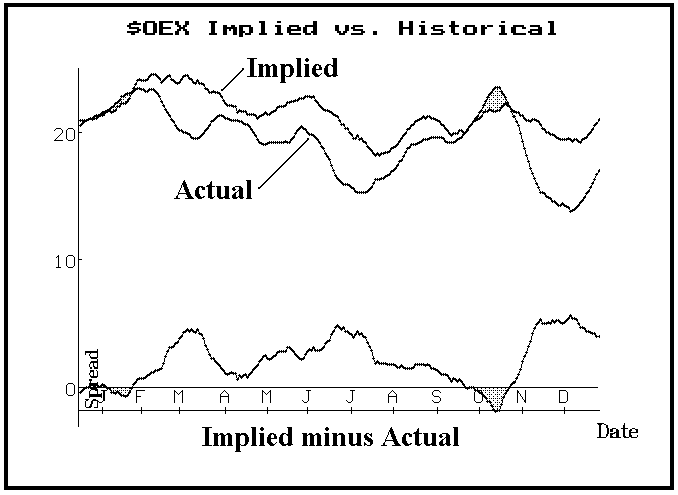

What Does Implied Volatility Measure. By comparing implied volatility to historical averages investors find insights into which equities may be facing higher or lower future volatility in the future.

The Black Scholes Formula Explained Finance Tracker Implied Volatility Partial Differential Equation

Accompanied by an implied volatility number which is a model-based estimate of future volatility as implied by option prices.

Market community implied volatility. In financial mathematics the implied volatility IV of an option contract is that value of the volatility of the underlying instrument which when input in an option pricing model such as BlackScholes will return a theoretical value equal to the current market price of said option. IV is implied volatility HV is historic realized volatility Seneca teaches that we often suffer more in our minds than in reality and the same is true with the stock market. Implied bond market volatility particularly since mid-2003.

Instead it suggests that the recent decline in implied bond market volatility is due to the fact that. Although not a guarantee implied volatility tends to increase while the market in the underlying security is bearish. Implied volatility is one of the important parameters and a vital component of the Black-Scholes model which is an option pricing model that shall give the options market price or market value.

Summing up the empirical evidence presented here on the basis of the predictive content of implied volatility does not suggest any major mispricing of options on long-term US bonds. Implied volatility IV is the markets forecast of a likely movement in a securitys price. Implied volatility falls when the options market shows an upward trend.

Implied volatility IV is the estimated volatility of a securitys price and is critical in the pricing of options. Implied volatility measures the probability that a certain stock will change in price. What is implied volatility.

In this paper a stochastic volatility model is presented that directly prescribes the stochastic development of the implied BlackScholes volatilities of a set of given standard options. Implied volatility does not forecast the direction in which the price change will progress. Options with elevated implied volatility are an indication that investors are anticipating the underlying equity to experience higher than normal price swings relative to its historical range.

An example of this is if the security has high. When options markets experience a downtrend implied volatility generally increases. Implied volatility is a tool that all market participants need to embrace as it is a real-time indicator of market sentiment.

This is due to the common belief that bear markets are riskier than bull markets. The present is all that matters for traders and investors History depends on interpretation. It is often used to determine trading strategies and to set prices for option contracts.

While reading How does implied volatility affect option pricing by Investopedia it states the following in key takeaways. Conversely when the underlying security is bullish implied volatility tends to decrease. This indicator can help identify when people are over paying for implied volatility relative to real volatility.

Thus the model is able to capture the stochastic movements of a full term structure of implied volatilities. However implied volatility does not clarify in which direction prices will move. The measure reflects the markets view on the likelihood of movements in prices for the underlying having the tendency to increase when prices decline and thus reflect the riskier picture.

The conditions are derived that have to be. In order to manage inventory and deal with asymmetric information risks it is necessary to adjust you bidask quotes as you are hitlifted. Analysts take into account numerous factors to project the likely movements in securities prices.

Volatility indices built upon the methodology of Cboe VIX 2019 have become popular measures of market uncertainty over the short term across a range of underlying asset classes. Implied volatility formula shall depict where the volatility of the underlying in question should be in the future and how the marketplace sees them. In theory one may interpret option-implied volatility as the aggregate view on how volatile the underlying security will be between a given day and the option expiry and hence should be as good a predictor as any.

Implied volatility is a critical metric in the determination of prices of options contracts. The information is based on a metric that predicts the future fluctuation of the price of the security. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the.

Suppose you quote bidask prices vols around the prices given by your implied vol surface. Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day. Suppose you are a market maker with a model that is producing an implied volatility surface for you.

A non-option financial instrument that has embedded optionality such as an interest rate cap can also have an implied. According to the CFA institute implied volatility is a measure of the expected risk with regards to the underlying for an option. It is expressed in percentages.

The past is history. Implied volatility is calculated by taking the price of a stock on the market and putting it in an equation that takes into account the time till the option expires as well as other conditions of the marketplace. They are easily interpretable as they reflect market pricing of subsequently realised volatility implied from option prices usually over the next 30 days.

Implied volatility data is information about the markets prediction of certain securitys value.

How To Remain A Profitable Stock Market Investor Even In Times Of Market Turmoil Australian Inve Stock Market Education In Australia Stock Market Investors

Interceptor Pro Volume Extremes Indicator Ift Tt 2az4cwq Description Theory And Examples Soon Available Here Theinvestbay Com Forex Traders And Invest

Pin On Stock Market Training Community

10 Myths About Trading Ehelpify Stock Market Forex Trading Forex

Bitcoin Traders Expect Volatility As Options Expire In 2021 Bitcoin Implied Volatility Expectations

Vix9d Vix Vix3m Vix6m Vix1y Fast Medium Slow Long Crossovers Implied Volatility How To Introduce Yourself Inverted Meaning

If You Wish To Be An Intelligent Investor In The Cryptocurrency Markets You Are About To Get Your Chance Https Ww Cryptocurrency Psychology Investing Books

Is Implied Volatility A Good Predictor Of Actual Volatility 09 02 Option Strategist

Kumo Implied Volatility Indicator By Wpatte15 Tradingview

Implied Volatility Crush Is Something Options Traders Need To Be Aware Of At All Times Learn What Iv Stock Trading Strategies Implied Volatility Option Trader

What Is Implied Volatility And How Do You Use It Ig En

Dtosc Contrarian Trading With Martingala Bollingerbandtrading Tradinglifestyle Trading Technical Analysis Charts Chart

Bollinger On Bollinger Bands Ebook By John Bollinger Rakuten Kobo In 2021 Band Technical Analysis Investors Business Daily

Cci And Bollinger Bands Reversal Trading Is Forex System That Trade On Reversal Forexisgreat Whatisoptiontrading Trading Forex Band

Pin On Bollinger Bands Bounce Trading Strategy

Big Rewards Don T Require Big Risk In Day Trading Day Trading Implied Volatility Trading Quotes

Comparing Implied Volatility And Historical Volatility During Earnings Season The Blue Collar Investor

Cmeg Is The Most Similar And Best Alternative To Suretrader That We Have Tried And Recommend Broker Brok Day Trading Interactive Brokers Stock Market Crash