The extreme market volatility of recent weeks has revealed fragility across health systems economies and asset markets. 172 Trading at times of extraordinarily volatile market conditions eg.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

When markets are volatile this means that prices are changing fast in a short period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Volatile market example. For example a security with a volatility of 50 is considered very high risk because it has the potential to increase or decrease by up to half its value. For example the SP 500 has a standard deviation of about 15 percent. Globalisation technological change and competition helped to foster a global economy that appeared efficient but it is vulnerable to large disruptive shocks.

Volatility is the measure of how much a stock or security might raise or lower in price compared to its long-term baseline. High volatility in the stock market usually means dramatic fluctuations measured in an overall market index such as the SP 500. The student will discover so many gems of knowledge that will help with their trading throughout his or her career that this book will never be far away.

When the VIX is on the rise the SP 500 index typically falls. Forex like other financial markets is influenced by numerous macroeconomic factors but liquidity is the main factor. In late January 2018 it hit a.

2012 Farlex Inc. For example when the stock market rises and falls more than one percent over a sustained period of time it is called a volatile market. It is a full course of instruction.

History shows that this indicator can be a reliable guide to turning points in the stock markets. The Most Volatile Markets dashboard within SONAR analyzes all the major indicators that suggest a market is about to change direction. Volatile markets are highly risky.

Stock market volatility is an integral concept for traders to understand. In fact the stock markets recent foray into bear market territory is in part because of all of the volatility and uncertainty surrounding the coronavirus. An assets volatility is a key factor when pricing.

Buying a put option gives right not obligation to the. Knowing the stocks with the highest potential for significant price movement as well as how to trade them optimally can. On the other hand non-volatile markets refer to markets where prices change very slowly or remain totally unchanged.

For example JPMorgan Chase tried to quantify the effects of President Donald Trumps tweets on the market. Whats important to remember though is what else history reveals. For example the results of an election may motivate volatility as investors anticipate potential changes in taxes trade agreements or federal spending.

Volatile Markets Made Easy is not just a book. Movements outside of those fluctuations can indicate a market will realize a crunch or oversupply of capacity for example. Key news announcements may expose the Client to additional risks including the risk that the Client may not get the price him or her requests.

For example historical volatility may be low yet we know that if the US Federal Reserve or the Bank of England releases an interest rate announcement this will cause increased price movement and volatility in the forex market. Forex is a good example of a volatile market. The statistical method used is the standard deviation.

This is typically called a volatility expansion Volatility expansion strategies generally make short-term trades. For example if a stock has high volatility in bearish market then the investor can buy put option and make a profit. For example the company may have faced regulatory action a major lawsuit negative media attention or a.

Technicians can make their language confusing and difficult to understand. By using options contracts investors can hedge their position against the extreme market conditions and can make a profit from the large swing in the prices of securities. Volatile markets often seem to come out of nowhere providing quick and unexpected changes in volatility.

And higher levels of volatility tend to indicate greater short-term losses. This lines up with what history shows. Implied volatility is derived from the options market where put and call options are bought and sold.

A market with a great deal of price instability. One prominent factor that may affect volatility is the news. Volatility is a measure of price-change during a specified amount of time.

How to use options for taking advantage of volatile markets. The index has become a bellwether for when fear is at its peak. A great example of this is the CBOE Volatility Index or the VIX which gauges the future equity market in the next 30 days.

For example the collapse of Lehman Brothers during the GFC in September 2008 saw the index sink to a low of 12. Some analysts make a living trying to explain volatility and its effect on the market. Strategies In A Volatile Market Personal Finance Ill show you a new way to accelerate your wealth building.

In any given market theres a certain level of volatility that is considered normal. Jeff Rose Contributor TWEET THIS The SP 500 is hanging right around 2850. Rising options prices will show volatility within the market.

A volatile market is characterized by significant but short-lived movements either up or down in price.

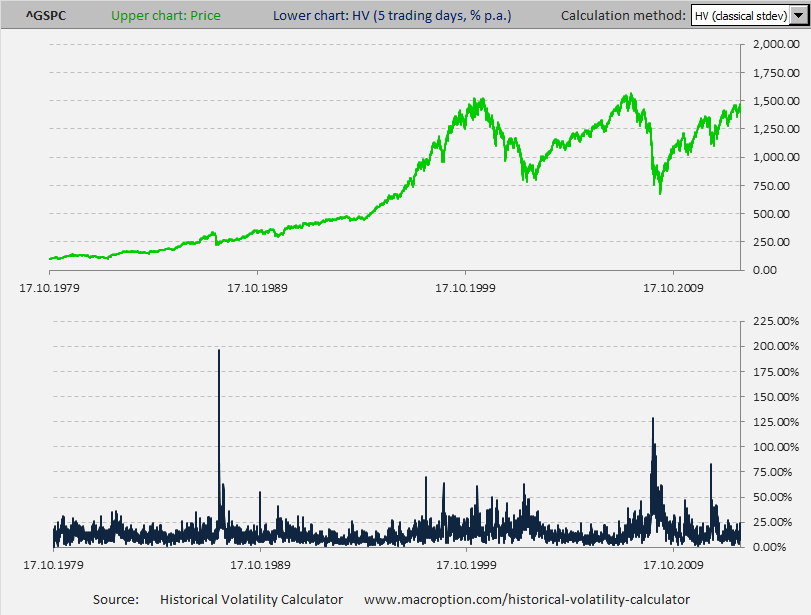

Three Charts To Help Put Stock Market Volatility Into Context Robinhood

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

Choppy Markets Best Indicators And Trading Strategies For Success

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-02-2b2f422acb804825bac05f317099fdaf.jpg)

Trading Volatile Stocks With Technical Indicators

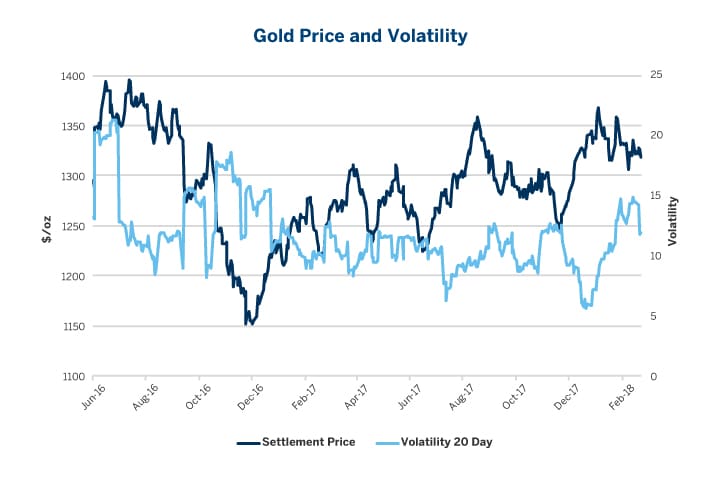

Introduction To Gold Volatility Trading Cme Group

Understanding Stock Market Volatility Rule 1 Investing

Volatility Applications Varsity By Zerodha

Risk Vs Volatility How To Profit From The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Trading Volatile Stocks With Technical Indicators

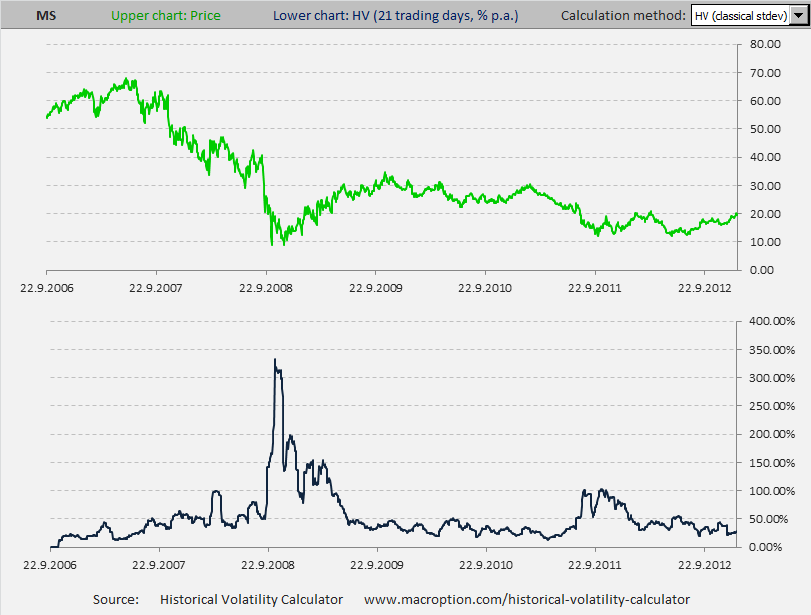

Can Volatility Be Over 100 Macroption

Can Volatility Be Over 100 Macroption

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg)

Trading Volatile Stocks With Technical Indicators

Risk Vs Volatility How To Profit From The Difference

The Most And Least Volatile Forex Currency Pairs In 2021 Table Chart Fxssi Forex Sentiment Board

Six Tips To Manage Volatile Markets Fidelity Institutional

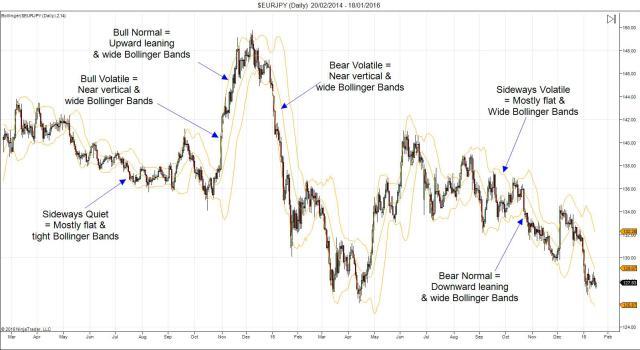

Understanding The Different Market Types How To Trade Them

What Is Volatility And Strategies To Trade It My Trading Skills

Take Advantage Of Volatility With Options Fidelity