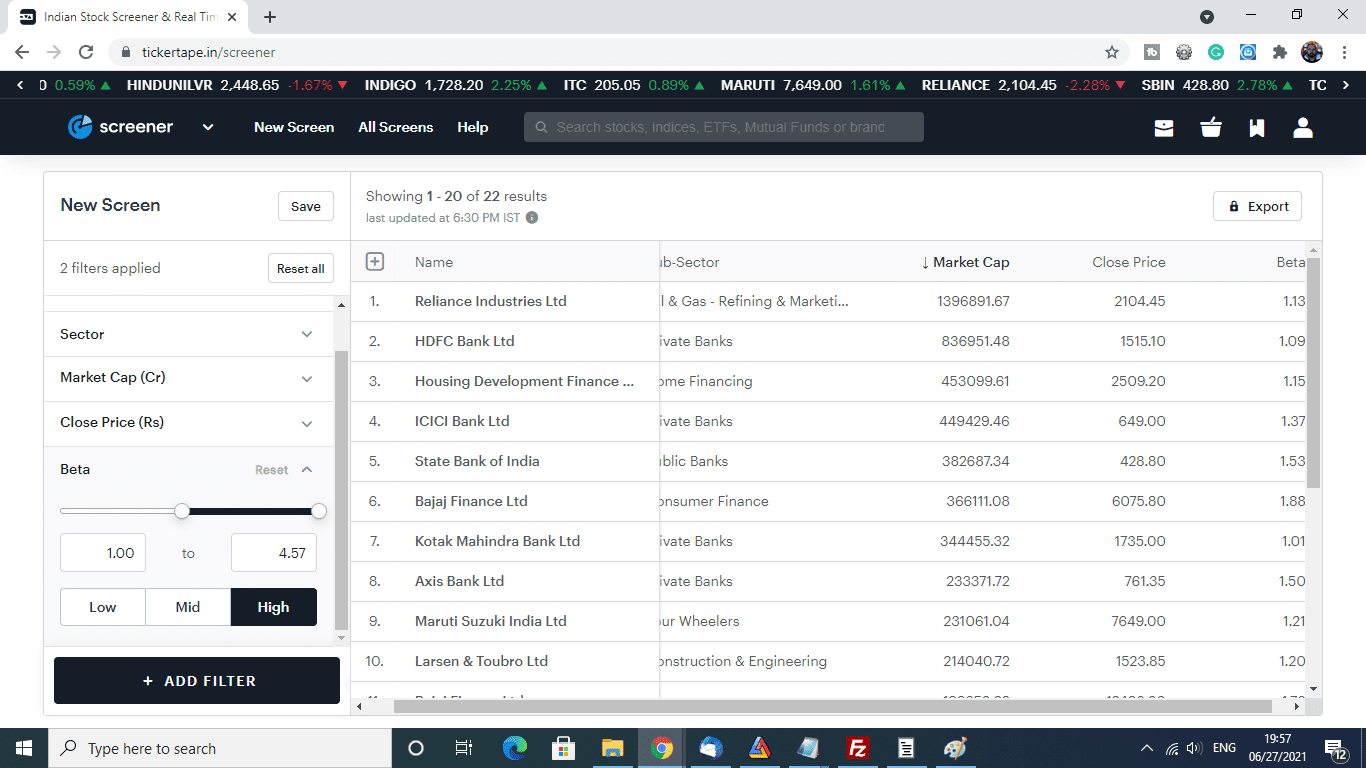

The greatest downside to small-cap stocks is the volatility which is greater than large-caps. The above list displays 22 high volatile stocks with high beta.

The Year In Vix And Volatility The Big Picture Big Picture Investing Chart

The Nasdaq Victory US.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Large cap stocks with high volatility. Between -10 and 29. Added to the stock price appreciation these. Here you can see the companies with the largest market cap.

Alterity Therapeutics has high liquidity and trades more than 23 million shares per. It has the highest dividend yield on our list at 4 per cent. Dividend Payouts Since these companies are already mature and require less money for future growth money is usually returned back to shareholders through dividends.

As of 27th June 2021 the image also reflects its current price Market Capitalization etc. Large cap stocks consist of 80 of the market capitalization and almost every investors trade these category of shares. Historically small-caps have posted higher returns than large-caps albeit with greater volatility.

Stability Large cap stocks are considered to be relatively safe stocks. These companies are top companies in their sectors which help protect you portfolio during high volatility. It has a 52-week low of 028 and a 52-week high of 515.

Stocks with the highest volatility Indian Stock Market. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. ETFs Tracking The Victory US Large Cap High Dividend Volatility Weighted BRI Index ETF Fund Flow.

Koninklijke Philips PHG Source. The biotech stock has a market cap of 60 million. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods.

Some investors think of. Stocks may see unusually-high price volatility when important new information affecting the stocks valuation is made known to the public but the market is uncertain how that news will affect the stocks long-term prospects. Between -32 and 58.

Volatility can benefit investors from every point of viewIn the Stock Market it performs well. The small stock volatility gap is quite broad and a buy-and-hold strategy with such funds would likely be a wild roller coaster ride to be sure. That said on the flipside these smaller stocks are clearly volatile compared to larger cap stocks.

Price fluctuations arent always obvious when looking at stocks that are priced below 1. The very largest large-cap companies such as Amazon NASDAQAMZM and JPMorgan Chase that have market caps of more than 200 billion also fall into the large-cap bracket. These stocks are traded by less investors as compare to above category.

The volatility of a stock is the fluctuation of price in any given timeframe. So more the investors more will be the chances that price get equilibrium. This Smallcase invests in top defensive large cap stocks which are high quality and market leaders.

Large cap companies are usually well established and. Here you can see the companies with the largest market cap. Historically the VIX has always been 70 of the RVX.

In this article we discuss the 15 most volatile stocks to buy now. Rising treasury yields have the largest impact on large-cap growth stocks that are very much richly valued. The range of returns for the top decile vs smallest decile have been as follows.

Volatility has increased significantly and even large-caps have not proved safe from sudden sharp downward swings. If you want to skip our detailed analysis of these stocks go directly to the 5 Most Volatile Stocks To Buy Now. Large-cap stocks are usually industry and sector leaders and represent well-known established companies.

The volatility of a stock is the fluctuation of price in any given timeframe. These companies have well analysed track records thus are less volatile than mid or small cap stocks. The stock also has the second-highest one-year performance on our list at an impressive 1285 per cent as.

Large-cap stocks are usually industry and sector leaders and represent well-known established companies. Listed Highland Capital Management ETFs. 103 rows Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows.

Mid and small cap stocks have 15 and 5 market share respectively. Compare their price performance expenses and more. The stock is up 44 in the past year so the dividend is running at 09 but if youre looking for a gold hedge this is a pragmatic choice.

Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a. If you recall in early 2021 an increase in interest rates created a rout in technology. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods.

TheStreet presents ten of the most volatile large-cap stocks so far in 2010. See all ETFs tracking the Nasdaq Victory US. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day.

The table below includes fund flow data for all US. One thing that caught my eye the other day was the volatility on the Russell 2000 which is the volatility on the small cap indices and which is currently trading at 20 is about 8 points higher than volatility on the VIX the large cap volatility index. Market capitalization shows the value of a corporation by multiplying the stock price by the number of stocks outstanding.

Large Cap High Dividend 100 LongCash Volatility Weighted Index including the cheapest and the most popular among them. Large Cap High Dividend 100 Volatility Weighted Total Return Index begins with up to the highest 100 dividend-yielding stocks within the.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-02-2b2f422acb804825bac05f317099fdaf.jpg)

Trading Volatile Stocks With Technical Indicators

Stock Market Or Forex Trading Graph In Blue Futuristic Display Graphic Concept Forex Trading Stock Market Forex

Finding High Volatility Stocks To Day Trade Trading Stocks Ideas Of Trading Stocks Tradingstocks Stocks Trad Day Trading Stock Screener Intraday Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg)

Trading Volatile Stocks With Technical Indicators

List Of High Volatile Stocks Nse For 2 5 Intraday Gains Stockmaniacs

The Most Volatile Penny Stocks Of 2021 How To Find Them

Most Volatile Stocks 2021 High Volatility Stocks To Watch Today

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

Instagram Instagram Instagram Photo Photo And Video

List Of High Volatile Stocks Nse For 2 5 Intraday Gains Stockmaniacs

List Of High Volatile Stocks Nse For 2 5 Intraday Gains Stockmaniacs

Spx S P 500 Large Cap Index Forex Trading Tips Technical Analysis Rsi

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-01-5516ae15297b41bd949ac3a640640b96.jpg)

Trading Volatile Stocks With Technical Indicators

Bollinger Band Trading Is Related To Volatility Learning How Price Volatility Works And Ways In Which You Technical Analysis Charts Implied Volatility Trading

Most Volatile Stocks 2021 High Volatility Stocks To Watch Today

Consistent High Volatility Stock Screen For Day Traders

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

Risk Reward Chart As Safe As It May Seem You Should Not Have All Bonds In Your Portfolio You Will Never Investing Government Bonds Certificate Of Deposit