Language of market commentary. It tends to rise quickly but drops more slowly.

The India VIX value is derived by using the Black Scholes BS Model.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Using-Moving-Averages-to-Trade-the-VIX-Apr-2021-02-4ab65b117ded4245808342a4a45a8e4f.jpg)

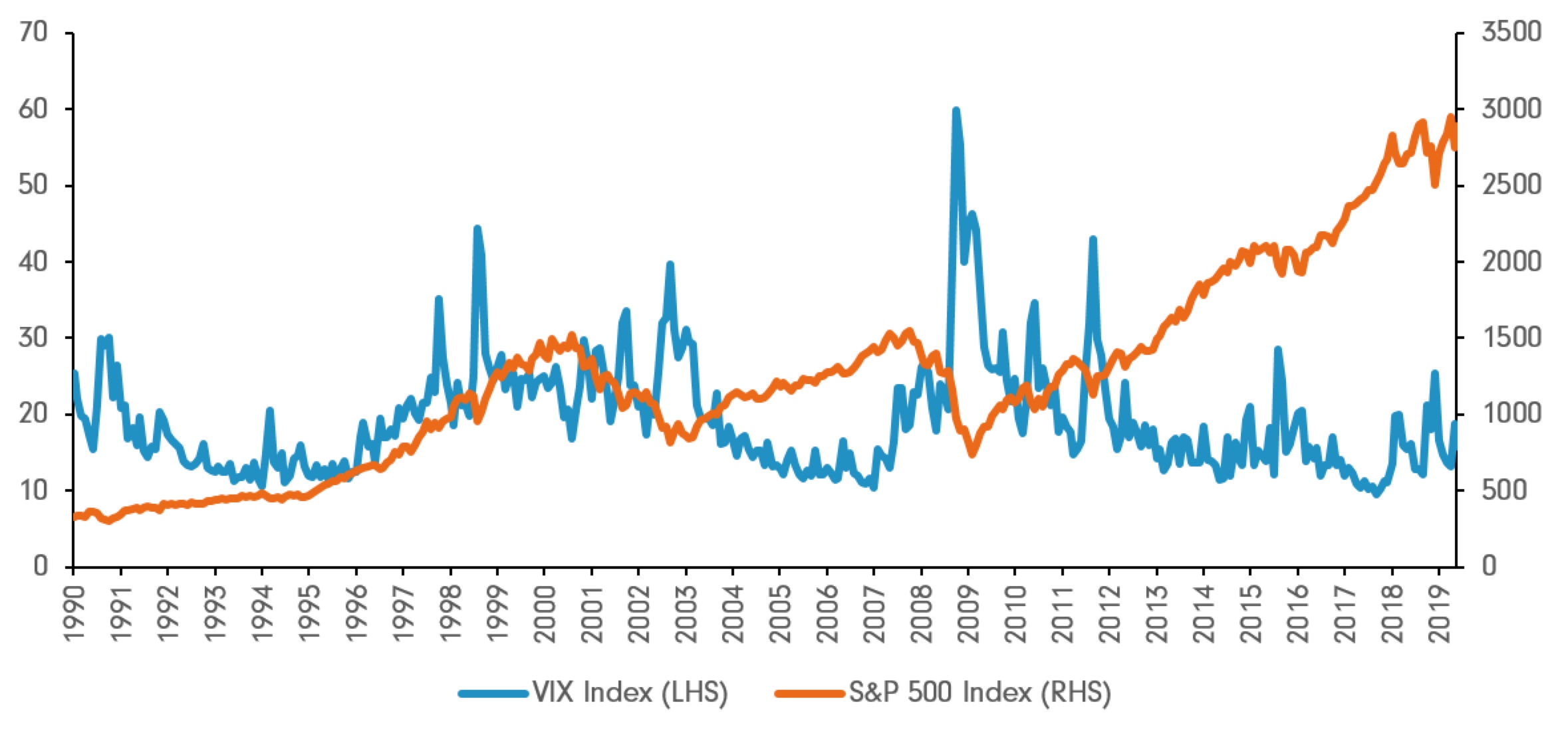

Vix stock meaning. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks. VIX There are many indicators that traders follow to try to predict market bottoms and market tops. The CBOE volatility index also referred to as VIX is a volatility based market index that measures the expected future volatility over the next 30 day period.

It is a measure of expected markets volatility in the near term. A higher volatility means that a Security value potentially can vary over a greater range of values. The Cboe Volatility Index or VIX is a real-time market index representing the markets expectations for volatility over the coming 30 days.

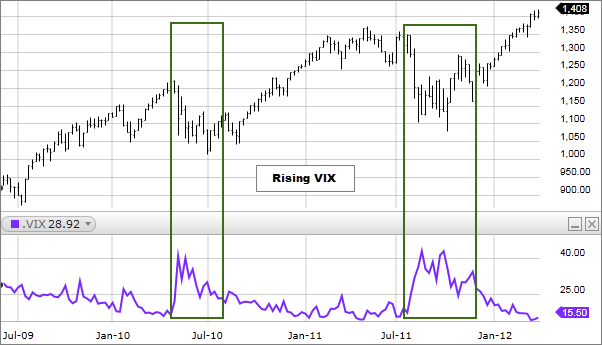

The VIX often referred to as the fear index is calculated in. As you can see the VIX is all over the place and goes quickly from overbought to oversold conditions. Some traders assume that UVXY tracks the CBOE Volatility Index VIX but in fact that is not true.

Unfortunately the meaning of a given VIX level is frequently misunderstood. VIX aka Volatility index is an index used to measure the near term volatility expectations of the markets. What does vix mean.

The VIX is a measure of expected future volatility. VIX is also a trademark of Chicago Board Options Exchange CBOE who introduced volatility as an asset class in the form of an index in 1993. You may hear it called the Fear Index but that too is a misnomer and not an.

In India market volatility is determined using the NIFTY 50 index. When VIX is going near 10 try to exit from all positions. Does VIX Predict Future Volatility provides market participants with simple rules that translate VIX levels into potentially more meaningful predictions or measures of market sentiment.

Investors use the VIX to measure the level of risk. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. VIX -- The Chicago Board Options Exchange Volatility Index or VIX as it is better known is used by stock and options traders to gauge the markets.

It also suggests selling SP 500 options will. Traders and investors will often track the SP500 VIX as a means to gauge the overall risk and sentiment within the equities market. India VIX is a volatility index based on the NIFTY Index Option prices.

India VIX is a short form for India Volatility Index. The index is forward-looking in that it seeks to predict variability of future market price action. Volatility refers to the amount of uncertainty or risk on the size of changes in a safety or index value.

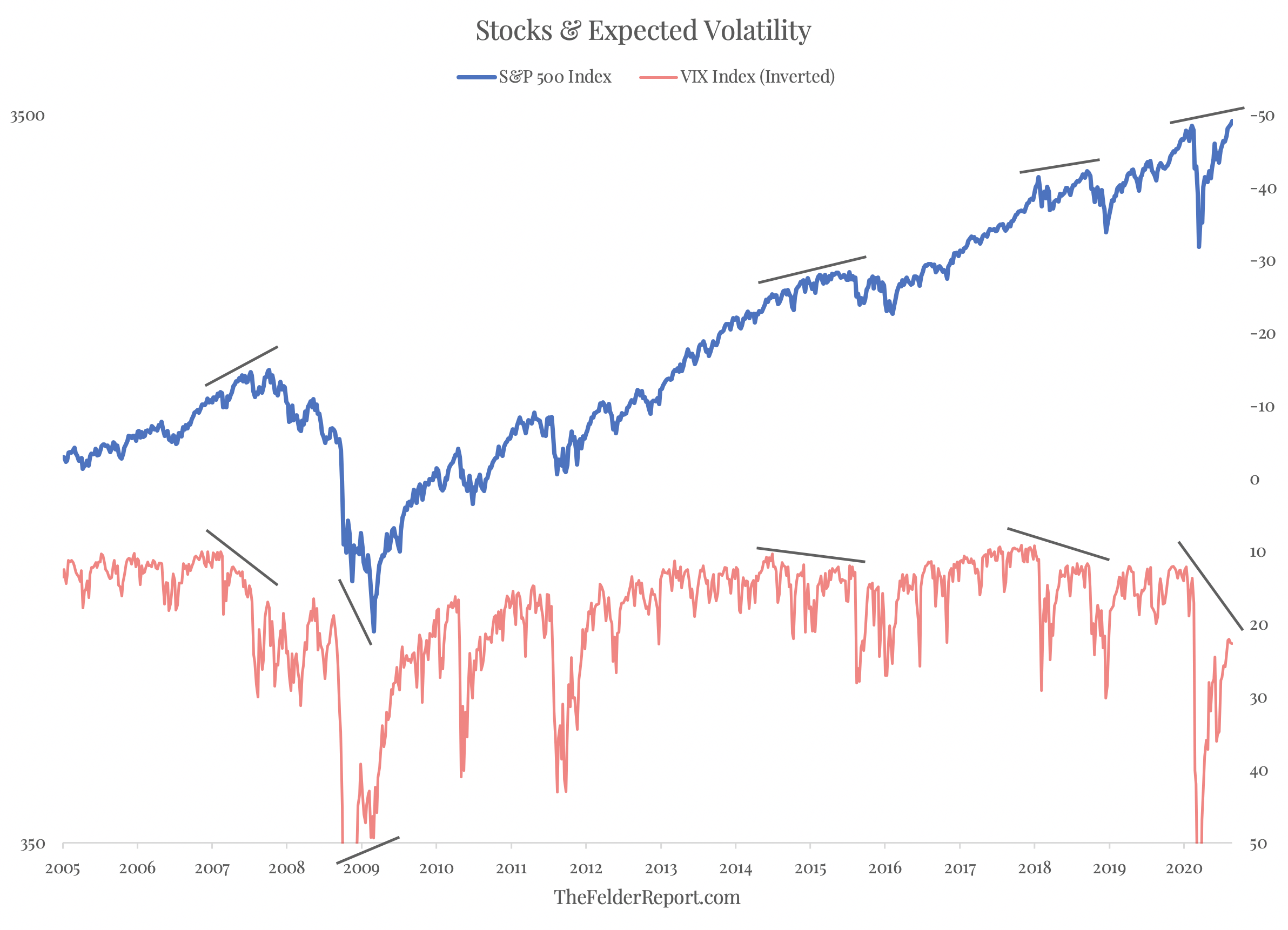

The VIX and the stock market are inversely related. India VIX - What is India VIX. Clearly extreme fear is short-lived.

The VIX is a highly touted index on CNBC and in financial circles but what is it and what does it represent. India VIX is index by NSE National Stock Exchange to denote volatility in the Indian Stock Market. There is never just one indicator that tells the whole story but one that you might want to add to your arsenal if it is not already there is the Market Volatility Index VIX.

The VIX is intended to be used as an indicator of market uncertainty as reflected by the level of volatility. If you were to bet on a spike in volatility the VIX may rise big time. When VIX is going above 20 buy fearlessly any stock.

In other words it explains the volatility that the traders expect over the next 30 days in the Nifty50 Index. CBOE Volatility Index VIX Explained. This means that the.

Instead UVXY tracks VIX futures which are a different animal altogether. In simple terms VIX refers to a markets expectations of price volatility or fluctuations in the next 30 days. VIX is a trademarked ticker symbol for the Chicago Board Options Exchange Market Volatility Index a popular measure of the implied volatility of SP 500 index options.

It means people are fearless rather you can say greedy. What is a good reading of the VIX. It is calculated from the options on the SP 500 market index.

Often referred to as the fear index or the fear gauge it represents one measure of the markets expectation of stock market volatility over the next 30 day period. VIX in trading terminology is short for Volatility Index. The results are known as India VIX.

Caches in India Vix Before understanding as Ndia Vix à is calculated lettês understand what is volatility and what is volatility. Definition of VIX. Our recent paper2 Reading VIX.

Most often the VIX minus the realized volatility orange line is above zero meaning implied volatilities typically overestimate actual volatility. It is the volatility index that measures the markets expectation of volatility over the near term.

The Vix Is Raising A Red Flag For The Rally Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV-final-Using-Moving-Averages-to-Trade-the-VIX-Apr-2021-02-4ab65b117ded4245808342a4a45a8e4f.jpg)

Using Moving Averages To Trade The Vix

Microsoft Return To Top Market Value Means Less For Gates Value Meaning Bill Gates Wealth Market Value

What Is The Vix Volatility Index And How Do You Trade It Ig Bank

This Usa Today Infographic Will Make Every Investor Cringe Infographic Investors Usa Today

What Is The Vix A Guide To The S P 500 Volatility Index

The Vix Hits Its Lowest Level Since The Pandemic Began Are We Finally In The Clear The Motley Fool

Every Vix Spike Has Its Own Meaning Vix Meant To Be Spike

Vix What You Should Know About The Volatility Index Fidelity Hong Kong

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

What Is The Vix Volatility Index And How Do You Trade It

What A Historically High Vix Means For Stocks

S P 500 Vs Vix Stock Market Indicators In 2021 Stock Market Vix Marketing

Vix Cboe Volatility Index Education Tradingview

Cboe Volatility Index Vix Explained The Options Futures Guide

Inside Vol 4 7 4 Volatility Trading Implied Volatility Dow Jones Index

What Is Vix Cboe Market Volatility Index Fidelity

What Is The Vix Volatility Index And How Do You Trade It

/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)