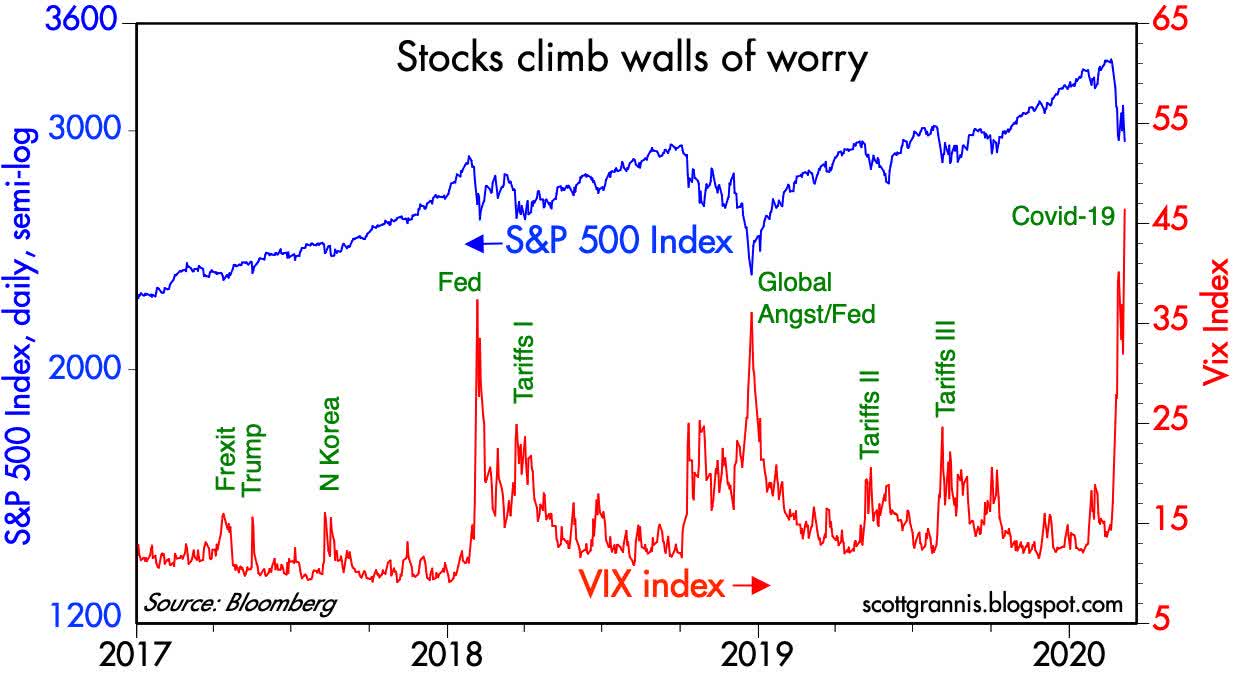

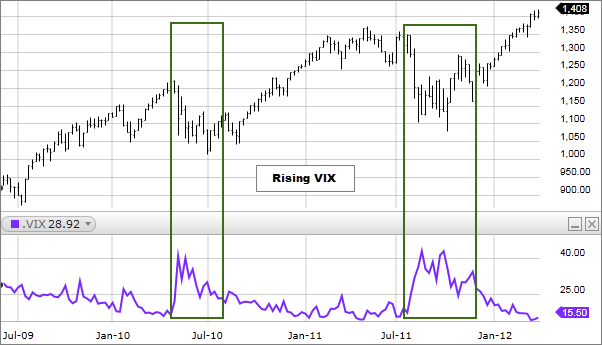

Investors use the VIX to measure the level of risk fear or stress in the market when making investment decisions. When the VIX rises the stock market normally heads south perhaps depending on the velocity of the rise in the VIX or vice versa.

The VIX often referred to as the fear index is calculated in.

Vix meaning in stock market. It also suggests selling SP 500 options will. Learn how to trade VIX with our in-house developed VIX trading strategyOften quoted as Wall Streets fear gauge VIX trading is a popular way to measure the level of risk in the stock market. CBOE Volatility Index - Stock Price Quote and News - CNBC Best used with some 20 other indicators that give you a realistic view of what i.

Answer 1 of 9. The fact that this metric represents expected volatility is very important. The VIX is intended to be used as an indicator of market uncertainty as reflected by the level of volatility.

VIX is a trademarked ticker symbol for the Chicago Board Options Exchange Market Volatility Index a popular measure of the implied volatility of SP 500 index options. CBOE Volatility Index VIX Explained. But how does trading the VIX work how to use the VIX in trading the best way to trade VIX and more will be revealed throughout this practical guide on how to use VIX in trading.

In India market volatility is determined using the NIFTY 50 index. A lower VIX level usually implies that the market is confident about the movement and is expecting lower volatility and a stable range. Often referred to as the fear index or the fear gauge it represents one measure of the markets expectation of stock market volatility over the next 30-day period.

You may hear it called the Fear Index but that too is a misnomer and not an. The VIX is a measure of expected future volatility. If your view is bullish then you buy a call for a strike price.

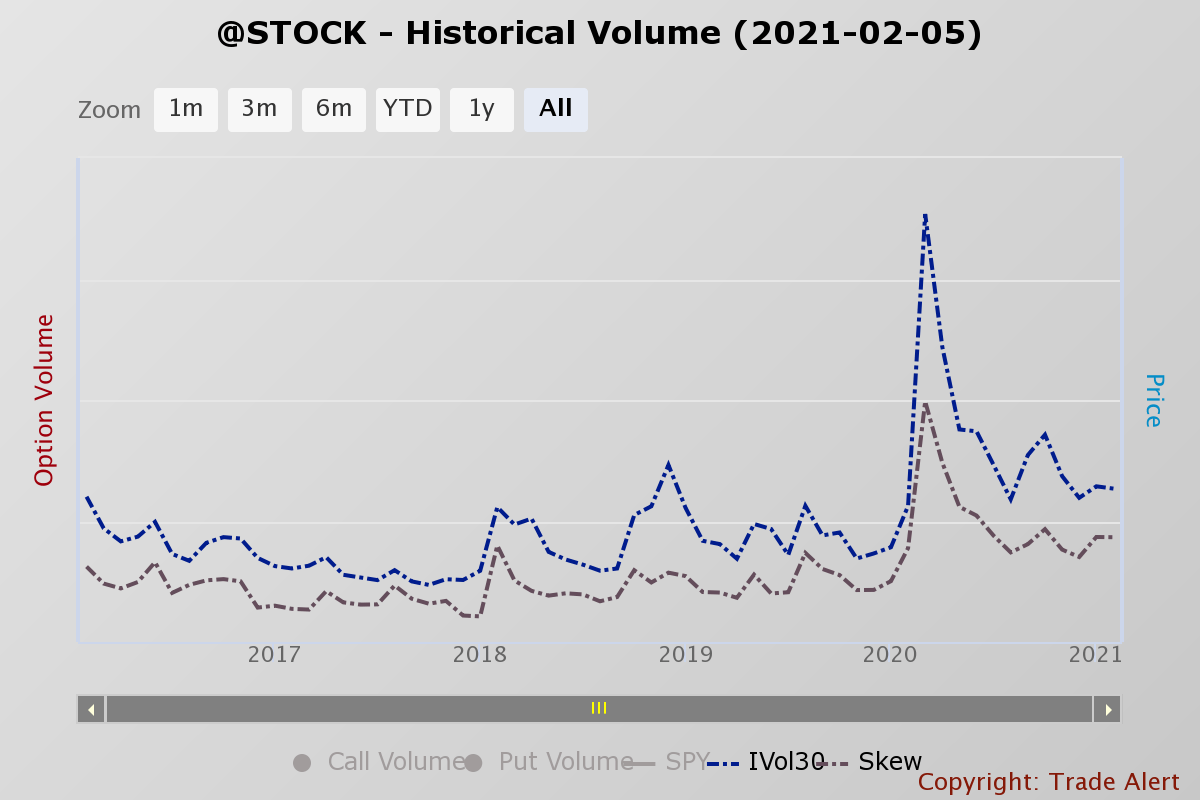

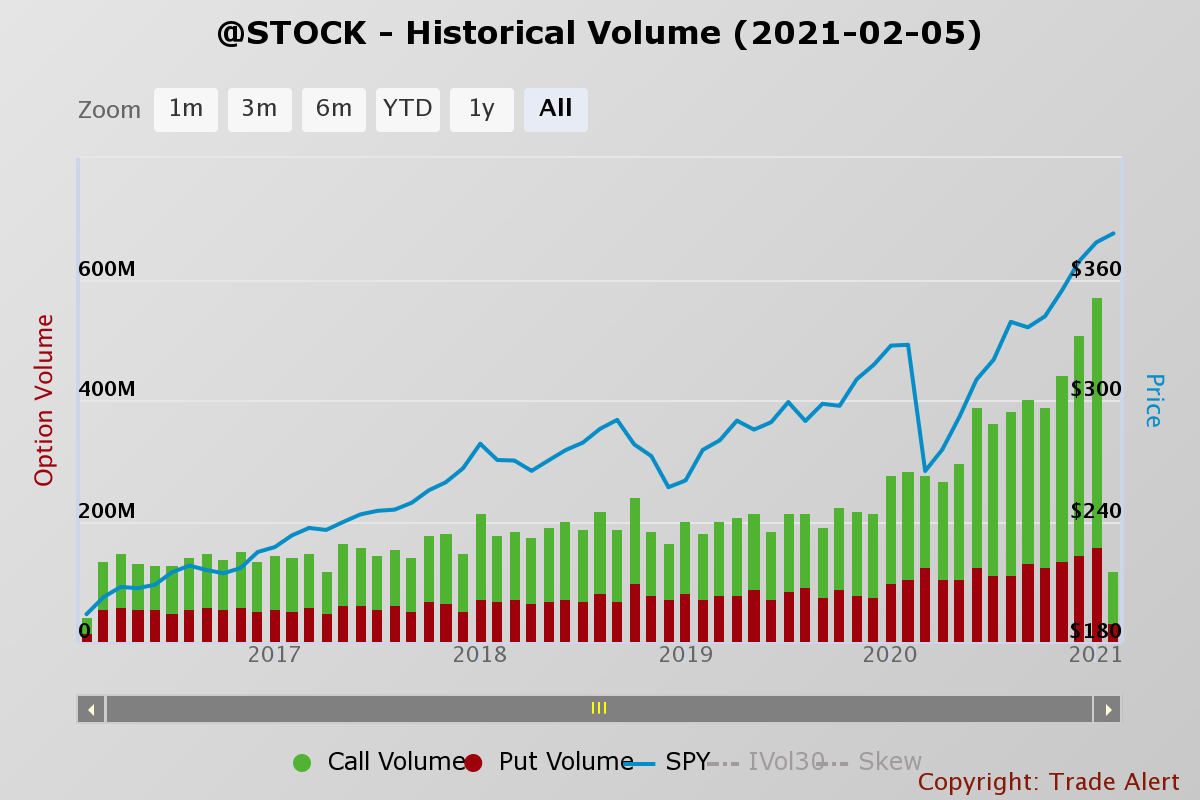

Thanks for A2A PCR is Put Call Ratio VIX is the Volatility Index Now let us see what is PCR. VIX in trading terminology is short for Volatility Index. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks.

A higher VIX level usually signals high volatility and lower trader confidence about the current range of the market. My choice is 10 days. The new asset class provides market players with new means of diversifying their portfolios since the VIX index often is negatively correlated to the market movements.

Most often the VIX minus the realized volatility orange line is above zero meaning implied volatilities typically overestimate actual volatility. VIX which is otherwise known as the Volatility Index is used by investors as a measure to find out the volatility in the market. Apart from the standard VIX Index the CBOE calculates several other variants of the broad market volatility index including the VIX9D sm VIX3M sm VIX6M sm VXN sm VXD sm.

The VIX is a highly touted index on CNBC and in financial circles but what is it and what does it represent. You can also sell a call first and buy it lat. It is a measure of expected markets volatility in the near term.

A low reading means the market is complacent and could be a signal that the market participants are being too bullish and we are ripe for a negative surprise. Wikipedia defines the VIX as the trademarked ticker symbol for the Chicago Board Options Exchange Market Volatility Index a popular measure of the implied volatility of SP 500 index options. A measure of volatility of the markets which can be adjusted for time frames to suit your style of trading.

The stock market recently experienced the fastest market crash on record so its not a complete surprise that the CBOE Volatility Index VIX recently closed at its most extreme level. The index is forward-looking in that it seeks to predict variability of future market price action. Traders and investors will often track the SP500 VIX as a means to gauge the overall risk and sentiment within the equities market.

When the stock markets appear relatively calm but the VIX index spikes higher professionals are betting that prices on the SP 500and thereby the stock market as. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days. Traders can also trade the VIX using a variety of options and exchange-traded.

The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. The CBOE volatility index also referred to as VIX is a volatility based market index that measures the expected future volatility over the next 30 day period. India VIX is index by NSE National Stock Exchange to denote volatility in the Indian Stock Market.

It is calculated from the options on the SP 500 market index. If the stock price goes up then Calls premium will increase for a strike price. In other words it will help you in finding out how fearful or confident the market is under any given conditions.

Often referred to as the fear index or the fear gauge it represents one measure of the markets expectation of stock market volatility over the next 30 day period. The results are known as India VIX. The VIX and the stock market are inversely related.

India VIX is a volatility index based on the NIFTY Index Option prices. The Cboe Volatility Index or VIX is a real-time market index representing the markets expectations for volatility over the coming 30 days.

What Is Vix In Indian Stock Market In 2021 Stock Market Volatility Index Vix

The Vix May Hold The Key To Where The Stock Market Goes Next Vix Seeking Alpha

The Vix May Hold The Key To Where The Stock Market Goes Next Vix Seeking Alpha

Djia Dow Jones Industrial Average Dow Jones Dow Jones Industrial Average Dow

What A Historically High Vix Means For Stocks

Cboe Volatility Index Vix Volatility Index Stock Market Implied Volatility

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

Value At Risk Financial Risk Management In Python Risk Management Risk Data Science

S P 500 Vs Vix Stock Market Indicators In 2021 Stock Market Vix Marketing

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

What Is The Vix Volatility Index And How Do You Trade It

Pin On Buildalpha Building A Trading Strategy

Fibonacci Golden Zone Indicator For Forex Fibonacci Forex Stock Market

What Is Vix Cboe Market Volatility Index Fidelity

Every Vix Spike Has Its Own Meaning Vix Meant To Be Spike

What A Historically High Vix Means For Stocks

What Is The Vix Volatility Index And How Do You Trade It

:max_bytes(150000):strip_icc()/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)