A measurement of historic volatility looks at a securitys past market prices. So what does stock volatility mean.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Trading Volatile Stocks With Technical Indicators

Volatility is how fast the price of an investment fluctuates over time.

Volatility meaning in stocks. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. High volatility is associated with higher risk. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way.

In finance volatility is a measurement of the fluctuations of the price of a security. The higher the value the more volatile the security will be. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time.

What is Volatility in the Stock Market. The concept of a Volatility Index was first developed by the CBOE Chicago Board Options Exchange in the early 1990s although the mathematics behind it goes back to the 1970s. It can be measured against the ups and downs of the market Or it can be plotted statistically against the average price.

Say higher the volatility higher the risk the price of the stock may go either high or low. A wider range makes trading harder because its more risky. Investors and traders analyse a securitys volatility to assess previous price changes and forecast future moves.

If volatility is high for a stock that means it could be a risky bet because of wild price swings. Volatility stands for the risk of change in the price of a security. A more volatile trade has the potential for significant gains but also substantial losses.

A common way to measure volatility is the beta value which has a base of 1. What is Stock Volatility. Also called VIX it is a tool that investors in the stock markets use before buying or selling stocks.

At its most basic stock volatility is the extent to which share prices increase and decrease. Experts often point to high market volatility as an indicator that a big drop and potential bear market is on the way. A stocks volatility is equal to the amount that particular stock will separate from the original price at which it was traded.

Generally it is measured by calculating the standard deviation between the returns of a market index or security. The more volatile a security is the more likely it is to go up or down in value in the short term. It is a rate at which the price of a security increases or decreases for a given set of returns.

It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. When volatility is high the dispersion will be wider as well as the price range. There are stocks which cost 5 dollars and there are other stocks which cost 200 dollars.

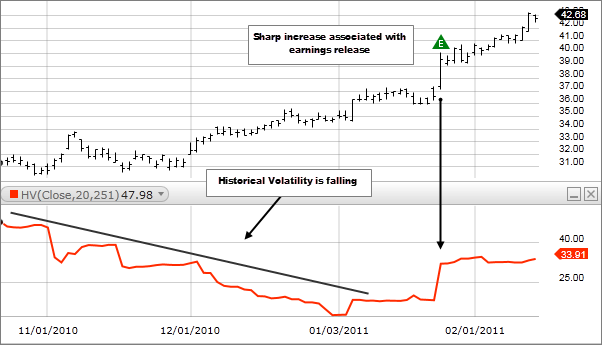

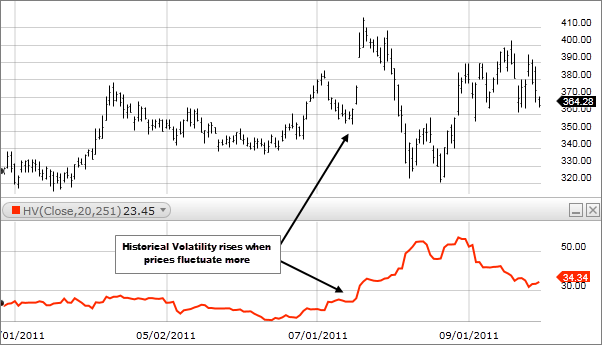

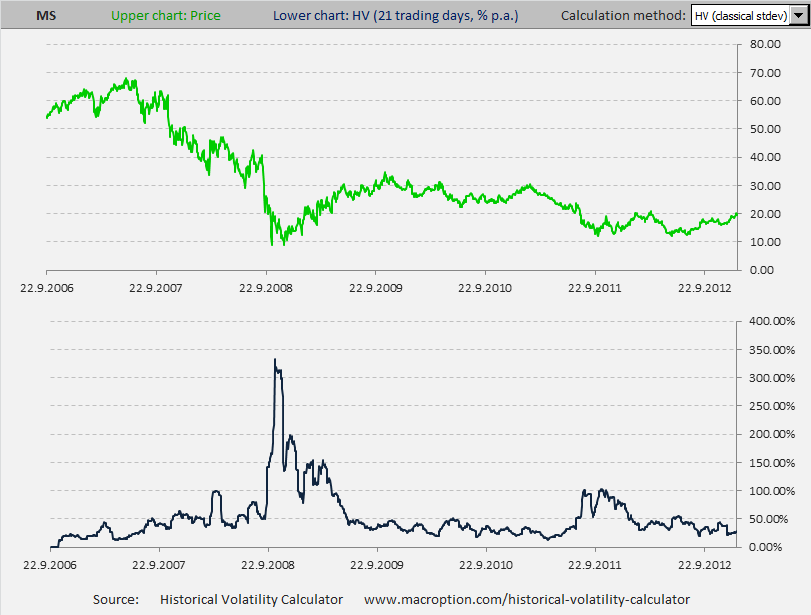

If you used. Historic volatility measures a time series of past market prices. What elevated volatility means.

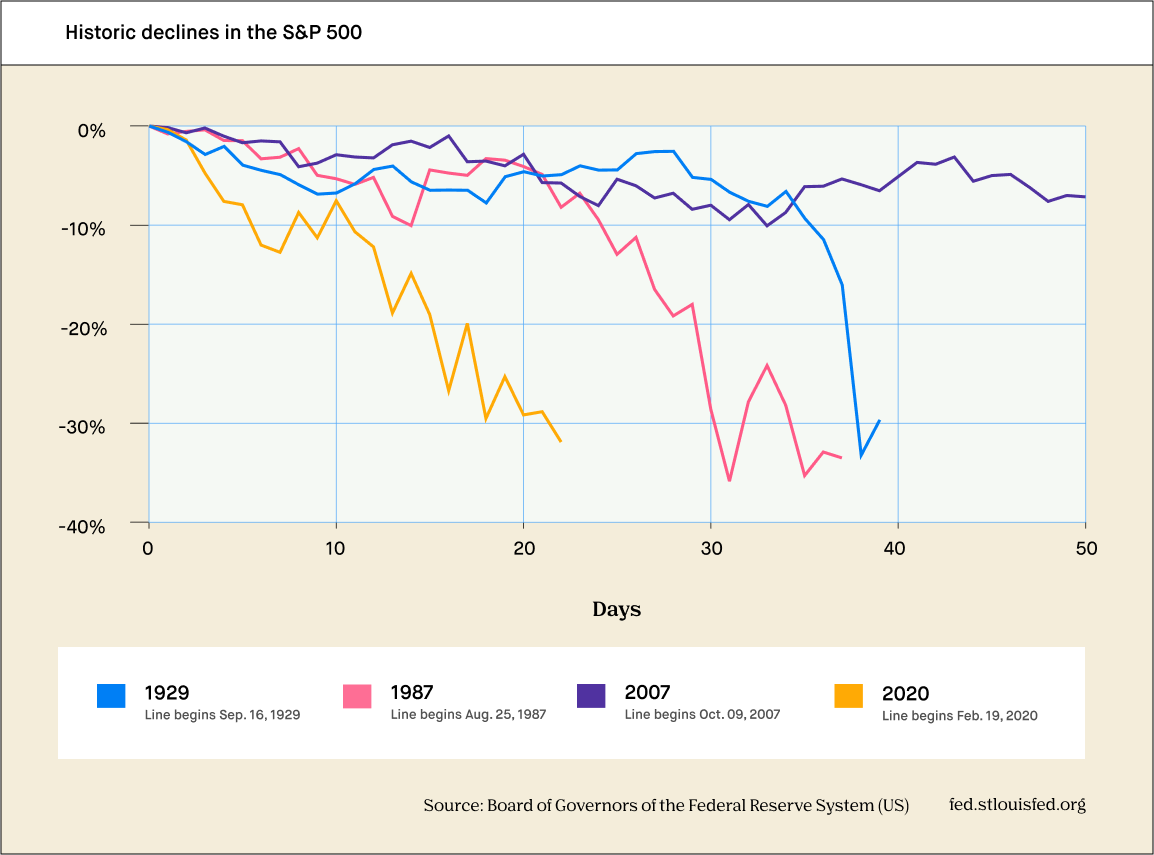

We are a risk averse group so an elevated VIX sends shivers down our spine. In simple terms VIX refers to a markets. Think back to March when the SPX 500 fell 32 as.

It can also be defined as a statistical measure of dispersion for particular securities and is. Volatility refers to amount of risk related to the amount person has invested on the stock. Stock market volatility refers to the range of price movement of a stock over time.

A highly volatile stock is inherently riskier but that risk cuts both ways. Volatility is the measure of how much a stocks price moves. Most traders associate higher volatility with downward action but it simply means wider ranges between high and low prices.

When investing in a volatile security the chance. In the stock market volatility stands for the risk of change in the price of a security. How volatility is measured will affect the value of the coefficient used.

Stock Volatility The relative rate at which the price of a security moves up and down. What is volatility. Loosely translated that means how likely.

A stock that maintains a relatively stable price has low volatility. It expresses the degree of risk associated with a securitys price fluctuations. Volatility as expressed as a percentage coefficient within option-pricing formulas arises from daily trading activities.

What is volatility. It is one of the most key measures in quantifying risk. It is essentially an analysis of the changes in the value of a security.

Measuring stock volatility in percent is more common as there is one big advantage over using currency units comparability. Volatility is a way to describe how often and by how much the price of a security changes in the market. Market volatility is defined as a statistical measure of a stocks or other assets deviations from a set benchmark or its own average performance.

It measures how fast those movements are how often they occur and how big they are. Volatility is a measure of the securitys stability and is usually calculated as the standard deviation derived from a continuously compounded return over a certain period of time. Malcolm Tatum Stock volatility is when stock dramatically increases or decreases within a period of time.

If it is. In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns. Stock volatility refers to the potential for a given stock to experience a drastic decrease or increase in value within a predetermined period of timeInvestors evaluate the volatility of stock before making a decision to purchase a new stock offering buy additional shares of a stock.

By using percentages you can directly compare their volatility more percent always means greater volatility. Volatility is found by calculating the annualized standard deviation of daily change in price.

What Is Volatility Definition And Meaning Capital Com

Three Charts To Help Put Stock Market Volatility Into Context Robinhood

What Is Historical Volatility Fidelity

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

What Is Historical Volatility Fidelity

Understanding Stock Market Volatility Rule 1 Investing

What Is Volatility Definition Causes Significance In The Market

Stock Market Volatility Defined The Motley Fool

Can Volatility Be Over 100 Macroption

The Impact Of Sentiment And Attention Measures On Stock Market Volatility Sciencedirect

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Risk Vs Volatility How To Profit From The Difference

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

Risk Vs Volatility How To Profit From The Difference

What A Historically High Vix Means For Stocks

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg)

Trading Volatile Stocks With Technical Indicators

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-02-2b2f422acb804825bac05f317099fdaf.jpg)

Trading Volatile Stocks With Technical Indicators