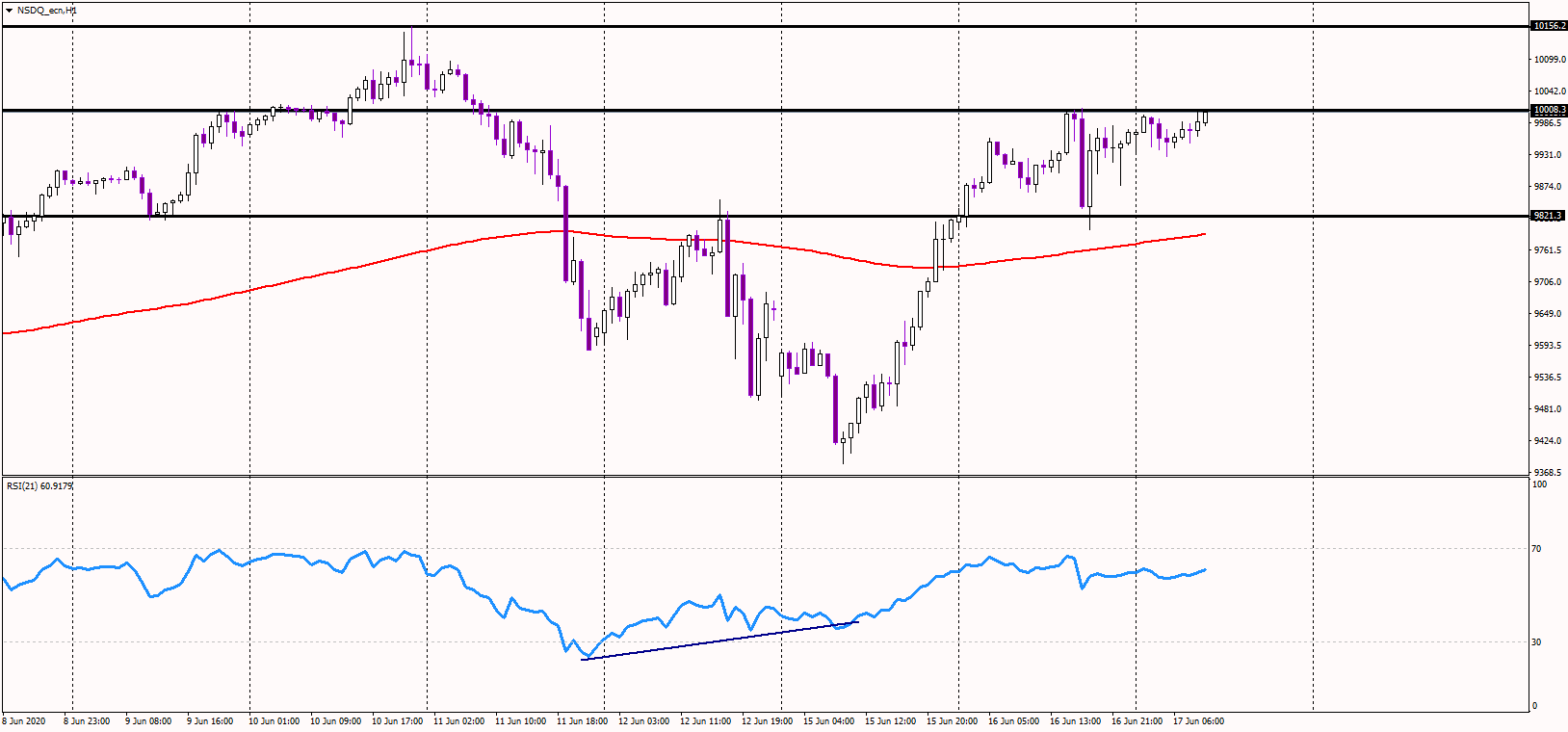

In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns. On the above 1-day chart price action on the Volatility index finds support on previous resistance.

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

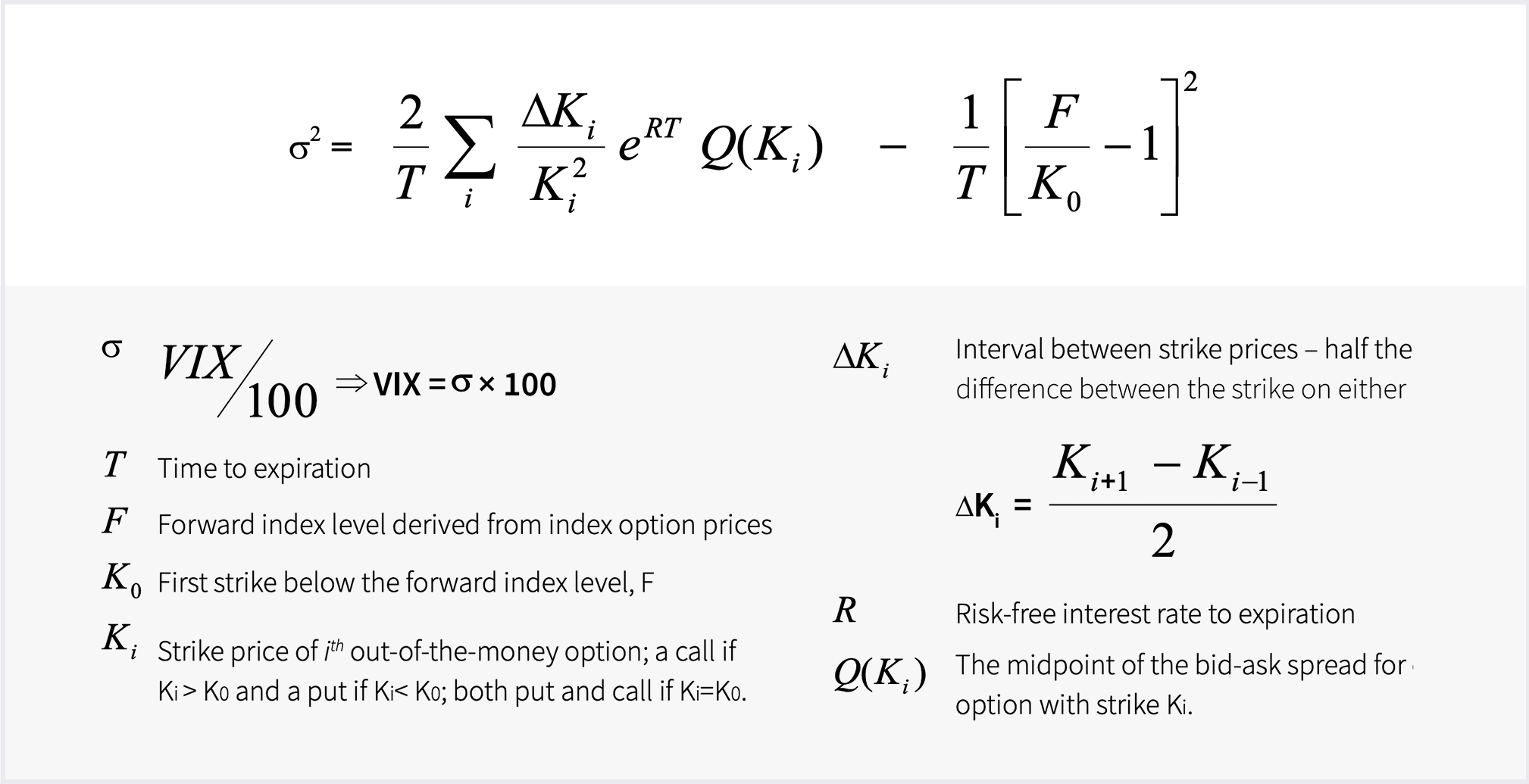

The Volatility 75 is finally derived by multiplying the standard deviation volatility by 100.

Volatility 100 index meaning. EXPECTING A FALL TO THE DAILY SUPPORT. The VIX Index is the first benchmark index introduced by Cboe to measure the markets expectation of future volatility. The Nasdaq-100 Volatility Index VOLQ is an improved measure of im-plied volatility on one of the most important domestic equity indexes the.

Implied volatility looks forward in time being derived from the market price of a market-traded derivative in particular an option. This means that if the current price is 100000 then the closest you can place a stop-loss order is at 950 or 50 away from the current price. The volatility 100 index is highly volatile and the volatility 10 index is the lowest.

Being a forward-looking index it is constructed using the implied. If history is about to repeat it might be an idea to have a. SEKOSpublished an idea on Volatility 100 index H12 months ago.

The VIX provides a measure of market risk and traders sentiments. These index numbers denote the rate of volatility in different indices markets. The VIX often referred to as the fear index is calculated in.

It was created by CBOE Chicago board options exchange in 1993 for the SP 500 Index. Operated by the Chicago Board Options Exchange it predicts volatility over the next 30 days by analysing the prices of near-term Nasdaq 100 options. These Synthetic Volatility Indices are used in normal Deriv options trading.

Historic volatility measures a time series of past market prices. This asset moves around a. The same logic applies for TP but this would be above the current price at 1050.

Since then the VIX is commonly used as a gauge of US. From the prices of out-of-the money options available in the market where the price of each. The numbers after Volatility indicates the level of volatility in the various Indices markets.

If the prices of a security fluctuate slowly in a longer time span it is termed to have low volatility. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. Some may refer to it in the qualitative sense as the choppiness of an instrument whilst others including me describe volatility as a quantitative measure of dispersion.

The Volatility Index or VIX is a market index that represents the markets volatility of the next 30 days. FTSE 100 IVI is a volatility index which measures the interpolated 3060 90 180 and 360 day. Where have you heard about the Nasdaq-100 Volatility Index.

The last time this occurred the markets crashed hard back in February 2020. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks. As such when the VIX reading is 20 it basically means that the 30-day annualized volatility is 20.

The level of fear is directly proportional to the VIX value. The calculation explains that the Volatility 75 Index is simply Volatility times 100. If we measure market volatility on a scale from 1 to 100 with 100 being maximum volatility that is indeed what the various volatility index numbers mean with the Volatility 100 Index being the most volatile and the Volatility 10 Index being the least.

In fact the Volatility 10 Index has just 10 of the volatility of the Volatility 100 Index. Volatility indicates the pricing behavior of the security and helps estimate the fluctuations that may happen in a short period of time. VIX is an indicator of the markets fear and when it exceeds 30 the market is in fear mode.

An index which measures investors expectations of volatility in the Nasdaq 100 stock market. It is similar to the real market. Value of 100 means maximum market Volatility in the index.

What is the Nasdaq-100 Volatility Index. The volatility 10 index market is the least volatile and the volatility 100 index is the most volatile of these. The volatility of 75 indexes is usually abbreviated as VIX and indicates the volatility of one of the most closely monitored stock indices the SP 500.

Volatility 100 index Volatility 100 index. Annualised implied volatility of the underlying FTSE 100 index. Expected volatility is calculated.

Is history about to repeat itself. There are a multitude of definitions and interpretations for the word volatility. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days.

The range of the Volatility index is from 0 to 100. Respecting the bullish channel. The concept of a Volatility Index was first developed by the CBOE Chicago Board Options Exchange in the early 1990s although the mathematics behind it goes back to the 1970s.

Ues result in tighter bidask spreads which means VOLQ provides a clearer measure of expectations for future volatility. Yesterday Volatility 100 did according to our prediction now we can see more confirmations that buying it is what we should do as it is continuing with the higher highs and higher lows. Volatility 100 1s index.

If playback doesnt begin shortly try restarting your device. Volatility 75 index refers to a synthetic index that is a simulation-based index and has 75 of real market volatility. This simulation is run by randomly generated numbers by a computer program.

Pros And Cons Of Intraday Trading Intraday Trading Stock Trading Strategies Stock Market Investing

What Are Volatility Indices Should You Trade Them Bonustrade App

Bitcoins Price Counters The Vix Confirming Its Still A Risk Asset Volatility Index Vix Investing

What Is The Vix Volatility Index And How Do You Trade It

Global Hedge Funds Up 12 85 In August Business Globalhedgefunds Hedge Fund Manager Equity Market Implied Volatility

Nasdaq 100 Volatility Index Definition And Meaning Capital Com

Crash And Boom 1000 Index Indicator Setup Mt5 Mobile Crash Boom Setup

Download Free Forex Anaconda Trading Strategy Cryptocurrency Trading Trading Charts Forex Trading Training

How To Trade The Jump Index Successfully Motivation Africa

How To Use Olymp Trade Sma Trend Indicators To Win More Joon Online Trading Trading Charts Put Option

Sources Of Comparative Advantage Comparative Advantage Economics Study Notes

What Are Volatility Indices Should You Trade Them Bonustrade App

Bottom Fishing For Stocks Meaning And Strategy Bottom Fishing Investing Strategy Option Strategies

Etfsor Exchange Traded Fundsare One Of The Fastest Growing Ways To Invest And Make More Money Its An Exc Make More Money Investing Real Estate Investing Books

Gbp Jpy Forex Simple Trading Strategy With 90 Winning Rate Forex Bitcoin Trading Trading Strategies Forex Online Trading

Boom And Crash 1000 Index Strategy Binaryforexvolatility In 2021 Boom Index Strategies

Risk Report A Quad 4 Investing Playbook Investing Risk Management Implied Volatility