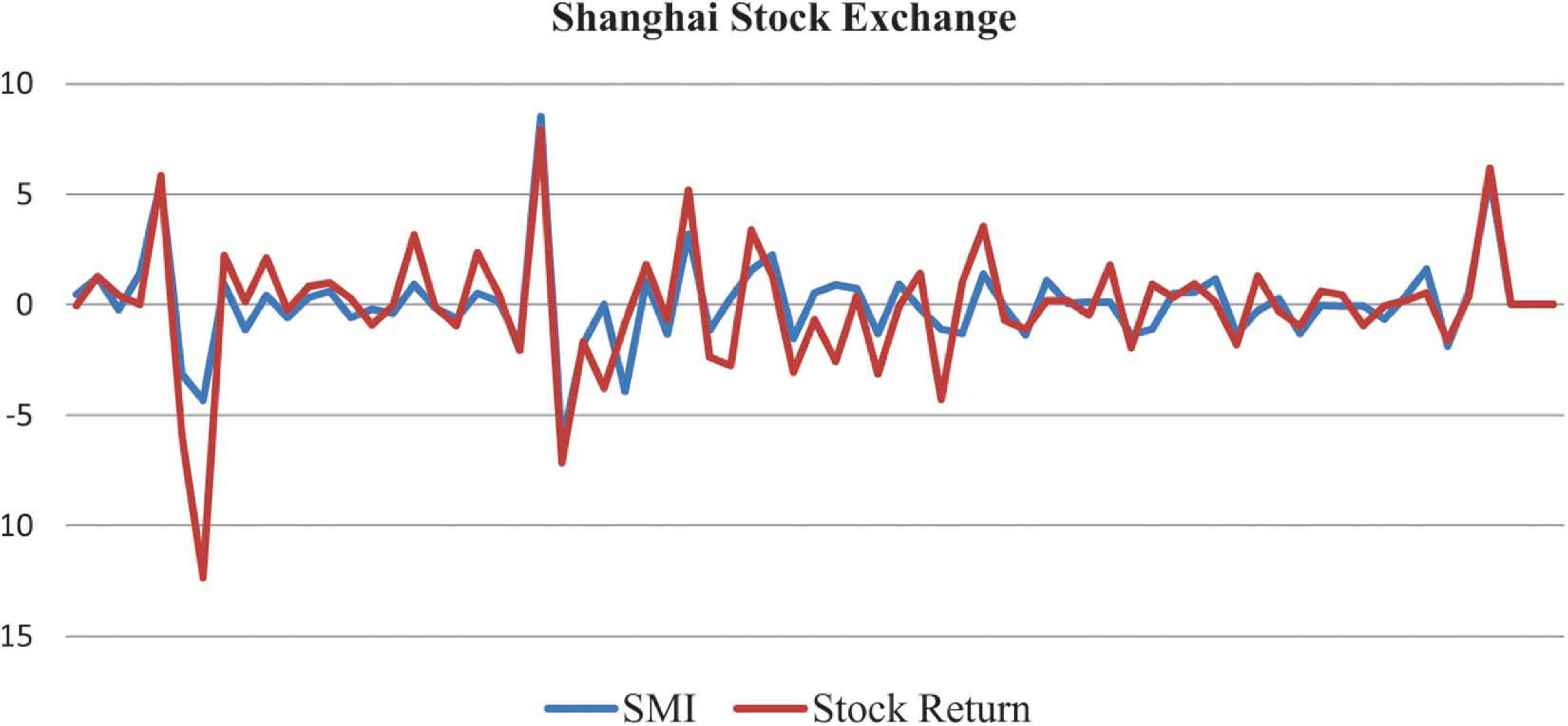

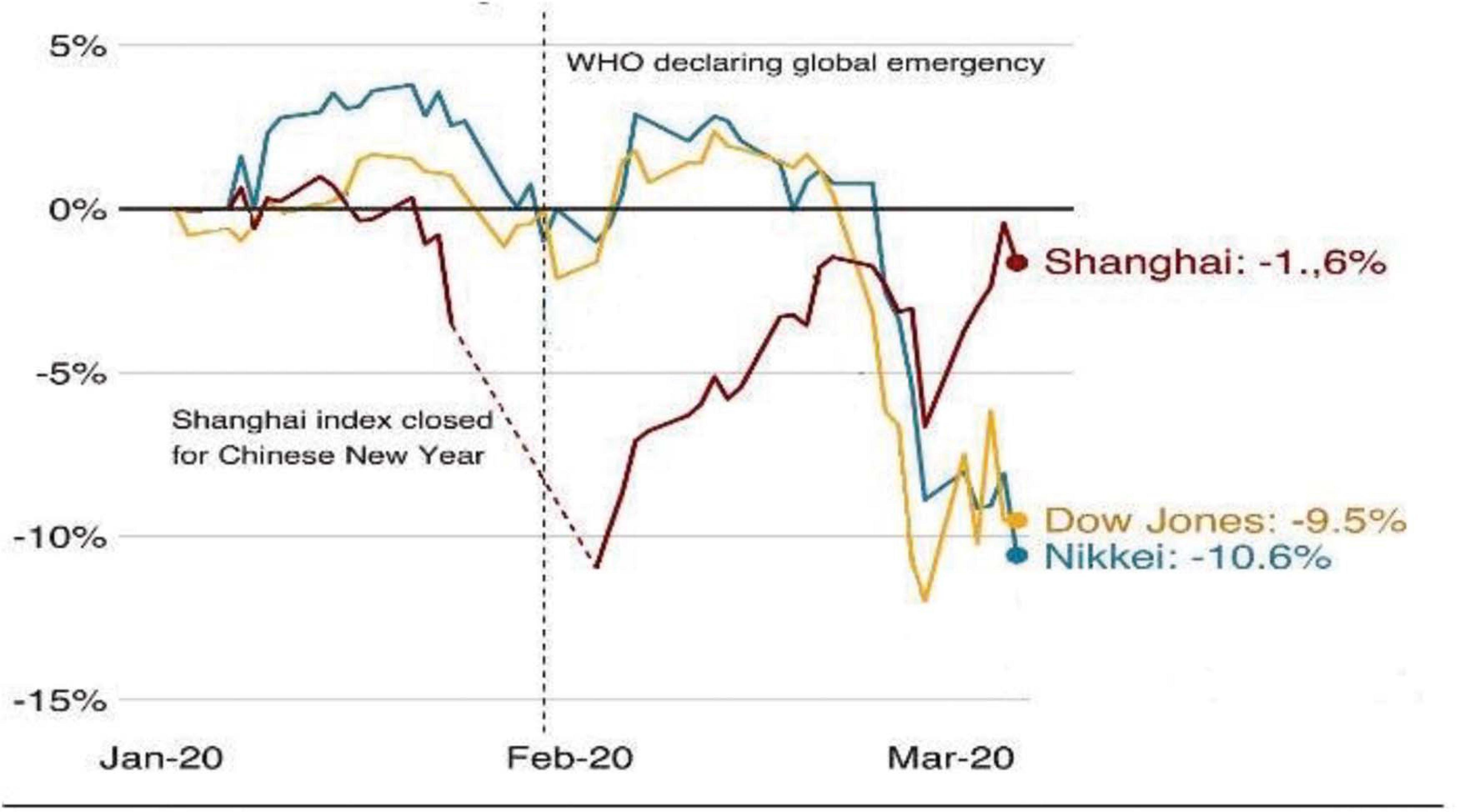

Frontiers The Investor Psychology And Stock Market Behavior During The Initial Era Of Covid 19 A Study Of China Japan And The United States Psychology

Loss Aversion Overconfidence Of Investors And Their Impact On Market Performance Evidence From The Us Stock Markets

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

The Impact Of Sentiment And Attention Measures On Stock Market Volatility Sciencedirect

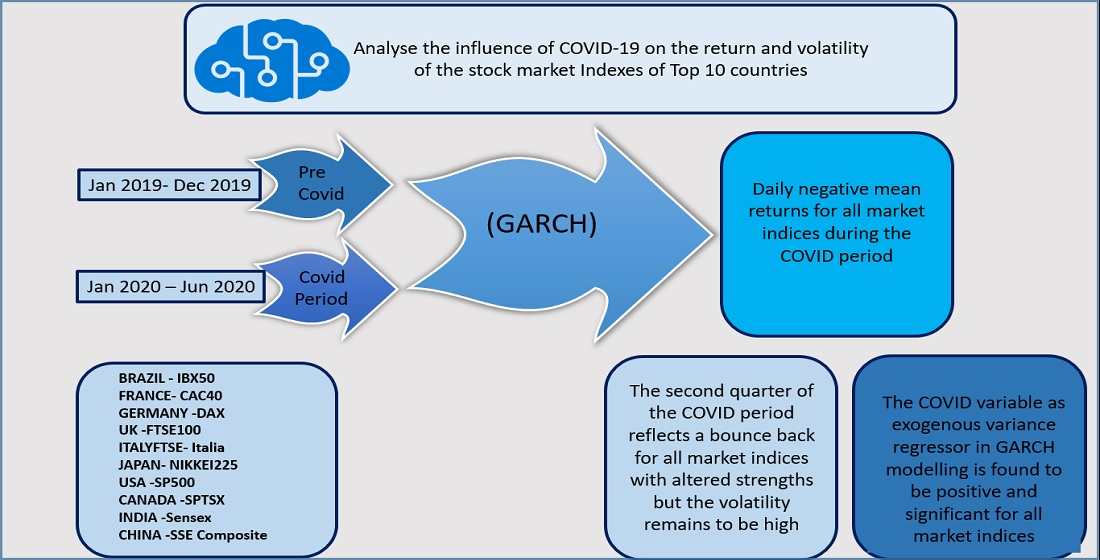

Jrfm Free Full Text Volatility In International Stock Markets An Empirical Study During Covid 19 Html

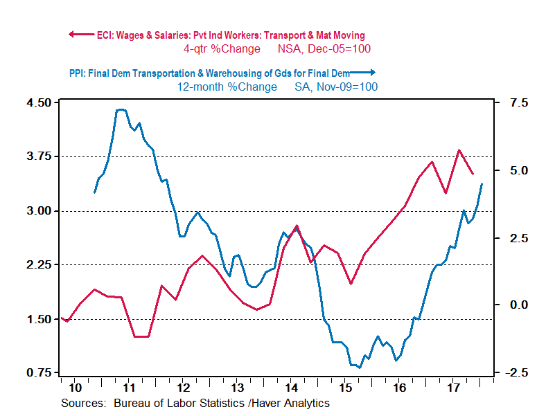

Stock Market Volatility And The Labor Market

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

World Investment Report Chapter 5 Capital Markets And Sustainable Finance

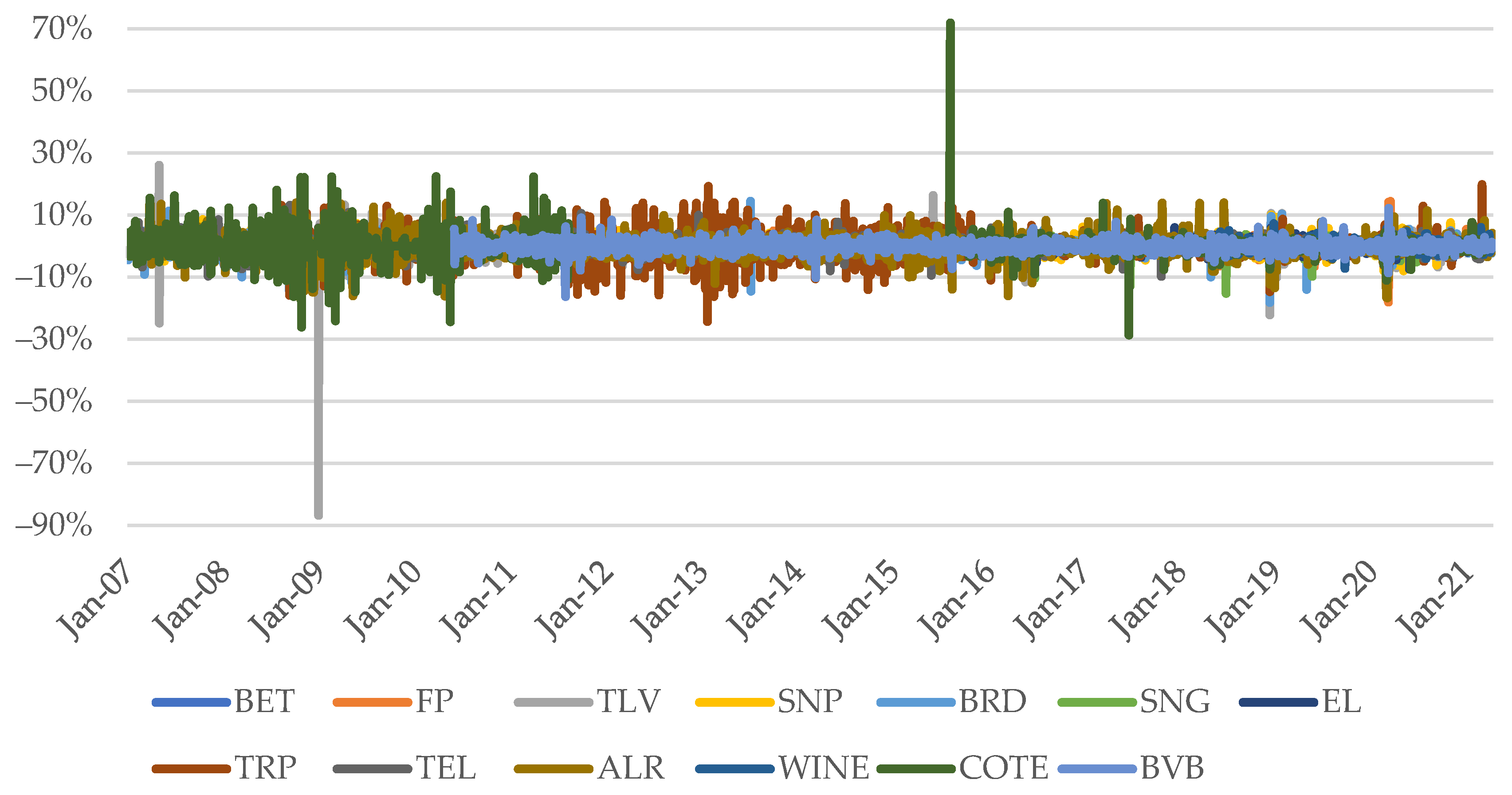

Jrfm Free Full Text Covid 19 Pandemic And Romanian Stock Market Volatility A Garch Approach Html

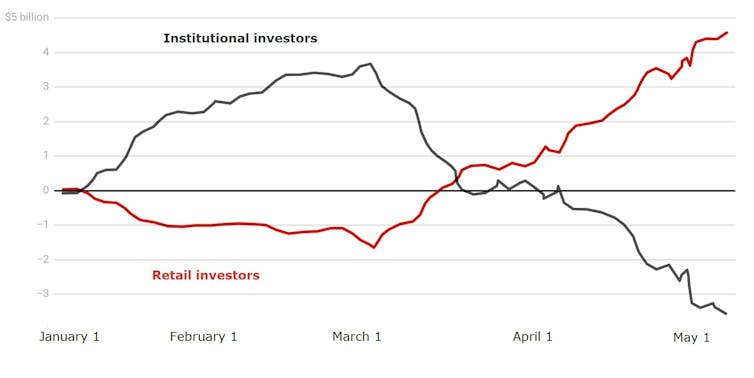

Retail Investors Are Buying While Professionals Are Selling

Jrfm Free Full Text Covid 19 Pandemic And Romanian Stock Market Volatility A Garch Approach Html

Frontiers The Investor Psychology And Stock Market Behavior During The Initial Era Of Covid 19 A Study Of China Japan And The United States Psychology

Jrfm Free Full Text Covid 19 Pandemic And Romanian Stock Market Volatility A Garch Approach Html